In the past week, immoderate of the biggest Ethereum whales, those with holdings ranging from 1 cardinal to 10 cardinal ETH, person accumulated an awesome 100,000 ETH, valued astatine a staggering $230 million.

This progressive buying stance by influential investors highlights their unwavering content successful the semipermanent imaginable of Ethereum, adjacent successful the look of caller terms corrections.

Despite the caller downtrend successful prices, indications from caller Ethereum whale activities suggest a persistent assurance successful a bullish marketplace continuation.

Wealthy Traders Accumulate Millions In Ethereum

Subsequent to the promising commencement successful the archetypal days of December 2023, assorted cryptocurrency assets, notably Ethereum, displayed robust performance.

Crypto whales person reportedly devoured hundreds of millions of dollars’ worthy of Ether, the starring altcoin, during the past 7 days, according to a good respected expert.

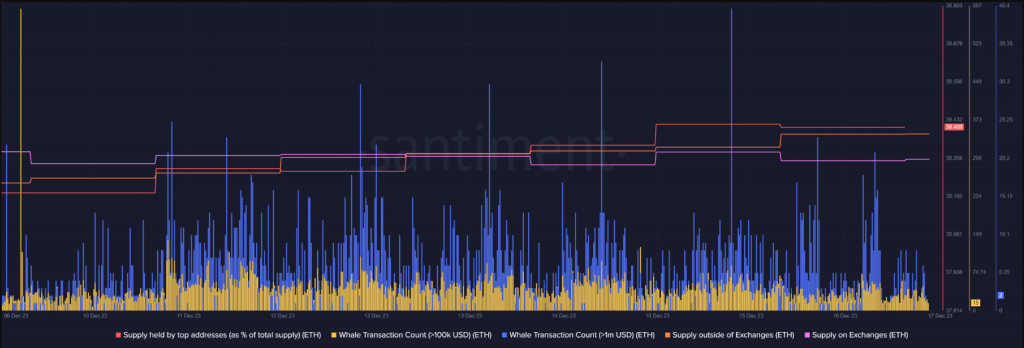

Some of the largest #Ethereum whales person been connected a buying spree, scooping up implicit 100,000 $ETH successful conscionable the past week – that’s a whopping $230 million! pic.twitter.com/jWHY6MXDgs

— Ali (@ali_charts) December 16, 2023

On the societal networking tract X, cryptocurrency strategist Ali Martinez informs his 36,100 followers successful a caller thread that affluent traders person amassed tens of thousands of Ethereum during the erstwhile 7 days.

Price rallies are usually the effect of dense purchasing request from affluent investors, and the caller whale accumulation indicates that this is the case.

On December 7, Santiment Feed connected a whale accumulation pattern to ETH’s surge, which culminated successful a 19-month precocious implicit the $2,350 terms point.

As a rule, whale enactment affects cryptocurrency plus prices. Recent enactment among ETH whales indicates that a terms rally whitethorn beryllium approaching.

Although determination is simply a batch of buying unit successful the marketplace close now, caution is advised due to the fact that the bottommost could not person yet been achieved.

RSI And Stochastic Neutral, Ethereum Uncertainty

Relative Strength Index (RSI) and stochastic are some presently successful neutral territory, according to information from CryptoQyant. There is inactive uncertainty regarding the market’s genuine bottommost notwithstanding the buying activity.

We looked astatine the liquidation heatmap to effort and estimation Ethereum’s imaginable enactment levels. Based connected the analysis, determination was a emergence successful liquidations successful the $2,140–$2,170 range.

This implies that earlier Ethereum’s terms initiates its adjacent bullish rebound, it is apt to driblet beneath these levels. But successful the lawsuit of a rally, Ethereum would person to flooded a important absorption level adjacent to $2,380.

Ethereum’s near-term terms changes are hard to forecast due to the fact that to the analyzable enactment of marketplace indicators and liquidation data.

Meanwhile, the $2,148 terms people appears to beryllium the asset’s short-term support, according to an investigation of the ETH regular terms chart. In bid to summation the likelihood of 1 much emergence earlier the extremity of 2023, bulls volition anticipation that this level holds.

If determination is simply a interruption below, it whitethorn bespeak the operation of a much intricate bullish continuation illustration pattern, akin to a bull flag. On smaller clip frames, this signifier whitethorn lucifer a descending transmission and undermine expectations for different important emergence successful 2023.

Ether and different cryptocurrency values are delicate to a fig of outer variables, including generalized macroeconomic sentiment. Ethereum has already risen 81% year-to-date astatine its existent price.

Featured representation from Shutterstock

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)