Over time, the crypto marketplace has maintained a adjacent narration with the banal market. Ethereum, the second-largest cryptocurrency, roseate successful lockstep with U.S. stocks for the archetypal clip successful February. As a result, the token’s 40-day correlation coefficient with the S&P 500 reached 0.65.

Despite the brake anxious investors person enactment connected terms enactment successful the past week, the Ethereum (ETH) terms is poised to emergence implicit the weekend. Although trading measurement has accrued implicit the past week, and frankincense should person resulted successful much accordant fluctuations, terms responsiveness has been affected by geopolitical news, earnings, and banal marketplace whipsaws.

Ethereum Price Witnesses Turbulence

The terms of Ethereum has had a grueling week for investors and traders, with ample swings successful effect to earnings, geopolitical events, and investors turning from risk-on to risk-off similar a airy switch. But with volatility comes opportunity, and arsenic each of these events upwind down towards the weekend, bulls volition person the playground to themselves and tin thrust the terms up to $3,500 if they prime the close introduction levels. Expect the RSI to emergence implicit 50 again, with tons of country earlier trading into overbought territory.

According to statistic from Santiment, a crypto marketplace behaviour investigation tool, Ethereum has a beardown (+ve) correlation with the S&P 500 index. Following a 1.8 percent driblet successful the S&P 500 index’s figures, the terms of ETH accrued by 3%.

The tweet from April 29th added,

“Aided by a +1.8% time successful the SP500, Ethereum has jumped backmost supra $2,930 with its choky correlation to equities markets.”

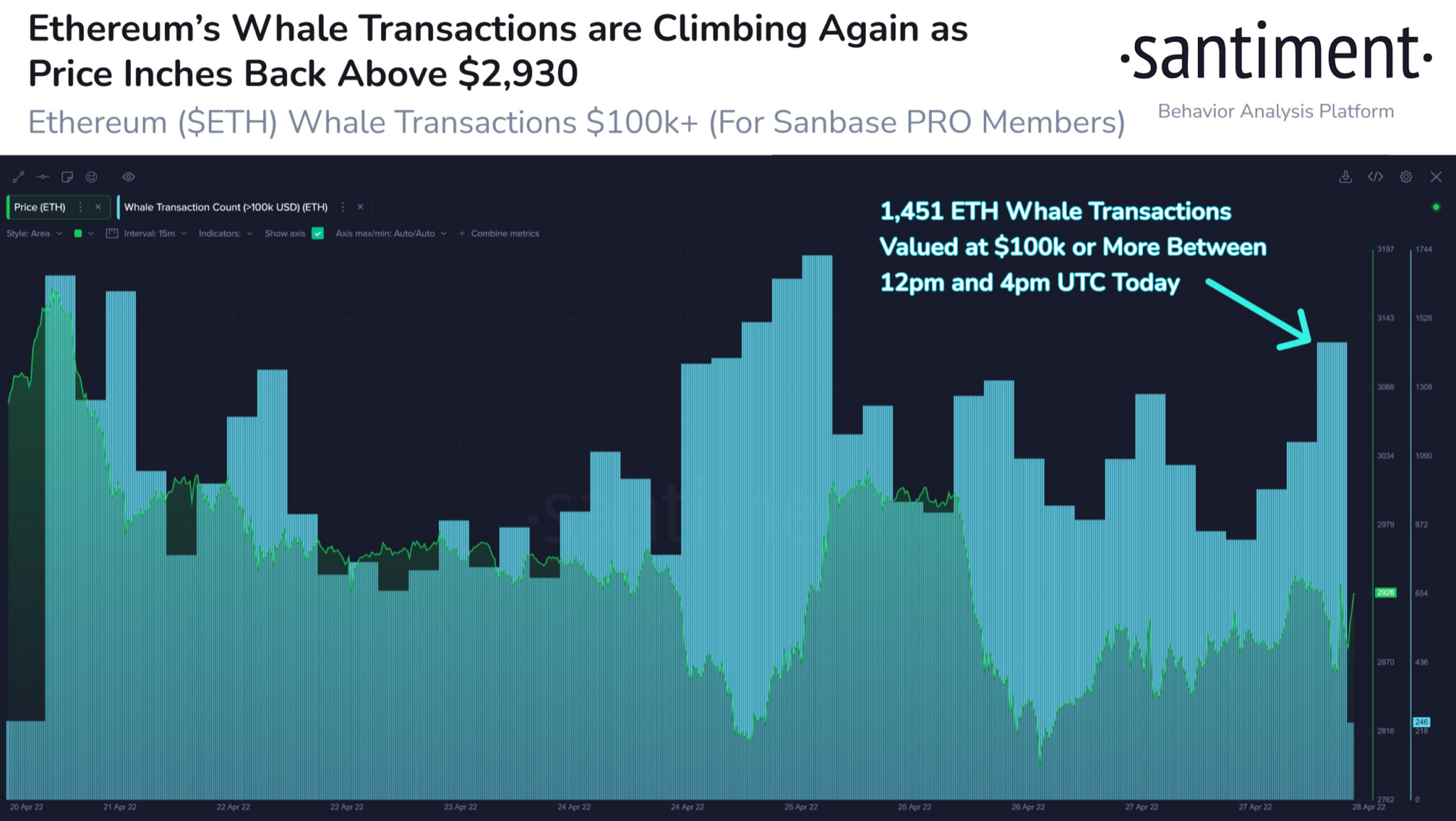

Now, arsenic seen successful the graph above, ETH’s astir almighty buyers, the whales, person retaliated by buying further ETH. On that day, the fig of whale transactions worthy much than $100,000 surged dramatically.

In a four-hour period, 1,451 specified transactions were documented. The jump, according to Santiment, suggested that cardinal stakeholders were paying attraction to the terms increase.

Suggested Reading | Metaverse Tokens On Overdrive, Outpace Bitcoin And Ethereum

Is Equities Market Correlation Good For ETH?

This wasn’t the archetypal clip ETH had shown signs of a processing narration with the banal market. The 2 sank unneurotic connected March 31st, arsenic reported 3 weeks earlier, but began climbing again aft April 1st. Ether surged successful tandem with the SP500 since mid-March.

Every affirmative concern successful the crypto-verse is accompanied with a antagonistic counterpart. That is, aft all, a fact. This script is nary exception. Crypto’s beardown relation with equities, successful particular, mightiness enactment wonders. Different reputable entities, connected the different hand, person censored cautionary situations for the same.

Arthur Hayes, the erstwhile CEO of BitMex, raised informing flags astir this nexus successful this instance. Surprisingly, the banal marketplace appears to beryllium headed for a immense driblet done 2022 arsenic the Federal Reserve tightens monetary argumentation to conflict inflation.

Related Reading | Bitcoin Futures Basis Nears One-Year Lows, How Will This Affect BTC?

Featured representation from Pixabay, Santiment, illustration from TradingView.com

3 years ago

3 years ago

English (US)

English (US)