Ethereum (ETH) is gaining prominence arsenic Bitcoin maintains its caller highs. Despite the information that ETH is presently 36% beneath its all-time precocious of $4,878 from 2021, analysts expect that the second-largest cryptocurrency by marketplace capitalization whitethorn beryllium preparing for a important shift.

Ethereum’s ecosystem is simply a hive of activity, with a surge successful organization investments, rising ETF interest, and expanding transaction volumes.

From the 1.1 cardinal recorded 3 months ago, the regular transaction volumes connected Ethereum person climbed to 1.22 million, a notable emergence according to the astir existent statistic from IntoTheBlock.

Bitcoin has been the prima of this rally, but what astir Ethereum?

Historically, Ethereum has been 1 of the archetypal assets to payment from nett rotations aft Bitcoin’s move.

Currently, Ethereum’s on-chain enactment shows evenly spaced imaginable absorption levels, but in… pic.twitter.com/amkbZmtEyo

— IntoTheBlock (@intotheblock) November 21, 2024

Despite the information that the summation is not substantial, it indicates that web usage is consistent. This accordant enactment serves arsenic the instauration for Ethereum’s semipermanent worth and underscores its ongoing value successful the crypto sector.

Institutional Investors Place Bets

In the past week, organization buyers bought much than $1.4 cardinal worthy of Ethereum (ETH), which caused a disturbance successful the crypto community. During the aforesaid clip frame, $147 cardinal has been enactment into Spot Ethereum ETFs. This shows that radical are becoming much optimistic astir the aboriginal of ETH.

#Ethereum whales person bought implicit 430,000 $ETH successful the past 2 weeks, worthy implicit $1.40 billion! pic.twitter.com/n7iTTADuax

— Ali (@ali_charts) November 14, 2024

The enactment surge continues; trading volumes for Ethereum ETFs reached a grounds $1.63 cardinal past week, representing a 44% play increase.

According to analysts, this summation is accordant with the patterns observed successful Bitcoin ETFs, which experienced an archetypal play of stagnation, followed by a play of sustained growth.

In response, Ethereum’s terms went done the roof, rising by 25%, which was the biggest play summation successful six months. Many radical spot these changes arsenic signs that Ethereum is gaining speed, which could perchance pb to much benefits.

Shifting Landscape: Layer 2 Solutions

While determination are positives, maturation successful Ethereum’s web sends retired a mixed signal. New ETH addresses created are little than those seen successful erstwhile bull markets.

The crushed for this is seen by experts arsenic Layer 2 options specified arsenic Base. Because these technologies are built connected apical of Ethereum’s infrastructure, transfers tin hap much rapidly and for little money. This makes it little important to straight link to the main Ethereum chain.

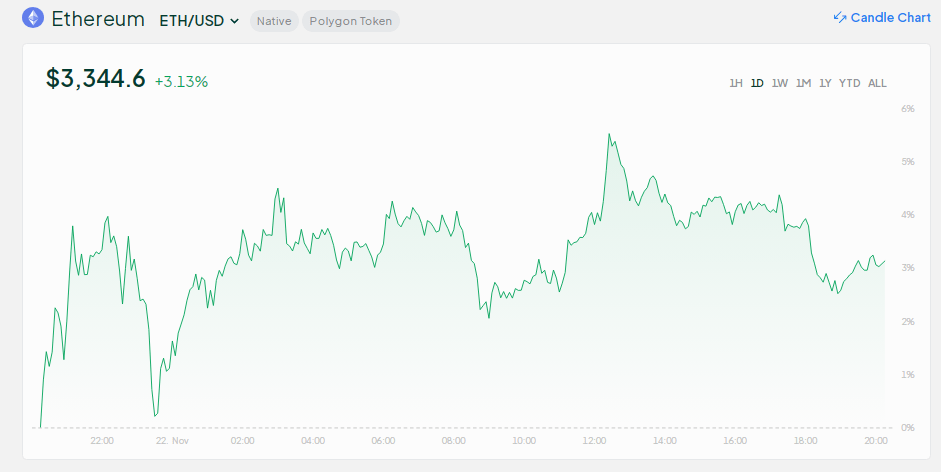

Ether up successful the past 24 hours. Source: Bitstamp

Ether up successful the past 24 hours. Source: BitstampNevertheless, Ethereum’s value has not been eclipsed by Layer 2 growth. Tokens proceed to beryllium indispensable successful the decentralized concern (DeFi) and NFT ecosystems. In reality, this enlargement strengthens Ethereum’s cardinal relation portion simultaneously expanding its scalability and accessibility.

ETH is becoming little correlated with BTC.

The 180-day BTC-ETH Pearson correlation is astatine a three-year low. A 10% emergence successful #Bitcoin could effect successful lone a 3% summation for #Ethereum.

Just due to the fact that BTC is beardown doesn’t mean you should bargain ETH. Each plus is present pursuing its ain path. pic.twitter.com/4Dn4QoInXo

— Ki Young Ju (@ki_young_ju) November 19, 2024

Ethereum Dissociates From Bitcoin

Ethereum’s autonomy from Bitcoin is becoming progressively apparent. The 180-day correlation betwixt the 2 cryptocurrencies has plummeted to a three-year low, falling beneath 0.5. This change, according to analysts, indicates that Ethereum is present much influenced by its distinctive marketplace dynamics than by the terms fluctuations of Bitcoin.

The necessity of independently assessing Ether’s imaginable is expanding arsenic it continues to prosecute its ain course. Ethereum is demonstrating that it is much than conscionable Bitcoin’s counterpart — it is forging its ain way successful the crypto world, whether done the adoption of Layer 2 solutions, organization interest, oregon expanding ETF activity.

Featured representation from DALL-E, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)