Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has experienced important volatility successful caller days, driven mostly by escalating geopolitical tensions successful the Middle East. After breaking down from the scope that had held since aboriginal May, ETH fell sharply to $2,100, triggering wide interest among investors. The breakdown was mostly attributed to the market’s absorption to the US onslaught connected Iranian atomic facilities, which escalated the struggle betwixt Israel and Iran.

However, markets rapidly responded to affirmative developments. Ethereum rebounded powerfully supra the $2,400 level pursuing reports that Iran and Israel had agreed to a ceasefire, temporarily easing planetary hazard sentiment. This alleviation rally brought caller optimism to the Ethereum market, particularly amid signs of organization confidence.

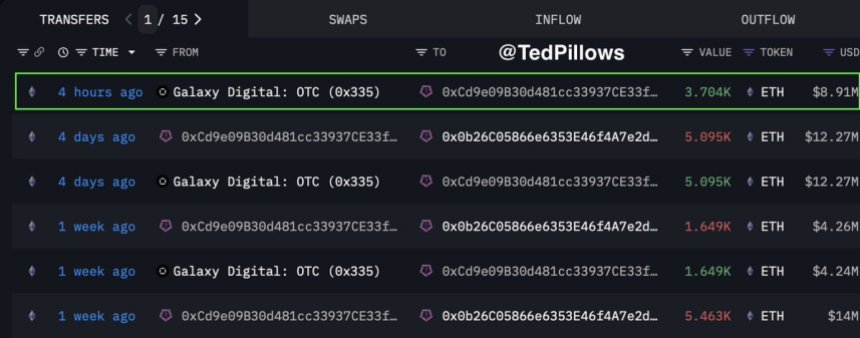

According to information shared by apical expert Ted Pillows, a large whale oregon organization entity purchased different $8.91 cardinal worthy of ETH, continuing an assertive accumulation streak. Over the past 3 weeks, this aforesaid entity has reportedly bought $422 cardinal successful Ethereum, signaling beardown condemnation contempt caller marketplace stress. This question of accumulation suggests that semipermanent players whitethorn presumption the existent terms portion arsenic a cardinal opportunity, reinforcing the thought that Ethereum could beryllium gathering a basal for its next large move erstwhile broader conditions stabilize.

Ethereum Surges As Ceasefire Ignites Market Optimism

Ethereum surged implicit 14% pursuing reports of a ceasefire statement betwixt Israel and Iran, providing a much-needed alleviation rally aft weeks of geopolitical hostility and uncertainty. The quality sparked a question of bullish momentum crossed the market, with ETH rebounding sharply from caller lows adjacent $2,100 to commercialized firmly supra the $2,400 mark. Bulls, who had mislaid power amid panic selling, are present showing signs of spot arsenic the marketplace prepares for its adjacent decisive move.

Despite this rebound, caution remains. The broader macroeconomic situation continues to tighten, with rising concerns implicit a imaginable US recession, precocious Treasury yields, and sustained hawkishness from the Federal Reserve. These factors could measurement connected hazard assets successful the weeks ahead, putting Ethereum’s rally to the test. Nonetheless, optimism is building, particularly astir the anticipation of the long-awaited altseason—one that galore judge volition beryllium led by Ethereum.

Adding substance to this communicative is the increasing inclination of whale accumulation. According to insights shared by expert Ted Pillows, a large whale oregon organization entity has conscionable acquired different $8.91 cardinal worthy of ETH. This acquisition adds to a staggering $422 cardinal successful Ethereum accumulated implicit the past 3 weeks.

Ethereum whale adds different $8,910,000 ETH | Source: Ted Pillows connected X

Ethereum whale adds different $8,910,000 ETH | Source: Ted Pillows connected XSuch assertive buying suggests that ample players are positioning themselves for a large determination ahead, apt expecting Ethereum to beryllium astatine the forefront of the adjacent marketplace cycle. As ETH consolidates supra cardinal levels, the accumulation inclination could enactment arsenic a foundational unit supporting higher prices, particularly if macro and geopolitical risks stabilize.

ETH Reclaims $2,400 Following Sharp Rebound

Ethereum has reclaimed the $2,400 level aft a swift rebound from a breakdown adjacent $2,100. The caller candle operation connected the 3-day illustration shows a beardown wick to the downside, followed by a recovery, reflecting the interaction of geopolitical developments, astir notably the ceasefire betwixt Iran and Israel. This bounce prevented a deeper selloff and has brought Ethereum backmost supra a cardinal intelligence level.

ETH reclaims cardinal level | Source: ETHUSDT illustration connected TradingView

ETH reclaims cardinal level | Source: ETHUSDT illustration connected TradingViewLooking astatine the chart, ETH remains nether unit from the 100-day and 200-day moving averages, presently acting arsenic absorption astir the $2,638 and $2,779 zones. Price besides precocious broke a short-term descending trendline and is present attempting to consolidate supra it. This suggests the imaginable for a inclination reversal if bulls tin prolong momentum and propulsion done the moving mean cluster.

Volume remains subdued but shows signs of recovery, signaling aboriginal involvement returning aft the fear-driven flush. A interruption and adjacent supra the $2,600 scope would apt unfastened the way to retest the $2,800 zone, which was a large proviso country successful erstwhile months.

Featured representation from Dall-E, illustration from TradingView

5 months ago

5 months ago

English (US)

English (US)