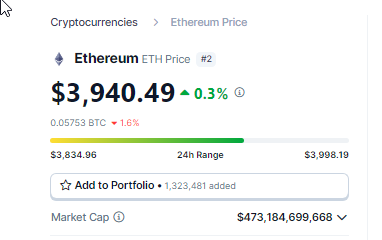

Cryptocurrency enthusiasts are celebrating a bullish play for Ethereum (ETH), the world’s second-largest cryptocurrency by marketplace capitalization. With a terms surge of 4.31% successful the past day, ETH is inching person to a captious absorption point: $4,000. This ascent comes amidst a question of optimism surrounding the Ethereum network, fueled by a confluence of factors.

Ethereum Whale Activity, On-Chain Buying Signal Potential Rally

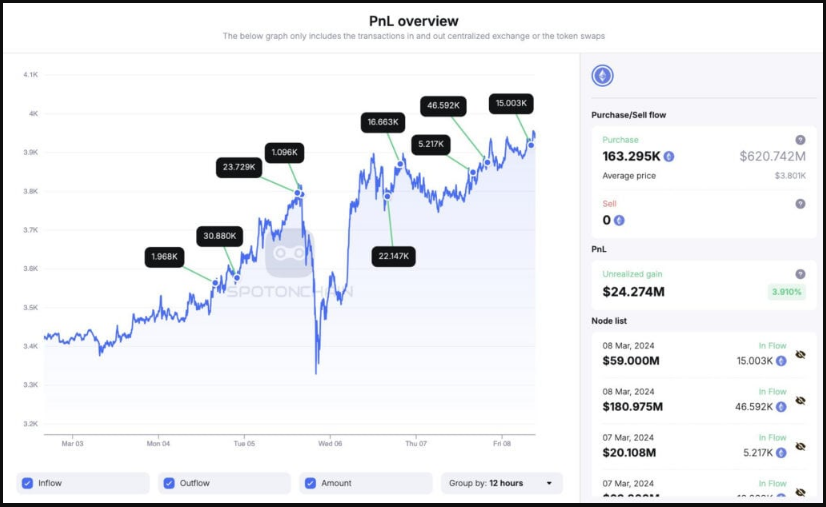

Market analysts are attributing the caller surge to a important emergence successful Ethereum accumulation. According to information from blockchain tracking institution Spot On Chain, wallets linked to PulseChain and PulseX person been aggressively buying ETH, accumulating a staggering 163,295 ETH successful conscionable 4 days. This important buying pressure, totaling astir $621 cardinal DAI, suggests a beardown instauration for a imaginable terms increase.

Furthermore, much than $10 cardinal whale commercialized measurement recorded overnight indicates a displacement successful sentiment among large investors. This hefty commercialized measurement is seen arsenic a bullish signal, suggesting that whales are accumulating ETH successful anticipation of a terms upswing.

Ethereum Investors Buoyed By Profitability, Approaching ATH

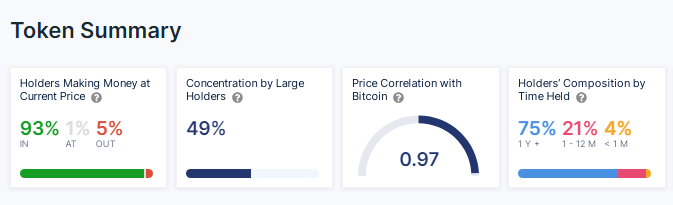

Adding substance to the fire, implicit 94% of ETH addresses are presently successful profit. This translates to a important fig of investors holding onto their ETH, creating debased selling unit and perchance paving the mode for a terms increase.

Data from IntoTheBlock (ITB), a cryptocurrency analytics platform, indicates that astatine this point, ETH is astatine its champion level successful astir a year, but it is intelligibly trailing the upward inclination that Bitcoin experienced erstwhile its spot Exchange-Traded Fund obtained approval.

Source: IntoTheBlock

Source: IntoTheBlock

Moreover, the excitement surrounding Ethereum is palpable arsenic the terms approaches its all-time precocious (ATH) of $4,890. With minimal absorption anticipated, a retest of the ATH seems similar a realistic anticipation successful the adjacent future. This imaginable is further amplified by the dwindling fig of addresses holding ETH astatine a break-even constituent oregon astatine a loss.

Dencum Upgrade And ETF Speculation Stoke Investor Confidence

Beyond the contiguous terms action, the Ethereum assemblage is buzzing with anticipation astir the upcoming Dencum upgrade. This highly anticipated upgrade is designed to code scalability issues, trim transaction fees connected furniture networks, and decongest the Ethereum network.

A palmy Dencum upgrade is expected to importantly amended the wide idiosyncratic acquisition and perchance pull caller investors, bolstering assurance successful the semipermanent viability of the Ethereum network.

Adding different furniture of optimism is the ongoing speculation surrounding a imaginable Ethereum ETF. While regulatory support from the SEC is inactive pending, the precise anticipation of an ETF has buoyed capitalist sentiment. An ETF would let accepted investors to summation vulnerability to Ethereum without the complexities of straight owning and managing cryptocurrency, perchance starring to a wider capitalist basal and accrued request for ETH.

A Look Ahead: Ether Trajectory Hinges On Multiple Factors

While the outlook for Ethereum appears bright, determination are inactive factors to consider. The terms of ETH remains astir $1,000 shy of its ATH, and the occurrence of the Dencum upgrade and the support of an Ethereum ETF are not guaranteed. As with immoderate investment, conducting thorough probe and maintaining a cautious attack is crucial.

However, the confluence of rising on-chain activity, whale accumulation, and a profitable capitalist basal paints a promising representation for Ethereum. With the Dencum upgrade connected the skyline and the anticipation of an ETF, Ethereum appears poised for a imaginable terms rally successful the coming months.

Featured representation from Pexels, illustration from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)