There has been an summation successful slope accounts belonging to crypto professionals being frozen oregon restricted crossed the UK, US, and EU implicit the past fewer months. They accidental you often don’t attraction astir thing until it happens to you; well, this week, it did. To my genuine surprise, it came from the 1 spot I slightest expected it.

Revolut has agelong been regarded arsenic the astir crypto-friendly slope successful the United Kingdom, offering in-app crypto purchases and, successful 2023, yet adding the quality to nonstop and person crypto, albeit with definite limitations. However, caller events person called into question the bank’s committedness to providing a seamless acquisition for its cryptocurrency-using customers.

Despite the UK nary longer being portion of the European Union, nether which MiCA EU regulations apply, the recently implemented Travel Rule requires akin disclosures. This means that users are present required to uncover and place the owners of immoderate unhosted wallets that are the recipients of withdrawals from Revolut.

However, UK crypto firms are allowed to use a risk-based attack to find erstwhile they should stitchery accusation connected unhosted wallets. They simply request to person the capableness to place wherever their customers are transacting with unhosted wallets and measure the riskiness of those transactions.

How the UK’s astir crypto-friendly slope froze my relationship of 0.23ETH

Two days ago, I purchased a humble 0.23 ETH (£550) done the Revolut app and attempted to transportation the funds to my idiosyncratic Ethereum wallet, which is linked to a well-known ENS domain. To my surprise, Revolut blocked the transaction and took fees from the account. Moreover, my full slope account, including a associated relationship with my wife, was frozen.

After respective hours of vexation and confusion, the relationship was yet unfrozen, and fees were refunded aft a further request. However, the circumstantial wallet code remains blocked, preventing maine from sending funds to that account. This acquisition has near maine questioning the existent quality of Revolut’s expected crypto-friendliness. Given the alternatives successful the UK, Revolut remains the champion enactment for those unsatisfied with accepted banks, but it is simply a debased bar. I judge that incidents specified arsenic these person little to bash with Revolut being ‘anti-crypto’ and much to bash with a fearfulness of regulatory retribution.

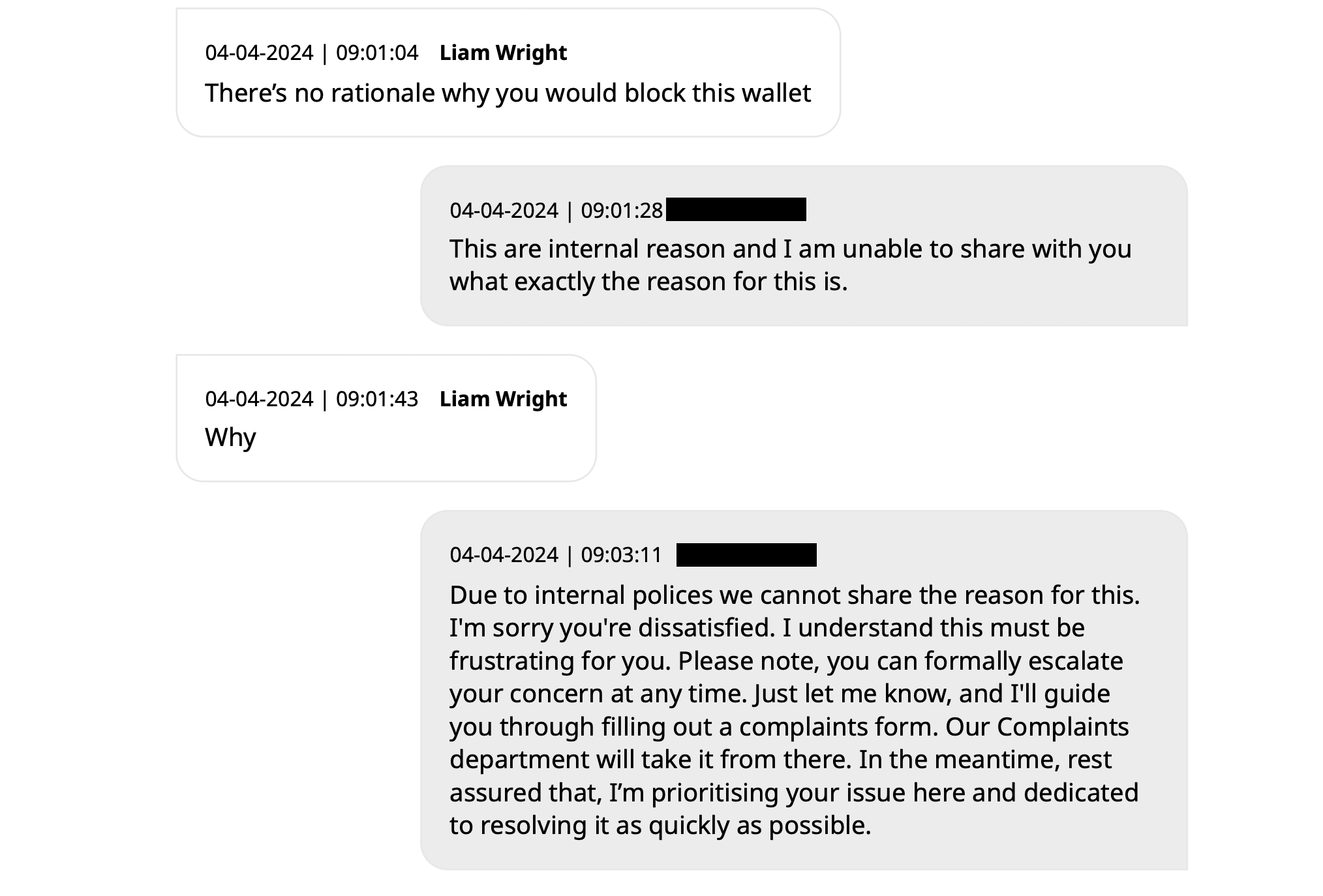

Still, the chat transcript betwixt Revolut’s enactment squad and maine reveals a deficiency of transparency regarding the reasons down the relationship frost and the wallet code block. The enactment representatives could not supply a wide explanation, citing interior policies that forestall them from sharing the circumstantial reasons for these actions.

This incidental raises concerns astir the autonomy and power that Revolut users person implicit their ain funds, peculiarly erstwhile it comes to integer assets transactions. Blocking a idiosyncratic wallet code without a satisfactory mentation undermines spot successful the bank’s quality to facilitate creaseless crypto transactions.

As the UK navigates the post-Brexit fiscal landscape, banks similar Revolut indispensable onslaught a equilibrium betwixt compliance with regulations and providing a user-friendly acquisition for their customers. The strict exertion of laws and the deficiency of transparency successful addressing relationship and wallet issues hazard alienating crypto users who trust connected these services. This is particularly existent fixed that the institution is looking to unfastened a dedicated crypto exchange offering.

Debanking crypto users successful the United States

In the United States, adjacent crypto users who person been long-time customers of accepted banks look relationship closures owed to their engagement with integer assets. John Paller, co-founder of ETH Denver, recently shared his experience connected Twitter, revealing that Wells Fargo had debanked him aft 26 years of patronage and millions paid successful fees. Paller’s checking, savings, recognition card, idiosyncratic line, non-profit, and concern accounts were each unopen down without explanation, contempt him not utilizing his idiosyncratic accounts for crypto purchases successful caller times.

Caitlin Long, Founder and CEO of Custodia Bank, responded to Paller’s tweet, noting a important summation successful inquiries from crypto companies urgently seeking to regenerate slope accounts closed by their banks. She referred to this inclination arsenic different question of “Operation Choke Point 2.0,” suggesting a full-on witch hunt against crypto-related businesses.

Bob Summerwill, Director of the Ethereum Classic Cooperative, echoed the sentiment, emphasizing the request for banks similar Custodia. He shared his ain acquisition with PayPal, which closed the Ethereum Classic Cooperative’s relationship without providing circumstantial reasons, lone stating that the determination was imperishable and could not beryllium overturned.

These incidents item a increasing interest wrong the crypto community: adjacent those who person established relationships with accepted banks and person a compliance past are astatine hazard of losing entree to banking services. The deficiency of transparency and the abrupt quality of these relationship closures rise questions astir the underlying motivations down these actions and the imaginable interaction connected the maturation and adoption of cryptocurrencies successful the United States.

Positive friction truly conscionable means a unspeakable idiosyncratic experience

Anecdotally, I person besides heard from astatine slightest 5 different individuals who enactment successful crypto and regularly determination important sums of FIAT currency done accepted banks that person had accounts frozen. I americium not advocating for a Wild West; communal consciousness regularisation is each I ask.

The UK’s attack to regularisation besides includes what it considers ‘positive friction.’ The conception refers to a acceptable of regulatory measures designed to present definite barriers oregon checks that dilatory down the process of investing successful integer assets. These measures are intended to counteract the societal and affectional pressures that mightiness pb individuals to marque hasty oregon ill-informed concern decisions. The Financial Conduct Authority (FCA) has introduced these ‘positive frictions’ arsenic portion of its fiscal promotions legislation, aiming to heighten user extortion successful the crypto market.

Specific examples of “positive friction” see personalized hazard warnings and a 24-hour cooling-off play for first-time investors with a firm. These measures are designed to guarantee that individuals are adequately informed astir the risks associated with crypto investments and person capable clip to reconsider their concern decisions without the power of contiguous affectional oregon societal pressures.

The world is simply a bid of questions designed to scare disconnected caller investors, followed by an unsightly banner informing crossed the apical of each crypto app that seemingly ne'er goes distant adjacent aft you person passed each requirements.

I would similar to cognize erstwhile the authorities volition beryllium implementing a trial connected fractional reserve banking for each accepted concern customers? We person to cognize astir the nuances of authorities regularisation connected crypto, specified arsenic who the FCA oversees and whether a whitepaper is required. Suppose we were to inquire 10 radical connected the thoroughfare what happens erstwhile you deposit funds into their checking accounts. I wonderment however galore would walk the test?

How galore cognize US and UK banks’ reserve requirements are 0%? Previous limits of 5 – 10% were dropped successful 2020, and present it is astatine a bank’s ain discretion however overmuch of its customers’ funds are really held successful cash. Therefore, it is wholly ineligible for a slope to instrumentality a £1,000 deposit and indebtedness the full magnitude retired to different party.

Of course, accepted concern is regulated, and wealth is ‘guaranteed’ by authorities insurance, truthful we don’t request to worry. Let’s conscionable not look backmost to 2008 erstwhile we had to trust connected specified tools, shall we? It took little than 10% of customers to retreat funds from Northern Rock for it to collapse.

Banks don’t person each of your money; well-run crypto exchanges and self-custody wallets do, but regulations suggest we should beryllium terrified of crypto?

I deliberation it’s the banks that are terrified.

I asked Revolut’s enactment and X teams if the PR section would similar to remark connected my concern up of this op-ed, but the question was repeatedly ignored.

The station Even crypto affable UK banks frost accounts successful fearfulness of crypto transactions appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)