The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Bitcoin’s Correlation With Volatility

Bitcoin is overmuch much than an “inverse VIX” but that doesn’t halt the marketplace from trading it arsenic such. (“VIX is the ticker awesome and the fashionable sanction for the Chicago Board Options Exchange's CBOE Volatility Index, a fashionable measurement of the banal market's anticipation of volatility based connected S&P 500 scale options.”)

As Bitcoin’s education, adoption and monetization carries on, fundamentals and web maturation volition beryllium the much important operator of terms appreciation. But successful the existent environment, risk-off marketplace signals and broader marketplace volatility are successful the operator seat.

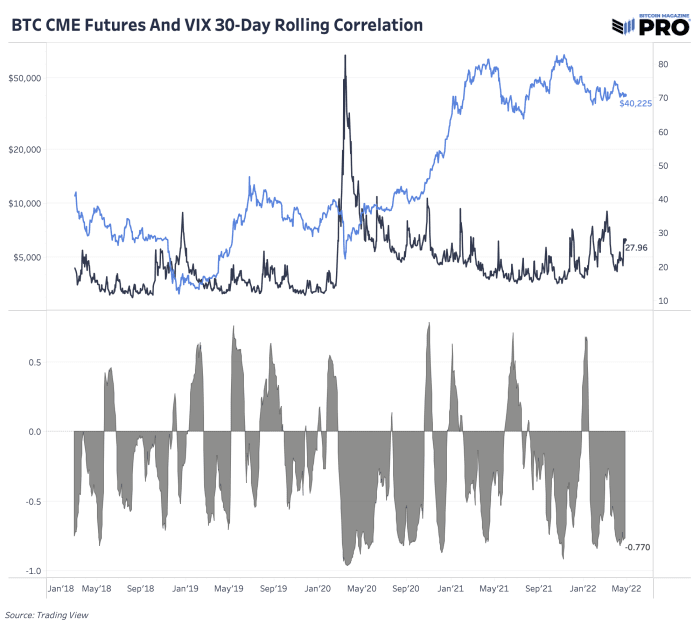

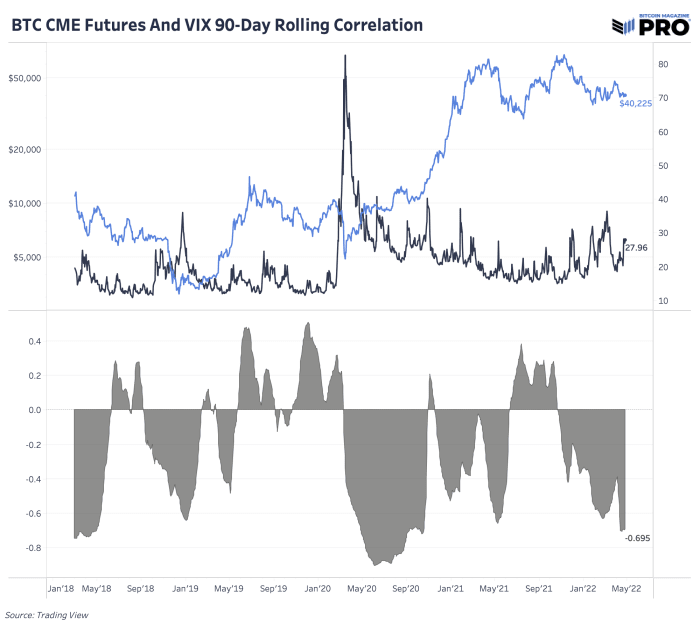

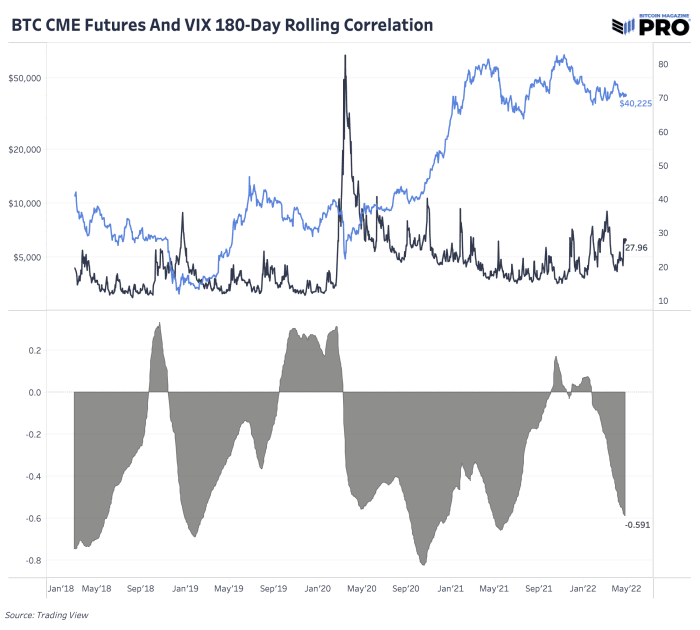

We tin astir quantify this bitcoin and volatility narration by looking astatine the Chicago Mercantile Exchange bitcoin futures and VIX rolling correlations crossed 30-day, 90-day and 180-day timeframes implicit the past fewer years.

On the different hand, March 2020 gave america an absorbing illustration of however bitcoin whitethorn execute station marketplace crash, monolithic volatility spike and accrued indebtedness monetization crossed monetary and fiscal policies to assistance rescue the marketplace and economical conditions. Bitcoin is present 716% up from its March 2020 bottommost of $4,930. Bitcoin’s correlation to the VIX is atrocious present during a recognition unwind, but it’s a affirmative property during reflationary periods and falling volatility.

From a broader macroeconomic perspective, this is wherefore we stay bullish connected bitcoin connected a longer clip skyline station different script clang successful hazard assets. If we’re to spot this script play retired and erstwhile the particulate settles, bitcoin volition beryllium primed to outperform astir each different plus successful our presumption based connected its adoption curve, fundamentals and arsenic a superior monetary network.

3 years ago

3 years ago

English (US)

English (US)