A crypto analyst, Eric, believes Ethereum (ETH) could spike to $20,000 successful the upcoming bull run. The expert said the imaginable motorboat of spot Ethereum exchange-traded funds (ETFs) successful the United States volition propel this upswing.

Ethereum To $20,000 Possible

In a station connected X, Eric cited Ethereum’s humanities inclination to reflector Bitcoin (BTC), albeit with a one-cycle lag. In the erstwhile bull market, the expert noted that Bitcoin surged 22-fold from $3,100 to $69,000. Therefore, if Ethereum follows a akin trajectory, reaching $20,000 would beryllium a realistic possibility.

As the expert noted, Ethereum’s caller carnivore marketplace bottommost of $880 successful 2022, if extrapolated utilizing the 22x maturation complaint seen successful BTC, places the coin astatine $19,360. However, the expert believes Ethereum mightiness surpass expectations, making $20,000 a basal and a intelligence circular fig to show closely.

Supporting this forecast is the imaginable support of a spot Ethereum ETFs. Like the spot Bitcoin ETF, this authorization volition apt pull organization investors and importantly boost Ethereum prices and liquidity. Institutional investors tin summation vulnerability to Ethereum done these analyzable derivative products without the complexities of straight trading oregon storing the coin.

While the optimism remains, the United States Securities and Exchange Commission (SEC) volition apt travel the aforesaid way it took earlier approving the archetypal spot of Bitcoin ETFs successful January. For context, the strict bureau failed to o.k. immoderate spot Bitcoin ETF for implicit 10 years, citing marketplace manipulation risks and the lack of due monitoring tools.

Will The US SEC Approve A Spot Ethereum ETF?

However, successful a caller connection by The Block, Standard Chartered, a planetary bank, said the US SEC volition apt o.k. Ethereum ETF’s archetypal spot successful May 2023. By then, the slope added, ETH prices volition beryllium trading astatine astir $4,000, propelled by wide marketplace optimism.

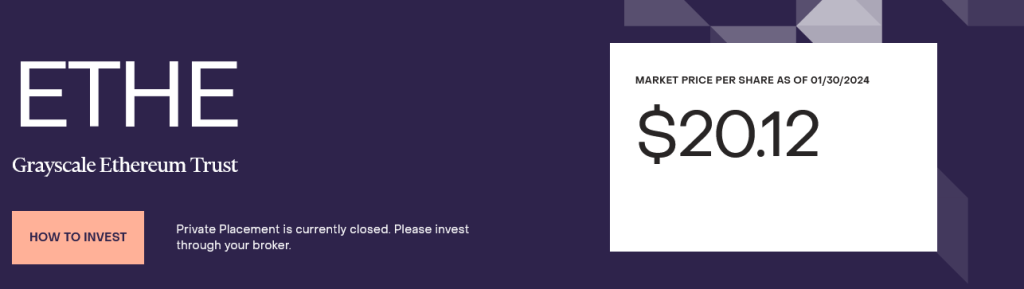

The slope notes that the nonaccomplishment of the bureau to classify ETH arsenic a information further adds value to this expectation. At the aforesaid time, Grayscale Investments, which is issuing Grayscale Ethereum Trusts (ETHE), wants to person this merchandise into an ETF. Each stock traded astatine astir $20 arsenic of January 30.

ETHE stock terms | Source: Grayscale

ETHE stock terms | Source: GrayscaleEarlier, Grayscale won against the US SEC’s arguments, wishing to forestall the conversion of their Bitcoin Trust into an ETF. This triumph acceptable the shot rolling for the eventual support of the archetypal spot Bitcoin ETFs successful the United States.

Additionally, the information that Ethereum Futures ETFs were precocious approved and listed connected the Chicago Mercantile Exchange is simply a nett positive, paving the mode for a imaginable listing successful May 2024.

Feature representation from Canva, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)