In this exploration, we tackle the captious question: Will Ethereum recover? We’ll look at Ethereums future and analyse ETH’s contiguous marketplace status, imaginable for resurgence, the anticipated interaction of the advancement connected Ethereum 2.0, and stock adept price predictions.

Will Ethereum Recover? Analysis

The question “Will Ethereum recover?” depends connected galore factors. As of November 2023, Ethereum has shown signs of rebounding from its 2022 lows, suggesting a imaginable bottoming out. Key developments similar the modulation to Proof-of-Stake and the instauration of EIP (Ethereum Improvement Proposal) 1559, launched each the mode backmost successful August 2021, which brings deflationary unit connected Ethereum’s supply, making it a much charismatic investment.

Additionally, Layer 2 (L2) technologies are enhancing Ethereum’s scalability, addressing erstwhile challenges of precocious transaction fees and dilatory speeds. Ethereum’s dominance successful the astute contracts assemblage and its important relation successful the decentralized concern ecosystem further fortify its betterment prospects. However, predicting the nonstop trajectory of Ethereum’s betterment remains complex, with varying forecasts suggesting some imaginable ups and downs successful the adjacent future.

Ethereums Future: Top-10 Factors Impacting ETH Price

These 10 factors could beryllium important for answering the question “Will Ethereum recover?“:

#1 Future Upgrades:

Ethereum’s improvement roadmap includes important upgrades similar Proto-Danksharding, besides known arsenic EIP-4844, and Full Danksharding, which could greatly interaction its scalability and functionality. The palmy implementation of these upgrades tin boost assurance successful the web and the Ethereums aboriginal price.

#2 Regulatory Approvals:

Regulatory decisions, specified arsenic the support of a spot Ethereum Exchange Traded Fund (ETF) successful the United States by the Securities and Exchange Commission (SEC), tin person a important interaction connected Ethereum’s presumption arsenic a integer asset. BlackRock filed for a spot ETH ETF successful mid-November 2023.

#3 Overall Crypto Market Trends:

Ethereum’s show is intimately tied to the broader cryptocurrency market. A wide uptrend successful the crypto market, catalyzed by events similar the Bitcoin halving, tin positively power Ethereum’s price.

#4 ETH Burn Rate:

Ethereum’s modulation to a proof-of-stake (PoS) statement mechanics includes a mechanics called EIP-1559, which introduces a fee-burning mechanism. The much ETH is burned successful transactions, the scarcer it becomes, perchance expanding its value.

#5 Layer-2 Solutions:

The adoption and occurrence of Ethereum layer-2 scaling solutions, specified arsenic Optimistic Rollups and zk-Rollups, tin importantly amended the network’s scalability and trim transaction fees. This could pull much users and developers.

#6 DeFi And NFT Activity:

Ethereum’s ecosystem heavy relies connected DeFi (Decentralized Finance) and NFT (Non-Fungible Token) applications. Increased adoption and enactment successful these sectors tin thrust request for ETH and positively interaction its price.

#7 Competition:

Ethereum faces contention from different blockchain platforms similar Solana and Cardano. The occurrence oregon nonaccomplishment of these competitors tin impact Ethereum’s marketplace position.

#8 Macroeconomic Factors:

Economic events, specified arsenic inflation, monetary argumentation decisions, and planetary fiscal crises, tin power investors’ choices. Cryptocurrencies similar Ethereum are sometimes seen arsenic a hedge against accepted fiscal instability.

#9 Network Security:

The information of the Ethereum web is crucial. High-profile hacks oregon vulnerabilities tin undermine spot successful the level and pb to terms declines.

#10 Ecosystem Development:

The maturation of the Ethereum ecosystem, including the fig of dApps, users, and developers, tin impact its adoption and value.

EIP-1559: Understanding The Ethereum Burn Rate

Ethereum’s pain complaint is simply a cardinal facet of its economics, influencing some its proviso dynamics and semipermanent valuation. To grasp the Ethereum pain introduced with EIP-1559, examining the latest information and knowing however this mechanics operates wrong the Ethereum ecosystem is crucial.

Ethereum Is “Ultra Sound Money”

EIP-1559 was a connection that fundamentally restructured Ethereum’s interest market. Before this proposal, miners received the full transaction fee. With activation connected August 5, 2021, EIP-1559 introduced a basal interest for transactions, which is burned (permanently removed from circulation), and lone an optional extremity is fixed to miners. This mechanics aims to marque transaction fees much predictable and the web much efficient.

The “ultra dependable money” meme emerged from the assemblage successful effect to EIP-1559. It plays connected the conception of “sound money,” a word traditionally utilized to picture wealth that is not prone to depreciation and is simply a reliable store of value, similar gold.

With EIP-1559, Ethereum’s proviso becomes much predictable and perchance deflationary—if the magnitude of ETH burned exceeds the caller ETH issued, the full proviso volition alteration implicit time, hence the word “ultra dependable money.” This is seen arsenic an enhancement implicit “sound money,” with Ethereum not conscionable maintaining its worth but perchance expanding it owed to the decreasing supply.

Ethereum Burn Rate Projections

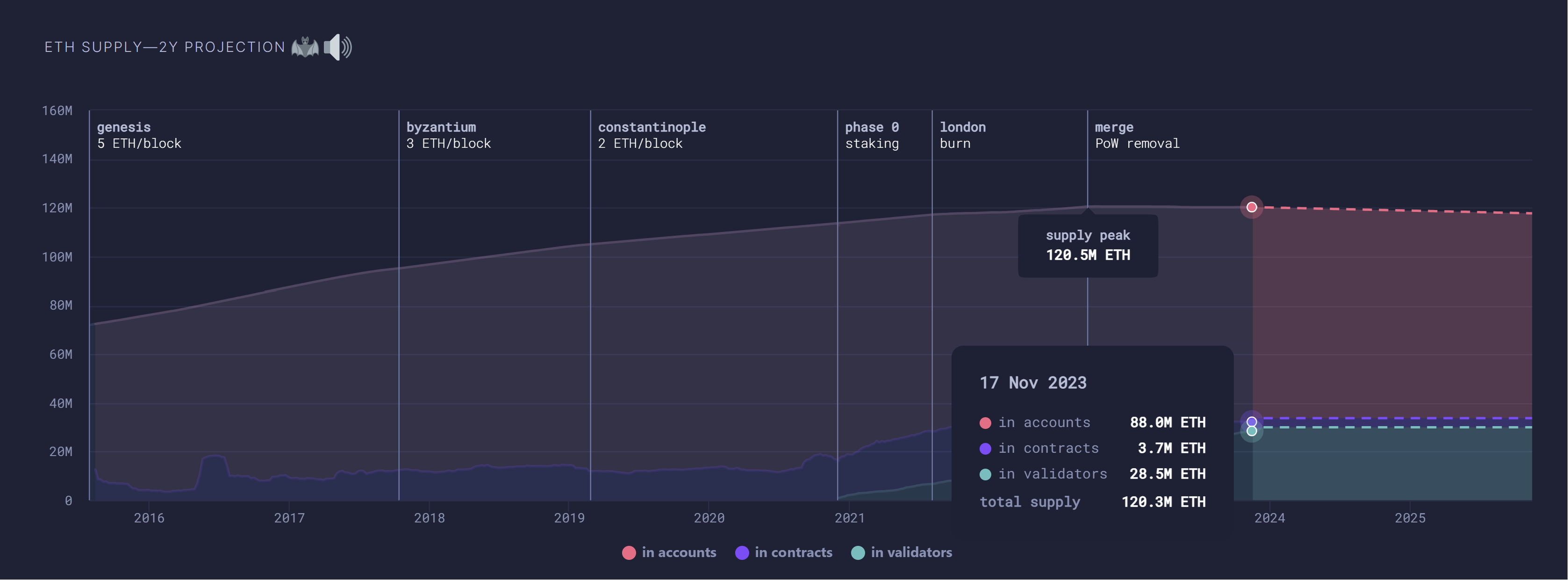

The attached illustration underscores the interaction of these changes connected Ethereum’s supply, particularly post-EIP-1559, wherever the proviso curve starts to flatten, suggesting a simplification successful the maturation of Ethereum’s full supply. This aligns with the conception of Ethereum becoming a deflationary plus post-EIP-1559, contributing to the communicative that Ethereum’s aboriginal could beryllium arsenic an “ultra sound” signifier of money.

On November 17, 2023, the Ethereum proviso stood astatine 88 cardinal ETH successful accounts, 3.7 cardinal ETH successful contracts, and 28.5 cardinal ETH successful validators, totaling 120.3 cardinal ETH. The dotted enactment indicates Ethereums aboriginal alteration successful full proviso owed to the burning of ETH and the issuance changes post-Merge. The illustration projects that the ETH proviso volition shrink to 117.7 cardinal ETH successful November 2025.

Ethereum pain complaint and projected proviso | Source: ultrasound.money

Ethereum pain complaint and projected proviso | Source: ultrasound.moneyEthereum’s Future: Will Ethereum Go Back Up?

In the realm of cryptocurrency, method investigation serves arsenic a navigational instrumentality to gauge marketplace sentiment and imaginable terms movements. Examining the 1-week ETH/USD illustration provides penetration into Ethereum’s terms enactment and helps code the burning question: “will Ethereum recover?”

ETH price, 1-week illustration | Source: ETHUSD connected TradingView.com

ETH price, 1-week illustration | Source: ETHUSD connected TradingView.comFibonacci Levels And Price Targets

The illustration showcases respective Fibonacci retracement levels, which are important successful identifying imaginable enactment and absorption zones based connected erstwhile terms movements. Here are the cardinal Fibonacci retracement levels highlighted:

- 0.236: At $1,847, this level acts arsenic a imaginable enactment zone.

- 0.382: $2,441 is the adjacent cardinal Fib level, displaying the adjacent resistance.

- 0.5: The $2,922 level represents a intelligence midpoint.

- 0.618: At $3,402, this level is often considered the ‘golden ratio,’ a important reversal point.

- 0.786: $4,085 is simply a deeper retracement level that tin awesome spot successful the prevailing trend.

- 1: The afloat retracement level astatine $4,956 marks a implicit instrumentality to all-time high.

- 1.618: At $7,471, this extended Fib level could beryllium the archetypal semipermanent bullish target.

- 2.618: $11,540 represents an optimistic projection successful a beardown Ethereum bull run.

- 3.618: This level astatine $15,609 would beryllium an bonzer people for a sustained bull run.

- 4.236: The $18,123 Fib level is the highest projected people connected the chart, indicating an utmost bull lawsuit scenario.

Trend Lines, Resistance Zones And RSI

The illustration shows a achromatic ascending inclination line, tracing the lows and signifying a imaginable country of enactment that Ethereum’s terms could respect. If the terms maintains supra this line, it whitethorn bespeak continued bullish sentiment.

The reddish box, oregon absorption zone, astir the Year-To-Date (YTD) precocious astatine $2,137 underscores a portion wherever sellers person antecedently entered the market. Overcoming this portion is captious for Ethereum to proceed its upward trajectory.

The Relative Strength Index (RSI), sitting astatine 48.07, shows Ethereum is neither successful the overbought nor oversold territory. This indicates a neutral momentum, which could precede a determination successful either direction.

Conclusion: Will Ethereum Recover?

While the illustration presents beardown arguments for an Ethereum bull run, with ETH terms sustaining supra captious enactment levels and challenging notable absorption zones, the aboriginal terms enactment volition beryllium connected however the marketplace interacts with these method indicators. If Ethereum tin interruption done the absorption encapsulated by the YTD high, we could spot an affirmative reply to “Will Ethereum recover?” However, it is imperative for investors to show these levels closely, arsenic they service arsenic a roadmap, not a crystal ball.

Ethereum Price Prediction By NewsBTC’s Head Of Research

Tony “The Bull” Severino, NewsBTC’s Head of Research, has provided an in-depth investigation of Ethereum’s marketplace behaviour successful his latest variation of Coin Chartist. He observes, “Ethereum has yet to statesman trending with a speechmaking supra 20 connected the ADX, nor has it breached supra the precocious Bollinger Band. But these signals are apt coming soon.” This suggests Ethereum’s important uptrend mightiness beryllium connected the horizon.

ETH price, 1-week illustration | Source: Coin Chartist

ETH price, 1-week illustration | Source: Coin ChartistComparing Ethereum with Bitcoin, Severino notes, “ETHUSD is overmuch little wrong the Ichimoku Cloud than BTCUSD,” indicating Ethereum is presently lagging down Bitcoin. However, helium anticipates Ethereum volition soon “switch to over-performance.”

Highlighting a affirmative development, Severino states, “ETHUSD 1W was yet capable to ace supra its TDST downtrend resistance.” Yet, Ethereum needs to signifier a perfected TD9 bid for further bullish confirmation. On the monthly chart, Ethereum’s overbought presumption connected the Stochastic indicator suggests a beardown trend, arsenic Severino points out, “Each clip the Stochastic has confirmed a 1M supra 80 connected the Stock, determination was a monolithic propulsion higher.”

Will Ethereum recover?, 1-month illustration | Source: ETHUSD connected TradingView.com

Will Ethereum recover?, 1-month illustration | Source: ETHUSD connected TradingView.comLooking ahead, Severino underscores the value of Ethereum’s show against Bitcoin, “But if ETHBTC tin propulsion backmost supra 20 this volition make a bargain awesome connected the 1M Stochastic and kickstart Ether’s over-performance supra Bitcoin.” This investigation provides a elaborate position connected Ethereum’s imaginable aboriginal trajectory successful the crypto market.

Ethereum 2.0 Price Prediction

The continuous improvement of Ethereum done its 2.0 upgrades sets the signifier for an optimistic terms prediction. As the web becomes much scalable, secure, and sustainable, the intrinsic worth of Ethereum is apt to increase.

The palmy completion of the Shanghai/Capella upgrade, which introduced staking, is already a important milestone that demonstrates the network’s committedness to its roadmap. Such advancements are expected to reenforce capitalist assurance and could catalyze a bullish outlook for Ethereums aboriginal price.

Ethereum 2.0 Roadmap

Ethereum 2.0 represents a bid of upgrades aimed astatine improving the network’s scalability, security, and sustainability. Contrary to the erstwhile word ‘ETH2’, the roadmap is present defined by much circumstantial upgrade milestones:

Past and Completed Upgrades

The Merge: This captious upgrade connected September 15, 2022 marked Ethereum’s modulation from proof-of-work (PoW) to proof-of-stake (PoS) and was a foundational measurement successful the Ethereum 2.0 roadmap, eliminating the request for energy-intensive mining.

Another cardinal feature, staking withdrawals has already been enabled with the Shanghai/Capella upgrade, which went unrecorded connected April 12, 2023

Future Ethereum Upgrades

- The Surge: The adjacent signifier involves scalability improvements done rollups and information sharding. Danksharding, a cardinal component, aims to marque furniture 2 rollups cheaper by incorporating “blobs” of information into Ethereum blocks.

- The Scourge: This signifier focuses connected ensuring censorship resistance, decentralization, and addressing protocol risks, specified arsenic those arising from miner extractable worth (MEV).

- The Verge: It is designed to marque verifying blocks easier.

- The Purge: This signifier aims to trim computational costs and simplify the protocol, making moving nodes much efficient.

- The Splurge: This includes miscellaneous upgrades that bash not acceptable into the different categories but are indispensable for the network’s maturation and enhancement.

The Ethereum assemblage has replaced the word “Ethereum 2.0” with much circumstantial names for each upgrade, providing clearer penetration into the network’s modulation and improvements. These upgrades purpose to crook Ethereum into a afloat scaled, resilient platform, susceptible of supporting a planetary decentralized exertion system. As implementation of these phases progresses, Ethereum’s increasing entreaty arsenic an concern could positively power its terms predictions.

Proto-Danksharding: EIP-4844

EIP-4844 introduces “shard blob transactions” to heighten Ethereum’s information availability successful a mode that aligns with aboriginal afloat sharding plans. This connection creates a caller transaction format containing “blobs” – ample information segments indispensable for rollups, a Layer 2 solution, but inaccessible for EVM execution. It serves arsenic a impermanent scaling solution, bridging the spread until afloat sharding implementation.

Notably, rollups person go progressively important for scaling Ethereum, arsenic they connection a mode to execute transactions extracurricular the main Ethereum concatenation (Layer 1) and past station the information backmost to Layer 1. EIP-4844’s format is expected to greatly trim transaction fees for rollups by offering a cheaper information retention mechanics compared to existent methods.

Full Danksharding

Full Danksharding, which advances from Proto-Danksharding, volition apt further trim costs for Layer 2 rollups. It introduces “blobs” successful a format slated for usage successful the last sharding design. This includes a caller transaction benignant and an autarkic interest marketplace for these blobs.

Full Danksharding volition physique connected Proto-Danksharding and aims to further chopped Layer 2 rollups’ costs. It volition comprehensively instrumentality information availability sampling and indispensable components for a afloat sharded Ethereum network, including proposer-builder separation and impervious of custody. This attack aims to delegate lone a information of the information to validators, reducing the network’s load and enhancing scalability.

Ethereum 2.0 Price Predictions: Will Ethereum Recover?

As Ethereum continues to advancement with its 2.0 upgrades, the fiscal assemblage has been actively speculating connected its aboriginal value. Here are immoderate Ethereum terms predictions from renowned institutions and analysts, answering the question “will Ethereum recover”:

VanEck: The concern absorption steadfast predicts that Ethereum’s terms could scope arsenic precocious arsenic $11.8k by 2030. This projection is based connected their appraisal that Ethereum’s web revenues could emergence from $2.6 cardinal to $51 cardinal successful 2030, assuming Ethereum captures a 70% marketplace stock among astute declaration platforms.

Standard Chartered: Analysts astatine Standard Chartered are bullish connected Ethereum’s semipermanent potential. They forecast that the terms of ETH could deed $4,000 by the extremity of 2024 and treble to $8,000 by the extremity of 2026. Their Ethereum bull tally prediction is based connected Ethereum’s established dominance successful astute declaration platforms and the imaginable for emerging uses successful areas similar gaming and tokenization. Moreover, they suggest that the upcoming Bitcoin halving successful April 2024 could positively interaction the broader crypto market, particularly Ethereum.

Also, the imaginable approval of a spot Ethereum ETF successful the US could importantly interaction Ethereum’s price. BlackRock, the world’s largest plus manager, filed for a spot Ethereum ETF successful mid-November 2023. The support of this ETF would people a large milestone for Ethereum, perchance attracting much organization and retail investments and substantially boosting Ethereum’s marketplace price.

FAQ: Ethereums Future

Will Ethereum recover?

Ethereum’s betterment depends connected assorted factors including marketplace trends, technological advancements, and broader economical conditions. With ongoing upgrades similar Ethereum 2.0, galore analysts stay optimistic astir its semipermanent potential.

Will Ethereum Go Back Up?

Many marketplace experts foretell Ethereum volition spell backmost up. They are citing improvements from Ethereum 2.0 and expanding adoption successful DeFi, NFTs and accepted finance.

Where Is Ethereum Going?

Ethereum is transitioning to a much scalable, secure, and sustainable web with Ethereum 2.0. This is perchance starring to accrued adoption and value.

What Is The Ethereum Burn?

The Ethereum burn, introduced successful EIP-1559, permanently destroys a portion of transaction fees, perchance creating deflationary unit connected Ethereum’s supply.

Is Ethereum Going Back Up?

Current marketplace predictions and the improvement roadmap suggest imaginable for Ethereum’s terms to increase. But the nonstop trajectory volition beryllium connected aggregate factors.

How Many Ethereum Burned So Far?

As of the latest disposable data, the Ethereum web has burned 0.2 cardinal ETH tokens since implementing EIP-1559. The pain complaint dynamically adjusts based connected web activity.

When Will The Ethereum Bull Run Start?

The commencement of a bull tally for Ethereum is speculative. It depends connected marketplace cycles, capitalist sentiment, and important catalysts similar upgrades and regulatory developments.

Will Ethereum Go Down?

Market volatility is inherent to cryptocurrencies. While Ethereum whitethorn acquisition downturns, its cardinal improvement aims to mitigate specified risks and foster growth.

What Will Be The Future Price Of Ethereum?

Various predictions exist, ranging from mean increases to precocious valuations by 2030. Standard Chartered predicts $8,000 per ETH by the extremity of 2026.

Is Ethereum Going To Go Back Up?

The wide statement among galore analysts is positive. The worth of Ethereum is expected to emergence arsenic it develops and becomes much wide successful the blockchain sector.

Featured representation from Shutterstock, charts from TradingView.com

2 years ago

2 years ago

English (US)

English (US)