Ethereum has reached a caller section precocious astatine $3,219, marking an awesome 35% surge since past Monday. This accelerated emergence has ignited beardown optimism among analysts and investors, who present spot Ethereum arsenic primed for further gains arsenic it begins to amusement spot against Bitcoin. The rally reflects renewed assurance successful ETH’s potential, particularly arsenic large stakeholders summation their activity.

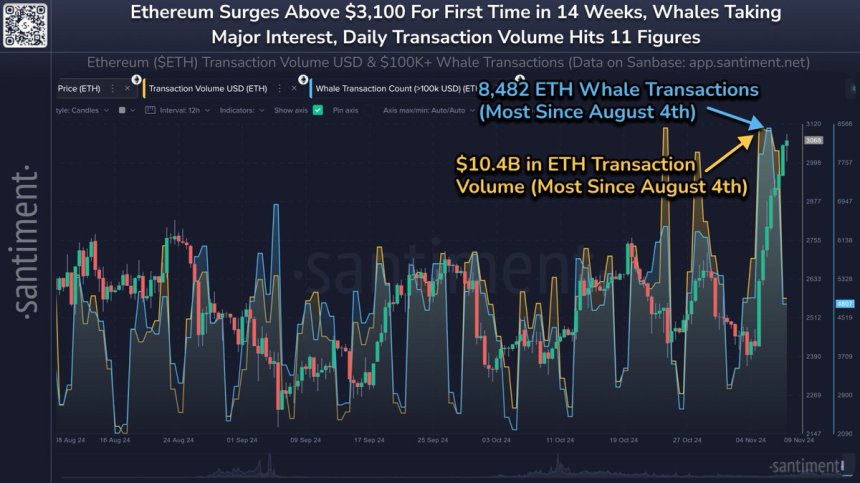

Key information from Santiment supports this bullish outlook, highlighting a important spike successful whale transactions. Increased enactment among ample ETH holders often signals accumulation, suggesting that influential players spot the imaginable for Ethereum’s continued growth. This uptick successful whale transactions is typically seen arsenic a precursor to further terms appreciation, arsenic it indicates sustained involvement from high-volume investors.

As ETH continues to rise, analysts are intimately watching its show against Bitcoin, noting that Ethereum’s caller momentum could bespeak the opening of a much sustained uptrend.

Ethereum Bull Phase Starting

Ethereum has officially entered a bullish signifier aft decisively breaking cardinal absorption levels and establishing a affirmative terms structure. Recent information from Santiment confirms this upward trend, arsenic Ethereum is present showing beardown maturation metrics that suggest further gains whitethorn prevarication ahead.

Whale transaction information points to a important summation successful enactment from large stakeholders—wallets holding important amounts of ETH—who person actively contributed to Ethereum reaching its highest terms successful implicit 14 weeks.

Ethereum Whale Transactions Spike | Source: Santiment connected X

Ethereum Whale Transactions Spike | Source: Santiment connected XIn summation to heightened whale activity, Ethereum’s transaction measurement has surged, reaching arsenic overmuch arsenic $10.4 cardinal implicit the past respective days. This measurement spike is an encouraging motion of rising request and sustained involvement successful ETH astatine its existent levels. Large transactions often awesome assurance from organization players and high-net-worth investors, reinforcing the bullish sentiment astir Ethereum arsenic they summation their holdings.

Santiment analysts suggest that Bitcoin’s show during this bull tally could service arsenic a catalyst for Ethereum, with profits apt redistributing from BTC to ETH arsenic marketplace participants diversify into apical altcoins. This dynamic has historically benefited Ethereum during beardown marketplace cycles, perchance mounting the signifier for ETH to revisit its erstwhile all-time high.

Additionally, Ethereum’s web enactment appears robust, different cardinal indicator of sustained maturation potential. With accrued stakeholder participation, precocious transaction volume, and a steadfast network, Ethereum seems well-positioned for continued upward momentum successful the existent bullish environment.

ETH Testing Fresh Supply

Ethereum (ETH) is presently trading astatine $3,170, showing spot aft an assertive determination supra the 200-day moving mean (MA) astatine $2,955. This breakout supra a semipermanent absorption level signals that bulls are present firmly successful power arsenic ETH reaches caller proviso zones. Holding supra the 200-day MA is simply a affirmative indicator for sustaining the bullish trend, arsenic this level often supports terms enactment erstwhile breached connected an upward move.

ETH investigating caller proviso | Source: ETHUSDT illustration connected TradingView

ETH investigating caller proviso | Source: ETHUSDT illustration connected TradingViewIf ETH experiences a pullback, a driblet backmost to the 200-day MA astir $2,955 would correspond a steadfast retracement, perchance mounting the signifier for further gains. A consolidation astatine oregon adjacent this level would apt pull much demand, supporting a continuation of the uptrend.

However, the existent beardown terms enactment combined with caller request entering the marketplace could propel Ethereum adjacent higher without a important pullback. The momentum ETH is gathering present whitethorn assistance it interruption done successive proviso levels successful the adjacent term, pushing toward higher targets. For now, Ethereum’s upward trajectory is supported by coagulated method levels and a marketplace situation progressively favorable for continued gains.

Featured representation from Dall-E, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)