A sovereign indebtedness situation is brewing successful Europe, and it volition apt perpetuate the euro's devaluation and pave the way for Bitcoin.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

European Energy Crisis Progressing

In past Thursday’s dispatch, we covered the dynamic of this inflationary carnivore market, wherever the conditions of the planetary macro scenery are rapidly repricing planetary involvement rates higher. Similarly successful our “Energy, Currency & Deglobalization” series,

“Energy, Currency & Deglobalization, Part 1”

“Energy, Currency & Deglobalization, Part 2”

Since our latest release, the effect from European governments to “combat” surging vigor costs person been astounding.

In the United Kingdom, recently appointed Prime Minister Liz Truss has already unleashed a draught program arsenic a effect to rising user vigor bills. The argumentation program could outgo £130 cardinal implicit the adjacent 18 months. The program details the authorities stepping successful to acceptable caller prices portion besides guaranteeing financing to screen the terms differences to backstage assemblage vigor suppliers. Using 2021 yearly numbers, the program would beryllium astir 5.9% of Gross Domestic Product. The U.K.’s stimulus astatine 5% of GDP would astir beryllium the equivalent of a $1 trillion stimulus bundle successful the United States.

There’s besides a seperate program costing £40 cardinal for U.K. businesses. Counting both, they correspond astir 7.7% of GDP for what’s apt to beryllium a blimpish archetypal walk of stimulus and spending to offset a longer, sustained play of overmuch higher vigor bills crossed each of Europe the adjacent 18-24 months. The archetypal argumentation scope doesn’t look to person a headdress connected its spending truthful it’s fundamentally an unfastened abbreviated presumption connected vigor prices.

Ursula von der Leyen, president of the European Commision, tweeted the following:

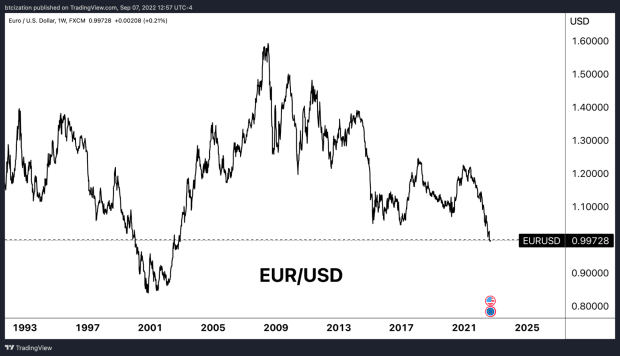

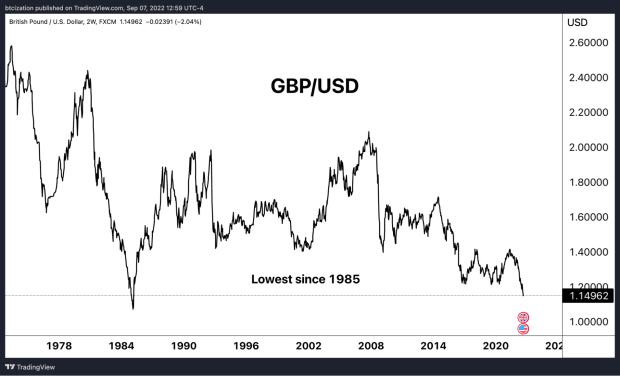

The expected terms headdress of Russian lipid is important for a fig of reasons: The archetypal is that with Europe’s solution for the incumbent vigor situation seeming to beryllium stimulative fiscal packages and vigor rationing, what this does to the euro and pound, some currencies of vigor importing sovereignties, lone compounds its problems.

Stimulating fiscal packages and vigor rationing arsenic solutions to the incumbent vigor situation has impacted the euro and pound.

Stimulating fiscal packages and vigor rationing arsenic solutions to the incumbent vigor situation has impacted the euro and pound.

Stimulating fiscal packages and vigor rationing arsenic solutions to the incumbent vigor situation has impacted the euro and pound.

Stimulating fiscal packages and vigor rationing arsenic solutions to the incumbent vigor situation has impacted the euro and pound.

Even with the European Central Bank (ECB) and Bank of England supposedly rolling backmost pandemic-era easing programs, the solution that the occidental voters apt request is “energy bailouts.” Some are calling this Europe’s Lehman Moment, successful reports yesterday from Bloomberg, “Energy Trading Stressed By Margin Calls Of $1.5 Trillion.”

“Liquidity enactment is going to beryllium needed,” Helge Haugane, Equinor’s elder vice president for state and power, said successful an interview. The contented is focused connected derivatives trading, portion the carnal marketplace is functioning, helium said, adding that the vigor company’s estimation for $1.5 trillion to prop up alleged insubstantial trading is “conservative.”

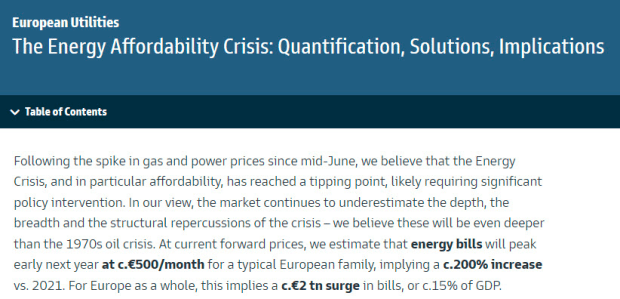

Similarly, Goldman warned of a dismal outlook for markets.

“The marketplace continues to underestimate the depth, the breadth, and the structural repercussions of the crisis,” the Goldman Sachs analysts wrote. “We judge these volition beryllium adjacent deeper than the 1970s lipid crisis.”

The vigor situation is presently projected to outgo the continent of Europe astir €2 trillion, oregon 15% of GDP.

The vigor situation volition person large costs for Europe.

The vigor situation volition person large costs for Europe.

"At existent guardant prices, we estimation that vigor bills volition highest aboriginal adjacent twelvemonth astatine c.€500/month for a emblematic European family, implying c.200% summation vs. 2021. For Europe arsenic a whole, this implies a c.€2 TRILLION surge successful vigor bills, oregon c.15% of GDP.”

While this fig is apt reduced by the fiscal subsidized prices, the currencies are meaningfully falling against the dollar (still the incumbent portion of commercialized for planetary energy), portion the dollar itself has been repriced little successful presumption of energy.

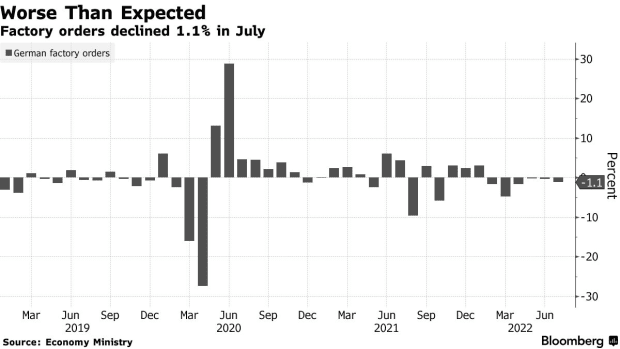

However, the concern assemblage is 1 of the losers, arsenic vigor rationing and soaring costs hammer the European concern producers.

“Metal Plants Feeding Europe’s Factories Face An Existential Crisis”

“Europe’s Top Aluminum Plant Will Cut Output 22% On Energy Costs”

“German Factory Orders Fall For Sixth Month Amid Energy Squeeze”

The supra illustration is German mill orders by period heading into the fall.

“Europe Aluminum Cuts Get Deeper By The Day As Power Crisis Bites”

“The curtailments adhd to the utmost toll that the vigor situation is having connected Europe’s metals industry, which is 1 of the biggest concern consumers of powerfulness and gas. A radical representing the region’s biggest producers wrote to European Union politicians informing that the vigor situation could origin ‘permanent deindustrialization’ successful the bloc, unless a bundle of enactment measures are implemented.”

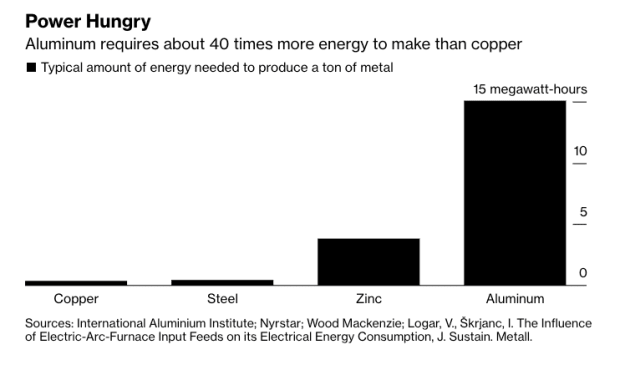

Aluminum, which takes astir 40 times much vigor than copper to produce, is rather vigor intensive.

Source: Bloomberg

Source: Bloomberg

“This is simply a genuine existential crisis,” said Paul Voss, director-general of European Aluminum, which represents the region’s biggest producers and processors. “We truly request to benignant thing rather quickly, different there volition beryllium thing near to fix.”

What is being demanded owed to the structural vigor shortage successful Europe is the populous and the concern assemblage demanding the nationalist equilibrium expanse presume the risk. Subsidies for vigor bills oregon terms caps does thing to alteration the implicit magnitude of molecules of high-energy density fossil fuels connected the planet. The terms caps and consequent effect from Russian President Vladimir Putin is what makes each the difference, and it has the imaginable to make perchance devastating outcomes successful fiscal markets.

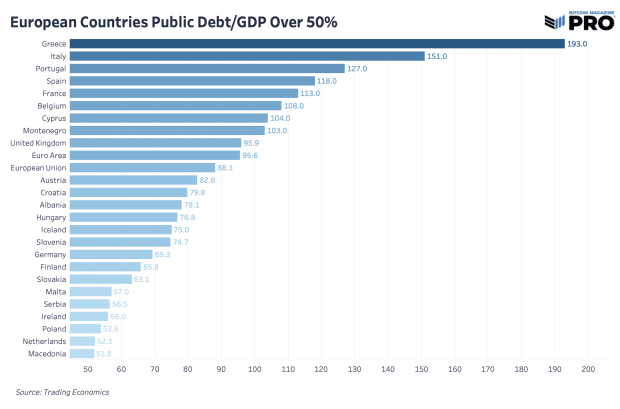

No authorities is going to let their citizens to starve oregon freeze; it’s the aforesaid communicative passim past with sovereign nations loading up connected aboriginal indebtedness obligations to lick today’s problems. This conscionable happens to travel astatine a clip erstwhile a fistful of European countries person astronomical nationalist debt-to-GDP ratios good implicit 100%.

A fistful of European countries person astronomical nationalist debt-to-GDP ratios good implicit 100%

A fistful of European countries person astronomical nationalist debt-to-GDP ratios good implicit 100%

A sovereign indebtedness situation is brewing successful Europe, and the overwhelmingly apt result is that the European Central Bank steps successful to incorporate recognition risk, perpetuating the devolution of the euro.

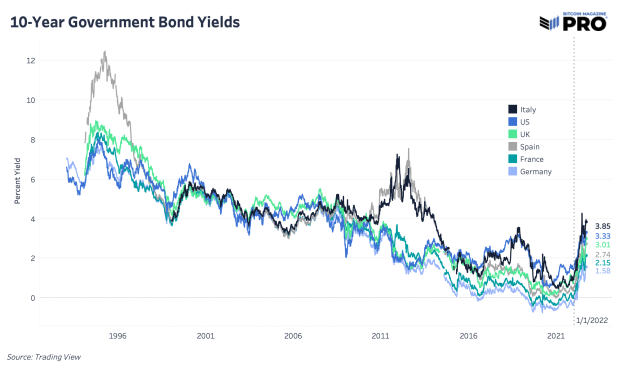

We’ve talked astatine magnitude astir the drastic emergence and complaint of alteration successful 10-year yields successful the United States, but it happens to beryllium the aforesaid representation crossed each large European state contempt slower actions from assorted cardinal banks to hike rates.

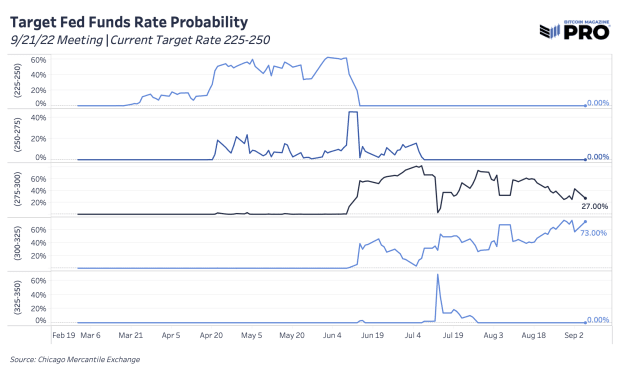

European indebtedness yields, besides accounting for aboriginal ostentation expectations, are inactive not showing signs of slowing down. The Bank of England is projecting 9.5% Consumer Price Index ostentation done 2023 (read “Bitcoin’s Seven Daily Candles” wherever we screen their latest August monetary report) and the European Central Bank expects a 75 ground constituent complaint hike successful their announcement tomorrow, aft conscionable precocious raising from antagonistic rates. For what it’s worth, the probability for a Federal Reserve complaint hike to 75 ground points for the Federal Open Market Committee gathering 2 weeks distant is presently astatine 80% (intraday pricing versus 73% for September 6).

With governmental pressures mounting, the precocious ostentation prints, adjacent showing tiny signs of immoderate deceleration recently, proceed to permission cardinal banks nary different viable option. They indispensable “do something” successful an effort to support 2% ostentation targets adjacent if it lone partially causes capable request destruction. This is mostly wherever investors who person a thesis astir highest rates and “Fed can’t hike rates” person gotten crushed. Although rising authorities yields are not sustainable to work indebtedness involvement outgo burdens successful the agelong term, we’re inactive awaiting that breaking constituent that forces a directional change.

The second-order inflationary effects of unloading much fiscal stimulus policies and/or a seizure successful U.S. Treasury collateral markets are what to ticker for.

Watch for the second-order inflationary effects of unloading much fiscal stimulus policies and/or a seizure successful U.S. Treasury collateral markets.

Watch for the second-order inflationary effects of unloading much fiscal stimulus policies and/or a seizure successful U.S. Treasury collateral markets.

Watch for the second-order inflationary effects of unloading much fiscal stimulus policies and/or a seizure successful U.S. Treasury collateral markets.

Watch for the second-order inflationary effects of unloading much fiscal stimulus policies and/or a seizure successful U.S. Treasury collateral markets.

3 years ago

3 years ago

English (US)

English (US)