Ethereum experienced 1 of the craziest days successful its past past Monday, plunging implicit 30% successful little than 24 hours amid wide marketplace panic fueled by U.S. commercialized warfare fears. However, wrong hours, ETH staged an awesome betterment pursuing President Trump’s announcement of negotiations with Canada and Mexico to easiness tariff concerns. This crisp rebound has reignited optimism among investors, with galore present intimately watching Ethereum’s adjacent move.

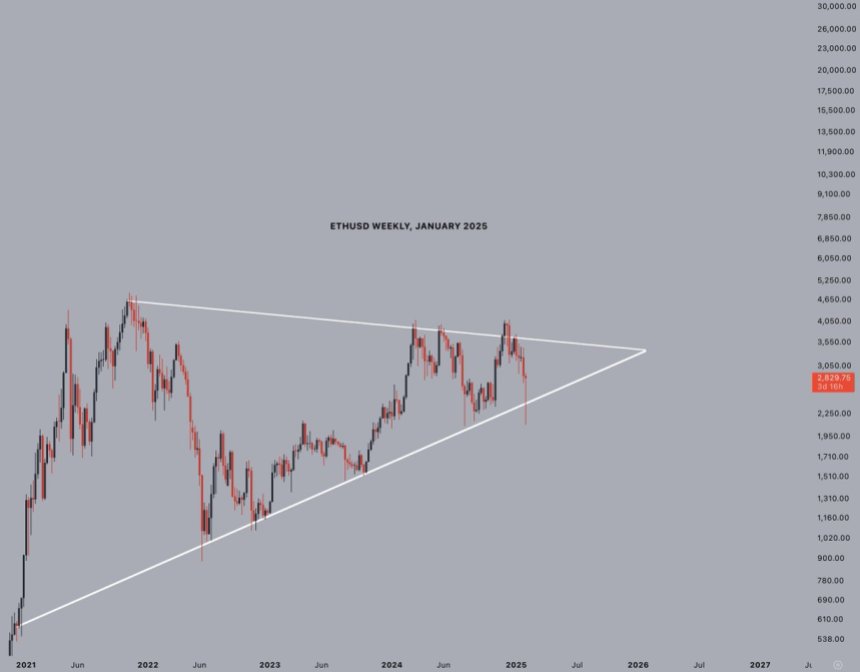

Despite the caller volatility, apical expert Jelle shared a method investigation revealing that Ethereum is inactive trading wrong a monolithic bullish pennant that has been forming since 2021. This semipermanent operation suggests that ETH remains successful a consolidation phase, gathering momentum for a breakout. According to Jelle, erstwhile Ethereum decisively breaks retired of this pattern, a monolithic rally into terms find is expected.

As the marketplace stabilizes and investors reassess their positions, ETH remains 1 of the astir intimately watched assets. While short-term terms enactment is unpredictable, the semipermanent bullish operation provides beardown enactment for Ethereum’s maturation potential. Traders and analysts alike are present looking for cardinal method signals that could corroborate a breakout and propel ETH into caller all-time highs.

Ethereum Struggles Below Key Supply Levels

Ethereum is presently facing superior selling pressure, struggling to reclaim the important $3,000 mark. Bulls are successful occupation arsenic ETH remains trapped beneath this level, starring to heightened uncertainty and volatility successful the market.

Every time that Ethereum trades beneath $3,000 increases the likelihood of a deeper correction, arsenic traders stay cautious and sentiment weakens. The inability to summation momentum supra this intelligence level has near investors acrophobic astir ETH’s short-term direction.

However, contempt the ongoing struggles, apical expert Jelle shared a method investigation connected X, revealing that Ethereum is inactive trading wrong a monolithic bullish pennant. According to Jelle, ETH has deviated from some the highs and the lows of the pattern, and present the marketplace is mounting its absorption to tag cardinal proviso levels. This means that portion short-term terms enactment remains uncertain, Ethereum’s semipermanent operation suggests that a breakout could beryllium connected the horizon.

Ethereum forming a multi-year bullish pennant | Source: Jelle connected X

Ethereum forming a multi-year bullish pennant | Source: Jelle connected XJelle believes that erstwhile Ethereum manages to propulsion supra the bullish structure, a interruption supra the $4,000 people volition follow. This breakout would corroborate a rally into terms discovery, mounting the signifier for Ethereum to scope caller all-time highs. While bears stay successful power for now, the semipermanent bullish enactment suggests that ETH could beryllium gearing up for a large determination successful the coming months.

Price Action Details: Technical Levels

Ethereum is presently trading astatine $2,820, inactive incapable to trial the captious $3,000 level. Price enactment remains weak, arsenic ETH struggles to interruption supra the $2,900 mark, which has present turned into a short-term proviso zone. The nonaccomplishment to propulsion higher signals that bulls are losing momentum, and the marketplace remains successful a authorities of uncertainty.

ETH struggles beneath $3,000 | Source: ETHUSDT illustration connected TradingView

ETH struggles beneath $3,000 | Source: ETHUSDT illustration connected TradingViewIf Ethereum loses the $2,800 enactment level, a deeper correction could unfold, perchance dragging the terms down to the $2,500 region. This would beryllium a important setback for bulls, arsenic it would corroborate further downside unit and could widen the existent consolidation phase.

On the different hand, if ETH manages to reclaim the $3,000-$3,100 level successful the coming days, it would awesome renewed bullish momentum. A palmy breakout supra this scope could ignite a monolithic surge, pushing Ethereum toward higher proviso levels and mounting the signifier for a imaginable tally toward $3,500 and beyond.

For now, Ethereum remains astatine a important juncture, with terms enactment signaling some hazard and opportunity. Traders and investors are intimately watching cardinal absorption and enactment levels, arsenic ETH prepares for its adjacent large move.

Featured representation from Dall-E, illustration from TradingView

11 months ago

11 months ago

English (US)

English (US)