Companies that are buying ether (ETH) for their treasury strategy are a amended bargain for investors than ETH spot exchange-traded funds (ETFs), said Standard Chartered expert Geoff Kendrick.

The expert noted that these firms are attracting attraction not conscionable for their holdings but besides for their fiscal structure, which is starting to go charismatic for investors.

“The NAV multiples (market headdress divided by worth of ETH held) person present besides started to normalise for the ETH treasury companies,” said Kendrick, adding that this dynamic is making the "treasury companies present precise investable for investors seeking entree to ETH terms appreciation."

Buying ETH for the equilibrium sheet, pursuing Michael Saylor's bitcoin (BTC) buying strategy, has taken disconnected recently. Many publically traded firms person jumped connected committee and seen their stock prices surge initially, boosting their marketplace headdress and NAV multiples. Now, their NAV multiples are coming down from their archetypal peak.

Some of the apical companies enjoying this marketplace euphoria see BitMine Immersion Technologies (BMNR) and SharpLink Gaming (SBET).

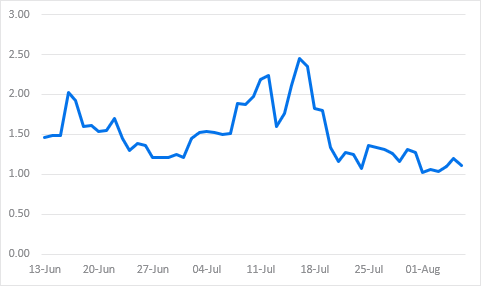

Among these companies, Kendrick highlighted SharpLink Gaming's (SBET) NAV multiple, which astatine its highest was astir 2.50 and is present coming down to a much normalized level of adjacent 1.0. This means its marketplace headdress is lone somewhat higher than the worth of its ETH holdings.

To beryllium sure, the expert said that helium doesn't spot immoderate crushed for the NAV to spell beneath 1.0, arsenic these treasury firms supply investors with "regulatory arbitrage opportunities."

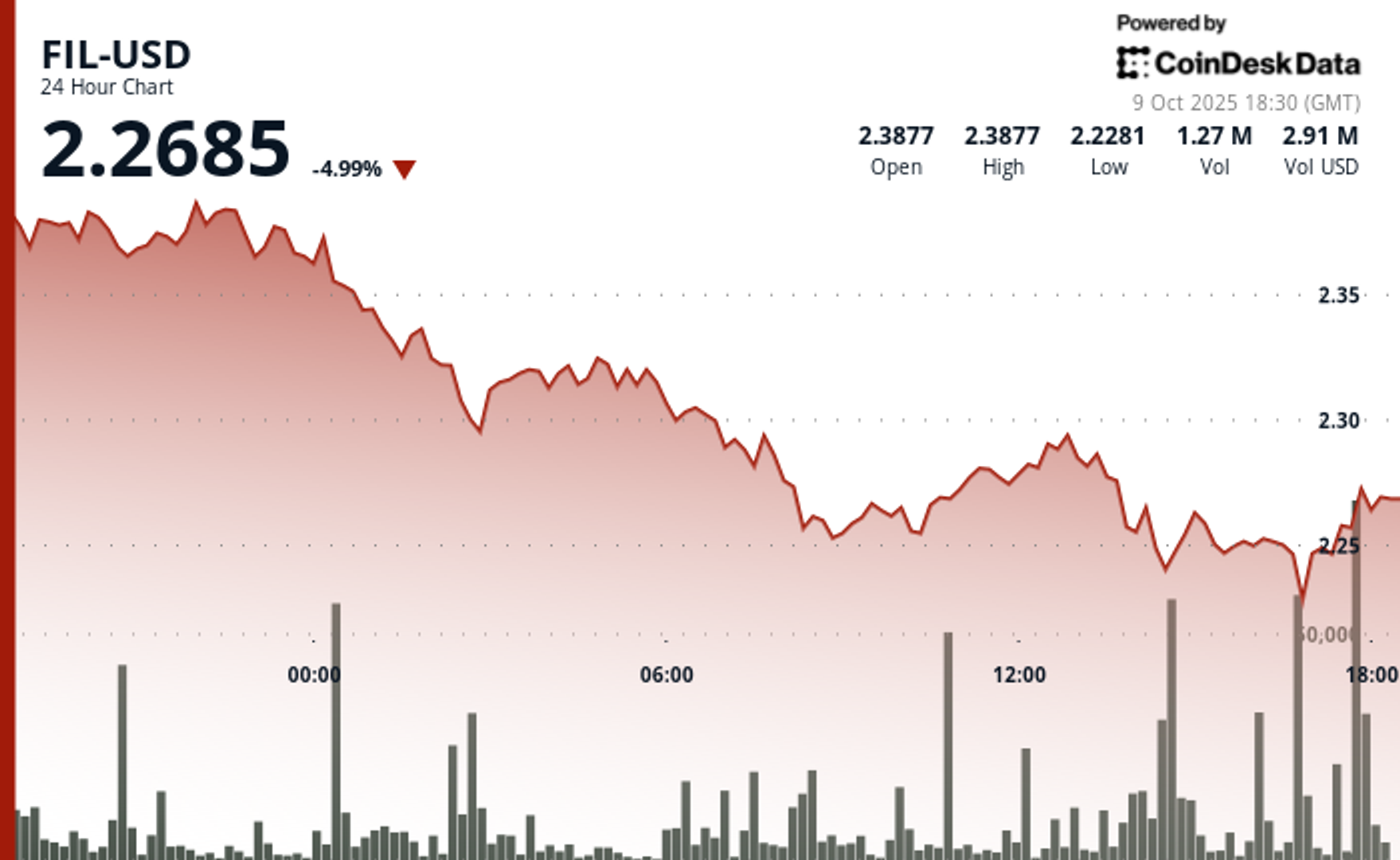

Kendrick besides highlighted that these treasury companies person bought conscionable arsenic overmuch ETH arsenic U.S.-listed spot exchange-traded funds (ETFs) since June.

Both groups present clasp astir 1.6% of the full circulating ETH proviso — conscionable nether 2,000 ETH — implicit that clip period, adding to his telephone that some the treasury stocks and ETF holders present supply akin vulnerability to ETH, each other being equal.

The operation of these 2 factors is present adding to his thesis that ETH treasury plays are a amended buying opportunities than ETFs. "Given NAV multiples are presently conscionable supra 1 I spot the ETH treasury companies arsenic a amended plus to bargain than the US spot ETH ETFs," helium said.

Standard Chartered is maintaining its year-end terms people of $4,000 for ether. ETH is presently trading astatine $3,652, up 2% implicit the past 24 hours.

Read more: Ether Treasury Companies to Eventually Own 10% of Supply: Standard Chartered

2 months ago

2 months ago

English (US)

English (US)