Ethereum has staged an awesome 35% rally since past Tuesday, marking a bullish breakout arsenic it tests important proviso levels for the archetypal clip since precocious July. Investor sentiment is progressively optimistic, driven by a surge successful Ethereum’s on-chain activity.

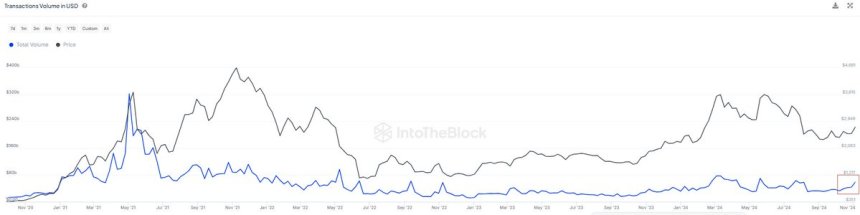

Key information from IntoTheBlock reveals that transaction measurement connected Ethereum’s mainnet has reached its highest levels since July, a bullish awesome highlighting renewed involvement and enactment successful the network. This surge successful measurement is often seen arsenic confirmation of a breakout, aligning with expectations from investors who person anticipated a beardown rally toward Ethereum’s yearly highs.

With momentum building, ETH present stands astatine a pivotal point: if it tin support spot supra these caller levels, the signifier whitethorn beryllium acceptable for further upside arsenic the broader crypto marketplace rallies alongside Bitcoin.

The adjacent fewer days volition beryllium important for Ethereum arsenic traders ticker to spot if the bullish sentiment tin prolong and propel ETH higher into caller terms territory.

Ethereum Bullish Trend Begins

Ethereum has entered a caller bullish signifier aft 8 months of accordant selling unit and important accumulation by astute money. Following a agelong play of subdued terms action, ETH is yet rising, signaling a inclination reversal galore analysts and investors eagerly awaited.

Data shared by IntoTheBlock connected X shows that Ethereum’s mainnet transaction measurement has surged significantly, with astir $60 cardinal settled implicit the past week—the highest level since July. This spike successful measurement is simply a wide indicator of renewed marketplace interest, and it suggests that much investors are actively trading and accumulating ETH.

Ethereum transactions connected the mainnet deed $60B successful a week | Source: IntoTheBlock connected X

Ethereum transactions connected the mainnet deed $60B successful a week | Source: IntoTheBlock connected XWhen transaction volumes emergence alongside terms increases, it often signals steadfast request and beardown marketplace confidence, supporting the likelihood of a sustained bullish trend.

The adjacent fewer months are expected to beryllium volatile arsenic speculative involvement and trading enactment vigor up, with galore traders positioning for important gains. Despite the anticipated terms swings, analysts hold that Ethereum’s adjacent large people is its yearly precocious of $4,000. Breaking this level would corroborate Ethereum’s bullish momentum and acceptable the signifier for imaginable caller all-time highs, aligning with the broader market’s optimism.

ETH Consolidates Above $3,000

Ethereum is trading astatine $3,180, pursuing a caller propulsion to a section precocious of $3,250. After a beardown play rally, the terms paused, hinting astatine the request for consolidation earlier different imaginable breakout. This play of sideways question could beryllium indispensable for ETH to found enactment and hole for further upside, arsenic it allows buyers to stitchery momentum portion absorbing immoderate short-term selling pressure.

ETH consolidates supra $3,000 | Source: ETHUSDT illustration connected TradingView

ETH consolidates supra $3,000 | Source: ETHUSDT illustration connected TradingViewKey method levels amusement that bullish sentiment is apt to fortify if ETH maintains its presumption supra $2,950, aligned with the 200-day moving mean (MA). Holding this captious enactment level would awesome buyers stay successful control, mounting up ETH for a imaginable rally toward $3,500 soon.

However, it’s besides imaginable that ETH could instrumentality a fewer days to physique up the momentum needed for its adjacent important determination arsenic investors measure the caller rally and see upcoming catalysts.

In the meantime, the marketplace appears optimistic, with analysts noting that maintaining levels supra the 200-day MA is important for confirming the semipermanent bullish trend. ETH’s consolidation signifier could beryllium the instauration for continuing its upward trajectory.

Featured representation from Dall-E, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)