After years successful the making, the Merge was finalized connected Sept. 15, switching Ethereum from Proof-of-Work (PoW) to Proof-of-Stake (PoS).

The roll-out enacted respective benefits, including cutting the chain’s vigor depletion by a reported 99% and mounting the groundwork for sharding to amended scaling successful a aboriginal hard fork.

The Merge besides picked up with EIP 1559, which rolled retired with the London hard fork successful August 2021. This introduced a simplification of Ethereum’s interest marketplace mechanism, including breaking fees into basal fees and tips, past burning the basal fee.

Under a PoS mechanics post-Merge, burning basal fees were sold arsenic a deflationary mechanics that would chopped token issuance by arsenic overmuch arsenic 88%.

CryptoSlate analyzed Glassnode information to measure whether the claims clasp up. Net proviso issuance has not been consistently deflationary successful the 3 months since the Merge.

Ethereum deflation fluctuates

According to Ethereum, nether the erstwhile PoW system, miners were issued astir 13,000 ETH per time successful artifact mining rewards. Now, post-Merge, stakers person astir 1,700 ETH successful regular rewards – this equates to an 87% simplification successful issuance.

However, with the advent of basal interest burns, the scope for a regular nett simplification successful proviso is enabled. Base interest burns beryllium connected web usage. The busier the web connected a fixed day, the much basal fees are burnt.

The minimum enactment fig for burned basal fees to transcend 1,700 ETH, truthful starring to a nett alteration successful supply, is astir 16 Gwei a day.

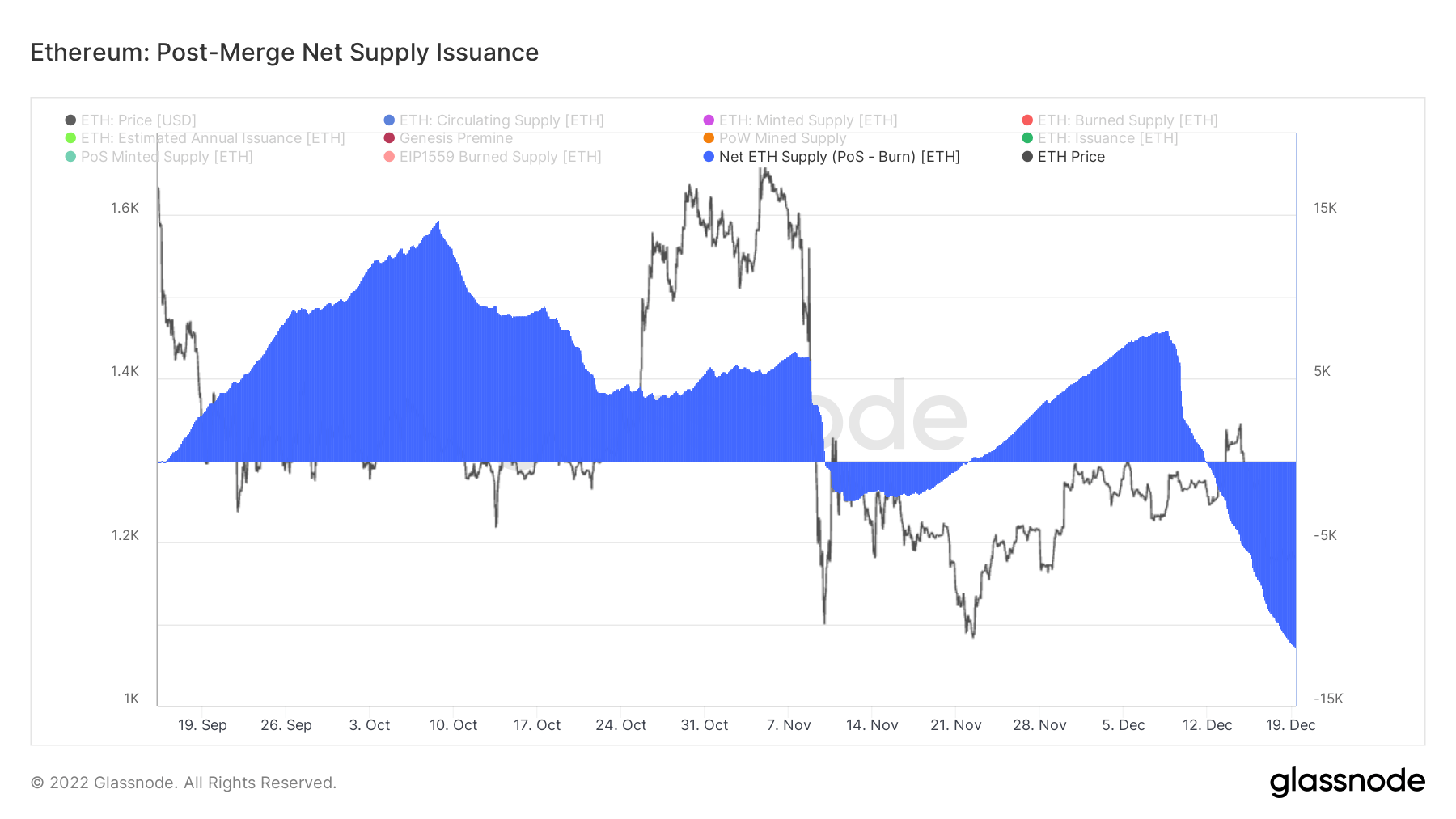

The illustration beneath shows that nett proviso issuance was inflationary instantly aft the Merge until Nov.9, hitting a precocious of 15,000 tokens successful aboriginal October.

Following an approximate two-week deflationary stint from Nov. 10, nett proviso issuance flipped to inflationary erstwhile much earlier returning to a nett antagonistic proviso issuance from Dec. 12 onwards, sinking to a caller debased of -11,000 tokens connected Dec. 19.

To date, periods of proviso ostentation transcend proviso deflation.

Ethereum: Post-Merge Net Supply Issuance / Source: Glassnode.com

Ethereum: Post-Merge Net Supply Issuance / Source: Glassnode.comNet Inflation Rate

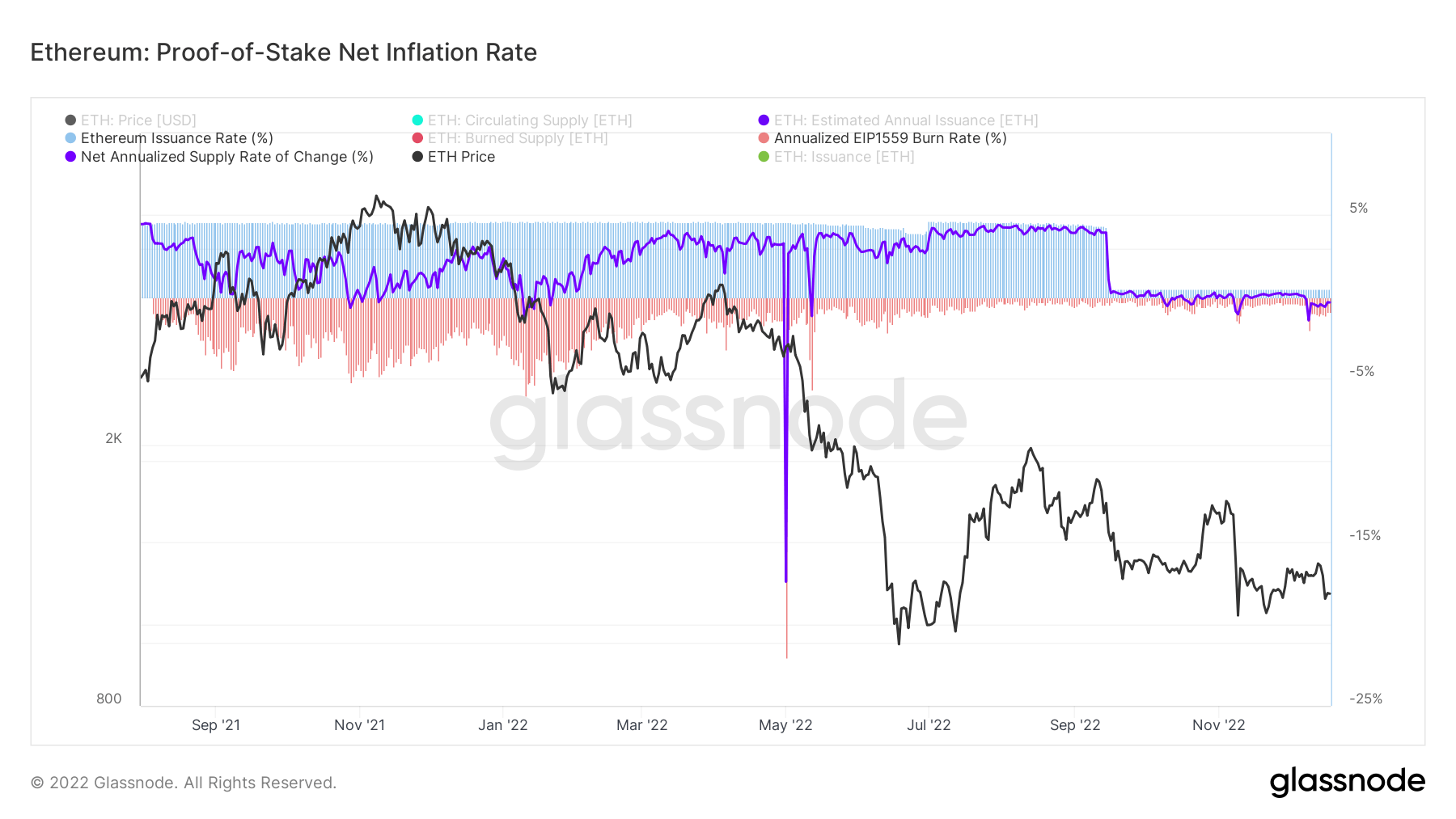

The illustration beneath shows the issuance complaint and pain complaint dropping post-Merge, with the erstwhile metric decreasing importantly aft Sept. 15.

Previously, the issuance complaint was comparatively steady, holding astatine astir 4.1% since October 2021. At the aforesaid time, implicit this period, the pain complaint was overmuch much volatile successful comparison, peaking astatine astir -5% earlier declining from August onwards to a complaint of 0.35%.

The existent issuance complaint of 0.5% and pain complaint of -0.9% springiness a nett proviso alteration complaint of -0.4%.

Ethereum: Proof of Stake Net Inflation Rate / Source: Glassnode.com

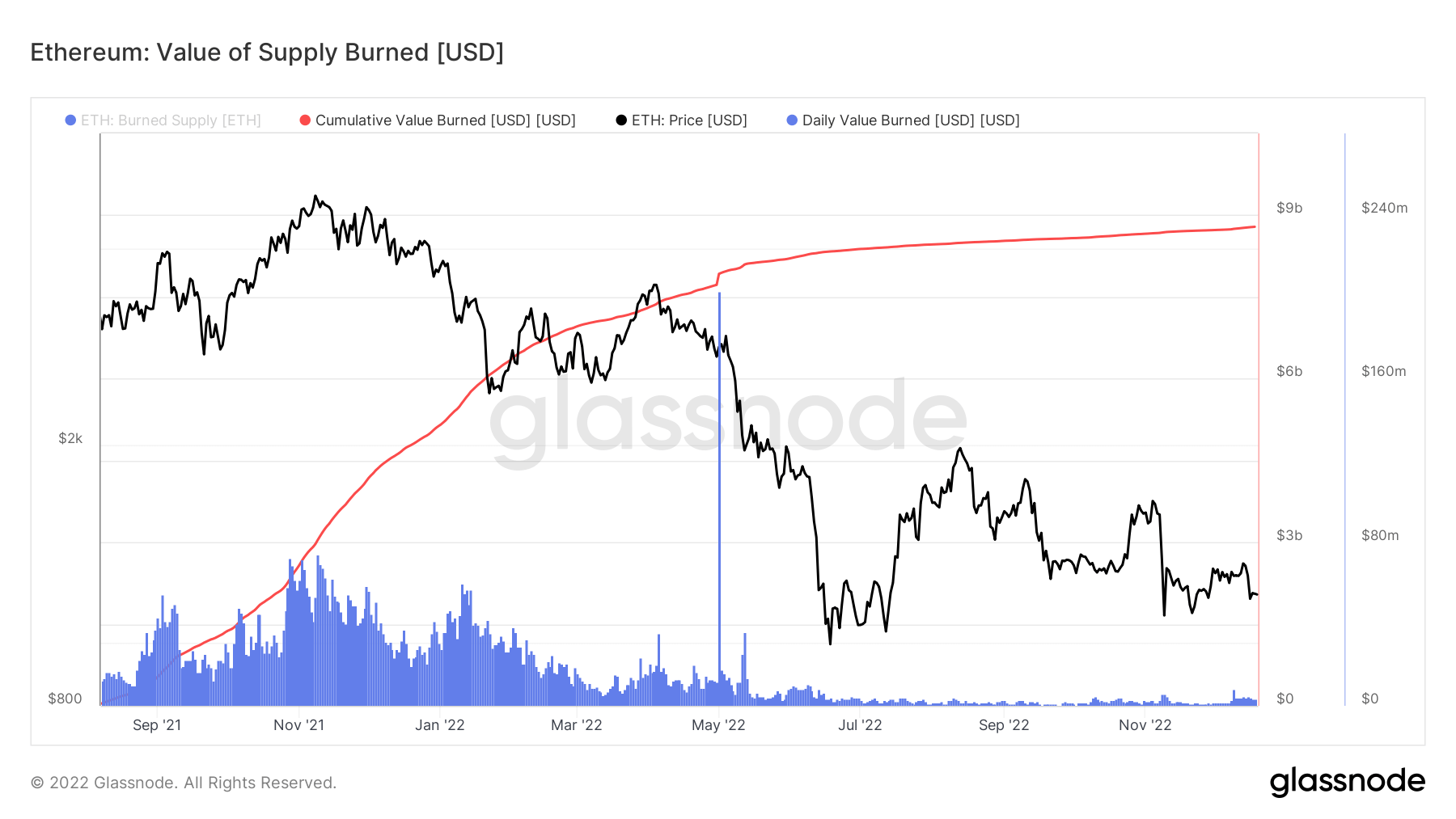

Ethereum: Proof of Stake Net Inflation Rate / Source: Glassnode.comMultiplying the burned basal interest by the spot terms astatine the clip of pain results successful the Value of Supply Burned metric.

Since June 2022, the regular worth burned has sunk importantly to astir $4 cardinal daily. The cumulative sum of each burns to day comes successful astatine conscionable nether $9 billion.

Ethereum: Value of Supply Burned / Source: Glassnode.com

Ethereum: Value of Supply Burned / Source: Glassnode.comStaking metrics

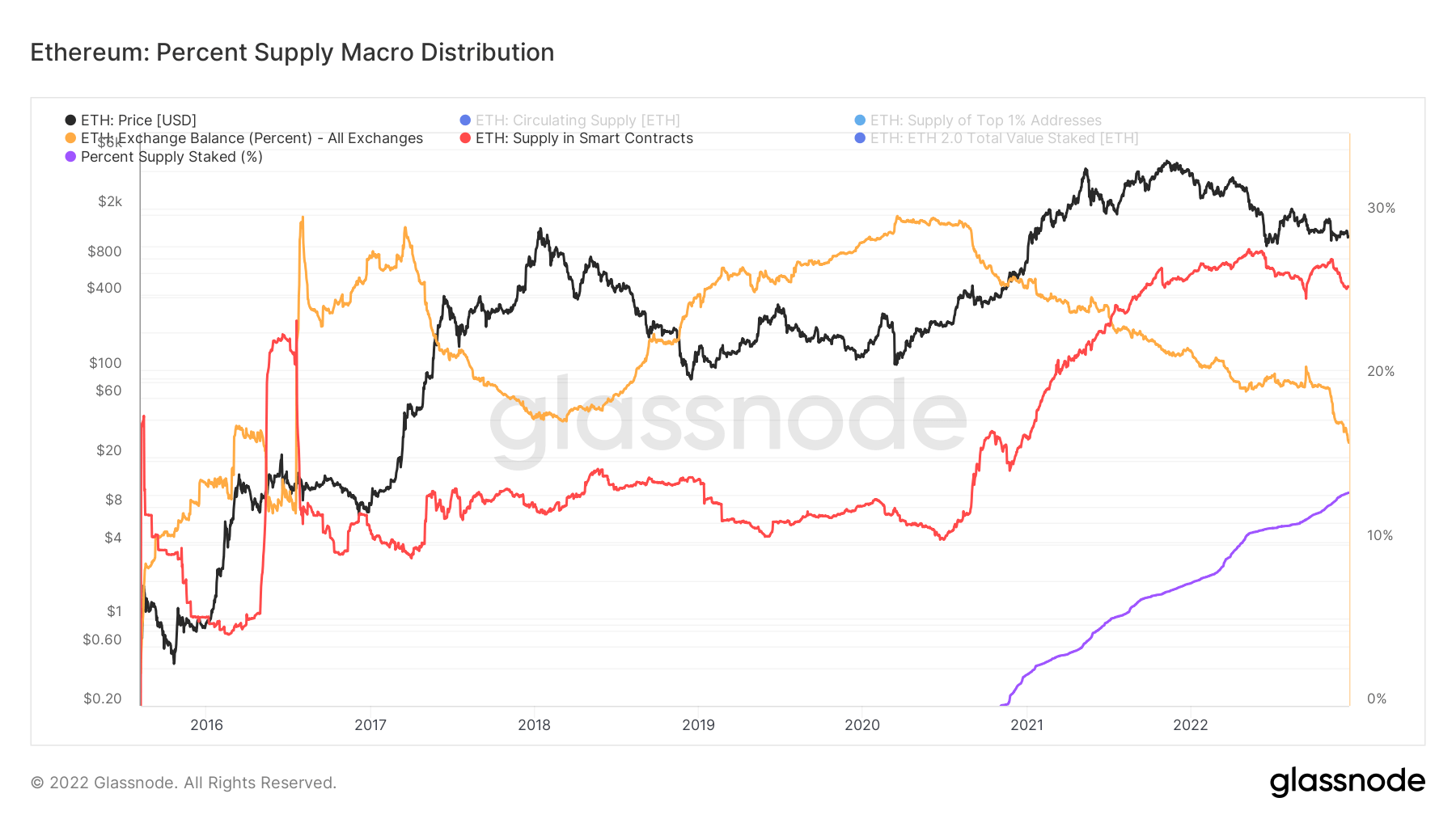

Around 13% of the Ethereum proviso is staked. This is importantly less than BNB Chain astatine 90.2%, Cardano astatine 71.6%, and Solana astatine 68.6%.

Currently, staked ETH cannot beryllium unlocked, apt a origin successful the comparatively debased percent of proviso staked versus different ample caps. However, erstwhile enabled, it is unclear whether this volition trigger a wide unstaking of tokens, truthful cutting the issuance of regular ETH staking rewards, oregon if much tokens volition beryllium staked based connected being capable to determination successful and retired of staking with less restrictions.

Since precocious 2020, the ETH proviso connected exchanges has fallen from 30% to 16.5%. In contrast, the proviso successful astute contracts has gone the different way, rising from 15% to 26%—the 2 transverse astir mid-2021.

Ethereum: Percent Supply Macro Distribution / Source: Glassnode.com

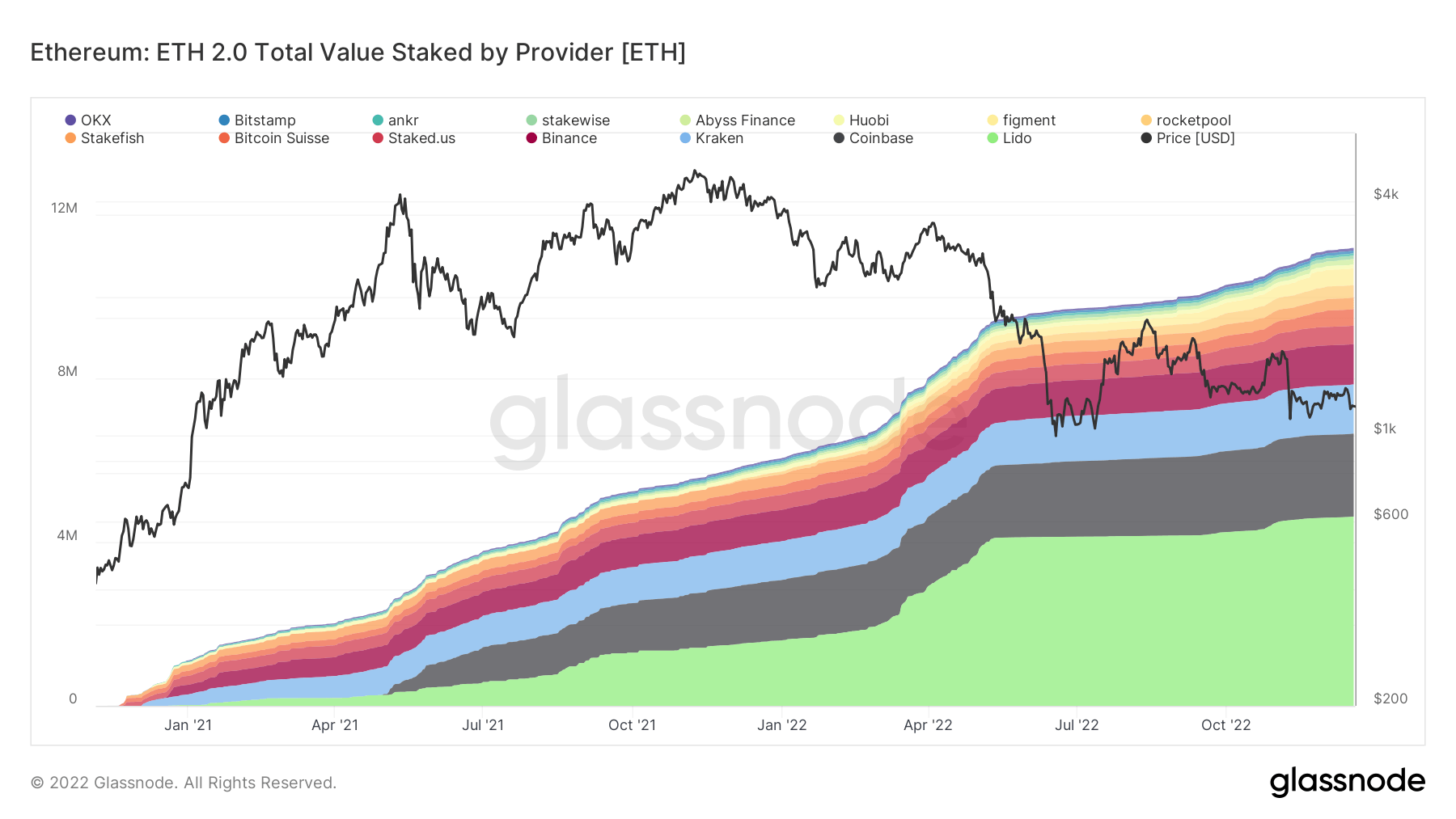

Ethereum: Percent Supply Macro Distribution / Source: Glassnode.comThe full fig of ETH staked is approaching 12 million. However, the organisation of this is highly concentrated among a fewer validators arsenic follows:

- Lido – 4.6 million

- Coinbase -2 million

- Kraken – 1.2 million

- Binance – 1 million

ETH 2.0 Total Value Staked by Provider / Source: Glassnode.com

ETH 2.0 Total Value Staked by Provider / Source: Glassnode.comThe station Ethereum token issuance continues inflationary, deflationary swing appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)