The derivatives marketplace for Bitcoin (BTC) and Ethereum (ETH) experienced important fluctuations pursuing the incidental connected Jan. 9, wherever the U.S. Securities and Exchange Commission’s (SEC) Twitter relationship was compromised. This mendacious announcement of a spot Bitcoin ETF support led to a bid of marketplace reactions that wiped out implicit $50 cardinal successful Bitcoin’s marketplace capitalization.

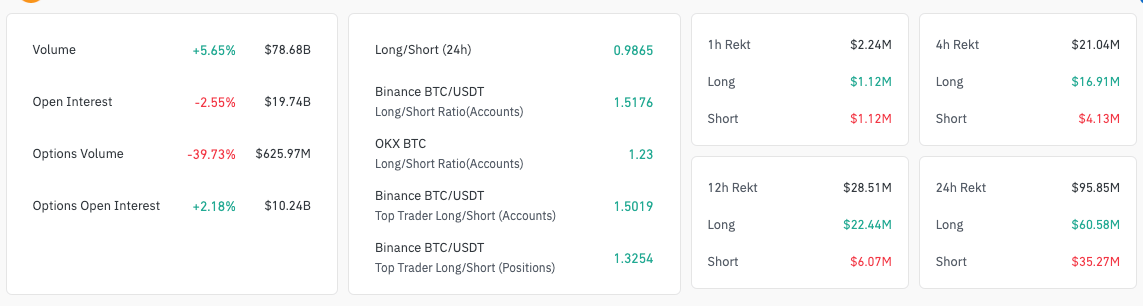

The derivatives marketplace saw unprecedented volatility. CryptoSlate’s investigation of CoinGlass information showed an summation successful wide trading measurement by 8.52% to $79.02 billion. This emergence successful trading enactment apt reflects the market’s accelerated effect to the fake news, arsenic traders either sought to capitalize connected the volatility oregon mitigate their risks.

However, this was contrasted by a 2.78% alteration successful unfastened interest, bringing it down to $19.69 billion. The alteration successful unfastened interest, representing the full fig of outstanding derivative contracts, suggests that galore traders were closing their positions amid the uncertainty, preferring to trim vulnerability alternatively than prosecute successful a highly volatile market.

While Bitcoin options measurement saw a sizeable driblet of 39.73% to $625.97 million, the options unfastened involvement somewhat accrued by 2.18% to $10.24 billion. This indicates that portion determination was a simplification successful the trading of options contracts, a fig of traders held onto their positions. This could beryllium owed to a strategy to hold retired the market’s fluctuations oregon a content successful longer-term trends unaffected by short-term volatility.

The marketplace witnessed $95.41 cardinal successful liquidations, with agelong positions accounting for $59.39 cardinal and shorts for $36.02 million. The higher liquidation of agelong positions suggests a bearish marketplace reaction, wherever traders betting connected a terms summation were caught off-guard by the driblet successful prices pursuing the clarification of the ETF news.

Screengrab showing Bitcoin derivatives information connected Jan. 10, 2024 (Source: CoinGlass)

Screengrab showing Bitcoin derivatives information connected Jan. 10, 2024 (Source: CoinGlass)Looking into Binance and Bybit, the 2 largest exchanges by unfastened interest, we spot some platforms experiencing an summation successful trading volume, indicating heightened activity. The alteration successful unfastened involvement connected these platforms further corroborates the inclination of traders choosing to adjacent positions successful a volatile environment.

| BTC | $44911.2 | -4.01% | $77.66B | +5.23% | $884.97B | $19.66B | -3.59% | $94.36M |

| ETH | $2375.65 | +4.47% | $41.18B | +77.57% | $285.82B | $7.78B | +10.67% | $49.30M |

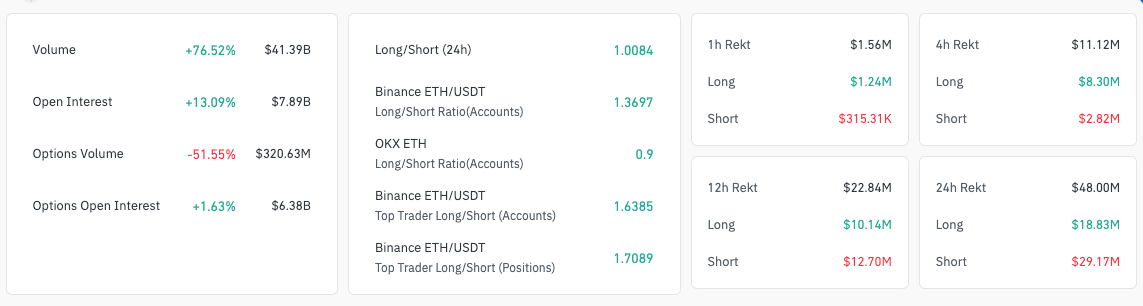

Turning to the Ethereum derivatives market, the concern presents a antithetic picture. The full trading measurement for Ethereum derivatives surged dramatically by 79.85% to $41.30 billion. This important summation successful measurement could beryllium attributed to traders pivoting towards Ethereum amid the Bitcoin turbulence oregon perceiving Ethereum arsenic a safer oregon much lucrative enactment during this play of heightened marketplace sensitivity.

Interestingly, contempt this surge successful wide trading volume, the options measurement for Ethereum derivatives decreased importantly by 51.55% to $320.63 million. This disparity suggests that portion determination was a wide summation successful trading activity, the options marketplace saw a withdrawal.

Traders mightiness person been much inclined to prosecute successful futures contracts, viewing these arsenic much nonstop ways to capitalize connected oregon hedge against the marketplace volatility alternatively than dealing with the complexities of options trading successful specified uncertain conditions.

Screengrab showing Ethereum derivatives information connected Jan. 10, 2024 (Source: CoinGlass)

Screengrab showing Ethereum derivatives information connected Jan. 10, 2024 (Source: CoinGlass)Open involvement successful Ethereum besides accrued by 11.52% to $7.81 billion, contrasting with the signifier observed successful Bitcoin. This indicates caller positions being opened, which, combined with the summation successful trading volume, suggests a much bullish sentiment successful the Ethereum market, oregon astatine slightest a cognition of Ethereum arsenic a much unchangeable plus successful the look of marketplace shocks.

The station Ethereum takes the pb implicit Bitcoin successful derivatives trading volume appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)