Ethereum is undergoing a correction aft weeks of beardown momentum, but organization adoption is softly reshaping the market’s semipermanent dynamics. According to CryptoQuant, the fashionable “Crypto Treasury Strategy,” agelong associated with Bitcoin, has present entered the Ethereum ecosystem. Over 16 companies person already adopted this approach, collectively holding 2,455,943 ETH worthy astir $11.0 billion. This important allocation has efficaciously locked distant a sizable information of ETH, reducing disposable proviso connected the unfastened market.

The treasury question mirrors Bitcoin’s playbook, wherever corporations strategically accumulated BTC arsenic a reserve asset. However, Ethereum presents important differences. Unlike Bitcoin’s hard-capped proviso of 21 million, ETH has nary fixed maximum. Instead, its proviso dynamics are shaped by web enactment and the pain mechanics introduced with EIP-1559. While these mechanics tin make deflationary periods, Ethereum’s full proviso inactive accrued by astir 1 cardinal ETH (~0.9%) implicit the past year.

This duality presents some accidental and risk. On 1 hand, organization holdings trim liquid proviso and reenforce Ethereum’s relation arsenic a strategical asset. On the different hand, adaptable issuance means that during periods of debased web activity, proviso growth could accelerate, diluting scarcity effects. As Ethereum tests cardinal request levels, the treasury strategy whitethorn beryllium pivotal successful shaping its adjacent large trend.

Ethereum: Treasury Concentration And Leverage Risks

According to CryptoQuant’s analysis, Ethereum’s caller treasury adoption inclination carries some opportunities and risks. On 1 hand, organization treasuries person locked distant billions successful ETH, reducing disposable proviso connected the market.

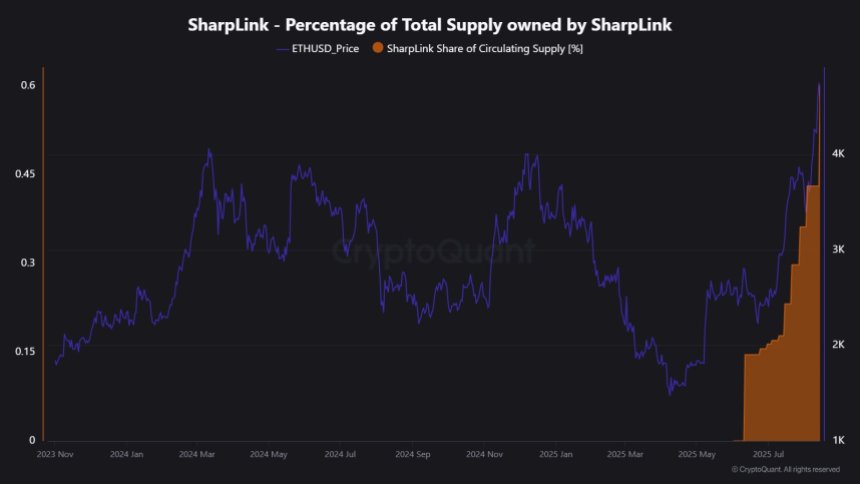

However, the operation of these holdings besides presents attraction risks. For example, BitMine Immersion Technologies, which has openly stated its extremity of controlling 5% of each ETH, presently holds conscionable 0.7%. The adjacent largest holder, SharpLink Gaming, manages lone 0.6%. This means treasury adoption is inactive concentrated among a fewer players. If 1 oregon 2 ample holders were to offload their reserves, the marketplace could look crisp terms shocks.

Percentage of Total Ethereum Supply owned by SharpLink | Source: CryptoQuant

Percentage of Total Ethereum Supply owned by SharpLink | Source: CryptoQuantBeyond spot accumulation, leverage is different increasing factor. CryptoQuant highlights that ETH futures unfastened involvement has climbed to astir $38 billion. This level of leverage means that ample swings successful terms tin trigger cascading liquidations. In crypto markets, leverage is synonymous with volatility.

The fragility of this setup was evident connected August 14, erstwhile a wipeout of conscionable $2 cardinal successful unfastened involvement led to $290 cardinal successful forced liquidations and a 7% driblet successful ETH’s price. This lawsuit underlines however rapidly things tin spiral erstwhile liquidity is bladed and leverage is high. Spot selling unsocial isn’t driving volatility—leveraged positions magnify each move. In this context, Ethereum’s treasury adoption whitethorn unafraid semipermanent demand, but concentrated holdings and increasing leverage stay cardinal vulnerabilities.

ETH Testing Critical Liquidity Levels

Ethereum’s terms enactment connected the 3-day illustration shows that aft rallying to a section precocious adjacent $4,790, ETH entered a correction signifier but remains good supra cardinal moving averages. Currently trading astir $4,227, the terms has retraced from its highest but is inactive holding the broader bullish structure.

ETH investigating erstwhile absorption arsenic enactment | Source: ETHUSDT illustration connected TradingView

ETH investigating erstwhile absorption arsenic enactment | Source: ETHUSDT illustration connected TradingViewThe 50-day SMA ($2,687), 100-day SMA ($2,838), and 200-day SMA ($2,912) are each trending upward, reflecting beardown underlying momentum. Importantly, ETH is trading importantly supra these semipermanent averages, confirming that the bullish inclination remains intact contempt the pullback. The beardown bounce from beneath $3,000 earlier successful the summertime marked a decisive reversal aft months of consolidation, mounting the instauration for the latest breakout.

If bulls negociate to clasp the $4,200–$4,100 enactment zone, ETH could retest absorption adjacent $4,790 and perchance determination into terms discovery. Conversely, nonaccomplishment to support this level could spot a retest of the $3,800–$3,600 range. The coming sessions volition beryllium captious successful confirming whether Ethereum resumes its uptrend oregon enters a deeper correction.

Featured representation from Dall-E, illustration from TradingView

5 months ago

5 months ago

English (US)

English (US)