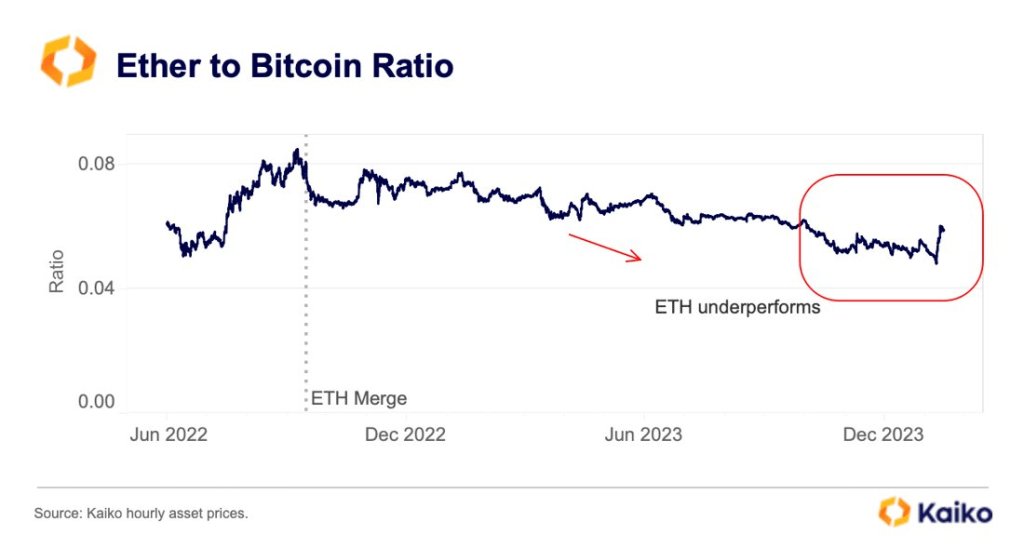

Amidst a volatile crypto market, Ethereum (ETH) is gaining momentum, outperforming its long-time rival Bitcoin (BTC). According to Kaiko data, the ETH/BTC ratio has steadily risen, rebounding from multi-year lows.

ETHBTC ratio inclination | Source: Kaiko connected X

ETHBTC ratio inclination | Source: Kaiko connected XETH/BTC Ratio Rising, ETH Momentum Building

The ETH/BTC ratio technically gauges marketplace sentiment towards these 2 starring crypto. The caller rebound indicates investors are progressively bullish connected Ethereum’s imaginable comparative to Bitcoin.

This upward trajectory is fueled by increasing optimism surrounding the imaginable support of spot Ethereum ETFs and the wide assurance that markets volition inclination higher successful 2024. The imaginable of this merchandise entering the marketplace has besides injected caller vigor into the ETH ecosystem, lifting the 2nd astir invaluable coin by marketplace cap.

Related Reading: Institutional Inflows Into XRP Surges 244% Amid ETF Speculation

After protracted little lows, the ETH/BTC ratio began rising instantly aft the United States Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs past week. This unexpected shift, analysts observe, is chiefly due to the fact that of expanding assurance successful the SEC approving a akin merchandise for ETH.

Spot Ethereum ETFs, which would supply nonstop vulnerability to the Ethereum market, would marque it easier for organization investors to payment from the volatility of ETH. So far, the SEC has approved an Ethereum Futures ETF, which, dissimilar the spot ETF, tracks an index, not the nonstop terms of this asset.

Blackrock is among the starring Wall Street giants funny successful issuing a spot Ethereum ETF. Considering its past of success, the determination by 1 of the world’s starring plus managers to use for this merchandise is an endorsement of its prospects. Earlier, Larry Fink, the CEO of BlackRock, said Ethereum, contempt its scaling challenge, mightiness spearhead the tokenization thrust successful the years ahead.

US SEC Yet To Clarify Whether Ethereum Is A Commodity Or Security

Even so, the SEC has yet to clarify whether ETH, a coin pre-mined with immoderate assets distributed to the Ethereum Foundation, is simply a commodity similar Bitcoin. Earlier, Gary Gensler, the chairperson of the SEC, was cornered by the United States policymakers to springiness the agency’s basal connected the coin but didn’t.

Nonetheless, with the imaginable of spotting Ethereum ETFs and the dominance of Ethereum successful decentralized concern (DeFi) and non-fungible tokens (NFTs), ETH volition apt proceed outperforming BTC successful the coming months. Price enactment information shows that ETH is already up 20% versus BTC successful the past trading week.

Feature representation from Canva, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)