Data shows the Ethereum Open Interest has been trading astatine comparatively debased levels recently. Here’s what this could mean for the asset’s price.

Ethereum Open Interest Has Been Moving Sideways Since Its Plunge

As explained by an expert successful a CryptoQuant Quicktake post, the ETH Open Interest has followed a akin trajectory arsenic the terms of the cryptocurrency recently. The “Open Interest” present refers to the full fig of derivative-related contracts unfastened for Ethereum connected each exchanges.

When the worth of this metric goes up, it means that investors are presently opening up caller positions connected these platforms. Generally, this benignant of inclination leads to an summation successful the market’s full leverage, truthful the plus terms could go much volatile.

On the different hand, a diminution successful the indicator implies the investors are either closing up their positions of their ain volition oregon getting forcibly liquidated by their platform. Such a drawdown whitethorn travel convulsive terms action, but erstwhile the driblet is over, the marketplace could go much unchangeable owed to the reduced leverage.

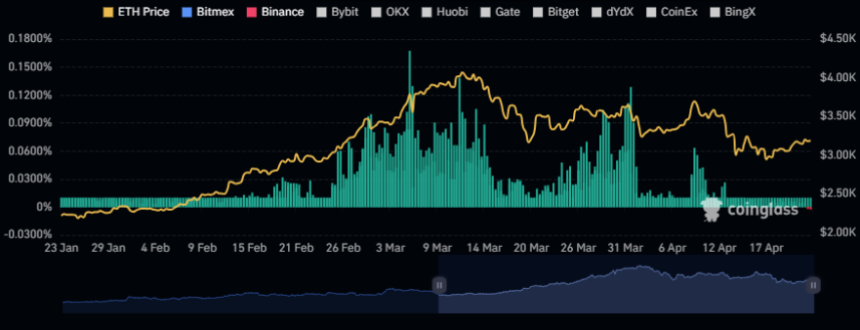

Now, present is simply a illustration that shows the inclination successful the Ethereum Open Interest implicit the past fewer months:

As displayed successful the supra graph, the Ethereum Open Interest registered a crisp driblet earlier alongside the asset’s price. The plunge successful the metric was people caused by the agelong declaration holders being washed retired successful the terms drawdown.

As the terms has mostly consolidated sideways since the decline, truthful has the worth of the Open Interest. The quant notes,

This alignment suggests a cooling down of enactment wrong the futures market. Consequently, the marketplace appears poised for the resurgence of either agelong oregon abbreviated positions, perchance initiating a caller and decisive marketplace question successful either direction.

Another indicator related to the derivative marketplace that could beryllium applicable for Ethereum’s aboriginal terms enactment is the funding rate. This metric tracks the periodic fees that derivative declaration holders are presently paying each other.

Positive backing rates connote that the agelong holders are paying the shorts a premium to clasp onto their positions; hence, that bullish sentiment is dominant. Similarly, antagonistic values suggest that a bearish sentiment is shared by the bulk of the derivative traders.

The illustration beneath shows that the Ethereum backing complaint has precocious turned red.

Historically, the marketplace has been much apt to determination against the sentiment of the majority, truthful the information that the backing complaint has flipped antagonistic whitethorn beryllium a bully motion for the chances of immoderate imaginable uptrends to start.

ETH Price

Ethereum has gradually accrued implicit the past fewer days, arsenic its terms has present reached $3,200.

Featured representation from Kanchanara connected Unsplash.com, CoinGlass.com, CryptoQuant.com, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)