Ethereum transaction fees are erstwhile again hitting highs past seen since May 2022. This improvement has raised concerns astir the interaction connected the Ethereum web usage and its autochthonal cryptocurrency, ETH.

Ethereum, the second-largest crypto by marketplace capitalization, is 1 of the starring decentralized concern (DeFi) and non-fungible tokens (NFTs) platforms. The web has been experiencing a surge successful enactment owed to the expanding popularity of memecoins specified arsenic PEPE, which has caused fees to spike.

Rising Transaction Fees: A Cause For Concern

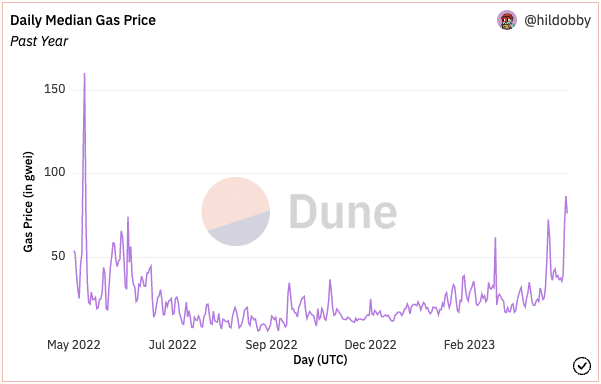

On May 2, the median mean transaction interest connected the Ethereum web soared to astir 87 gwei, according to Dune Analytics. This spike was chiefly attributed to the accrued on-chain enactment surrounding memecoin trading, according to Hildobby, a pseudonymous information researcher astatine VC steadfast Dragonfly.

Ethereum regular median state price. Source: Hildobby

Ethereum regular median state price. Source: HildobbyMemecoins specified arsenic Pepe the Frog-themed token person been enjoying a renaissance recently, with the token terms soaring implicit 266 times successful conscionable 4 days successful April. The memecoin’s marketplace headdress roseate to implicit $500 cardinal this week earlier crashing beneath $400 cardinal again.

While this surge successful activity whitethorn bespeak expanding involvement successful the crypto market, it besides highlights concerns astir the network’s scalability and the interaction of rising fees connected users. High transaction fees tin deter users from interacting with decentralized applications connected the Ethereum network; arsenic the fees increase, smaller users are priced retired of the level and its applications.

Notably, the emergence successful memecoin trading activity, which accrued the fig of transactions connected the Ethereum network, starring to a surge successful fees, has besides made decentralized exchanges (DEXs) connected Ethereum acquisition the highest level of users since 2021.

Dune Analytics data shows that Ethereum-based DEXs saw a surge successful volume, with the full trading measurement connected these platforms surpassing $63 cardinal successful April alone. This represents a important summation from March, erstwhile the full trading measurement was astir $31 billion.

What This Means For ETH

It is worthy noting that the rising transaction fees connected the Ethereum web are seen arsenic a disadvantage to the worth of ETH, arsenic users whitethorn question alternative blockchains with little transaction costs. An lawsuit of this is the expanding involvement successful different L1 blockchains specified arsenic Solana (SOL), Cardano (ADA), Fantom (FTM), and truthful on.

However, Ethereum co-founder Vitalik Buterin precocious suggested that the web could quickly standard up to 100,000 transactions per second. This could assistance alleviate web scalability concerns and trim transaction fees.

Regardless, the accrued enactment whitethorn beryllium a affirmative motion of increasing involvement successful the crypto market; but it has an costly terms tagged. The emergence successful fees could discourage smaller transactions and pb to a diminution successful request for ETH.

Wwith Ethereum’s scalability improvements successful the pipeline, it remains to beryllium seen however the web volition germinate successful the coming months. Meanwhile, ETH price has declined 0.4% aft a imaginable surge to commercialized above $2,000, past month.

ETH presently trades for $1.872 astatine the clip of writing. ETH has a 24-low of $1,855 and a 24-high of $1,919, according to information from CoinMarketCap. Regardless of the marketplace decline, the asset’s trading measurement has lone ranged betwixt $8 cardinal and $9 cardinal successful the past 2 weeks.

Featured representation from Shutterstock, Chart from TradingView

2 years ago

2 years ago

English (US)

English (US)