Shanghai, Capella, Shapella, 0x01, execution layer, statement furniture – portion the web3 assemblage undoubtedly boasts awesome method competence, Ethereum’s latest update had adjacent the champion of america confused astatine times.

A Nansen study connected Ethereum withdrawals reviewed by CryptoSlate shone a airy connected everything that’s going on, utilizing information derived from Nansen’s Shapella dashboard.

Sha-nghai Ca-pella

The Shapella Upgrade, successfully executed connected April 13, marked a important milestone successful Ethereum’s multi-stage roadmap by enabling the withdrawal of staked Ethereum (ETH) connected the Beacon chain. This highly anticipated upgrade reduces the liquidity hazard associated with staking, encouraging accrued participation.

The sanction comes from combining the 2 simultaneous upgrades, Shanghai and Capella. Shanghai upgraded the execution layer, and Capella upgraded the statement layer. The upgrades differed lone successful presumption of the portion of the web they targeted, arsenic the extremity of some upgrades was to unfastened withdrawals.

Ethereum staking

Unlike different Proof-of-Stake (PoS) systems, Ethereum requires validators to involvement a fixed magnitude of 32 ETH, with rewards based connected this amount. Validators whitethorn person much than 32 ETH owed to accrued rewards oregon little if slashed oregon penalized. To alteration withdrawals, validators indispensable acceptable their withdrawal credential prefixes from 0x00 to 0x01.

Since the Shapella upgrade, the fig of validators with the 0x01 credential has accrued from 40% to 83.3%, according to Nansen’s data.

Furthermore, Ethereum’s staking strategy involves 2 types of withdrawals: partial and full.

Partial withdrawals see withdrawing accrued rewards portion keeping the minimum 32 ETH required for validator operation, processed periodically done an automated process successful astir 2-5 days.

Moreover, afloat withdrawals impact withdrawing a validator’s full equilibrium voluntarily oregon pursuing a slashing event. Full withdrawals instrumentality longer than partial withdrawals, involving aggregate steps: the exit queue, a “minimum validator withdrawability” hold of 256 epochs (27.3 hours), and the automatic withdrawal process (2-5 days).

Why bash stakers person to hold successful a queue?

The exit queue serves arsenic a protective measurement to support the information of the Ethereum network. Its superior relation is to power the complaint astatine which validators tin exit the network, preventing a ample fig of them from leaving simultaneously. If excessively galore validators exited quickly, the web could go susceptible to attacks owed to a reduced fig of progressive validators securing it.

The 27.3-hour hold (equivalent to 256 epochs) imposed connected the exit process is an further information measurement designed to supply the web with capable clip to observe and respond to immoderate harmful activities. This hold acts arsenic a safeguard, ensuring that atrocious actors cannot negatively interaction the web and past exit without consequence. Essentially, the exit queue and the associated withdrawal hold enactment unneurotic to support the stableness and information of the Ethereum web during the validator exit process.

Liquid staking

Liquid Staking Derivative protocols (LSDs), specified arsenic Lido, present superior ratio by leveraging liquidity and, thus, whitethorn power validator decisions. There has been a flimsy summation successful the magnitude of ETH staked successful LSDs since the Shanghai upgrade. Although nary dashboard presently tracks if this summation is chiefly driven by restaking, a correlation is apt owed to the benefits of LSDs. Nansen is reportedly moving connected a dashboard to way this metric.

Understanding upcoming withdrawals is indispensable for assessing Ethereum’s staking ecosystem. Kraken, 1 of the apical withdrawers, is often misconceived arsenic 1 of the apical sellers. However, according to the report, their “full exits person not materially impacted full withdrawal numbers,” arsenic astir withdrawals person been rewards and validators are inactive successful the exit queue oregon pending the automatic withdrawal process. Furthermore, validators whitethorn person different reasons to petition withdrawals, specified arsenic switching validator setups oregon moving to LSD protocols.

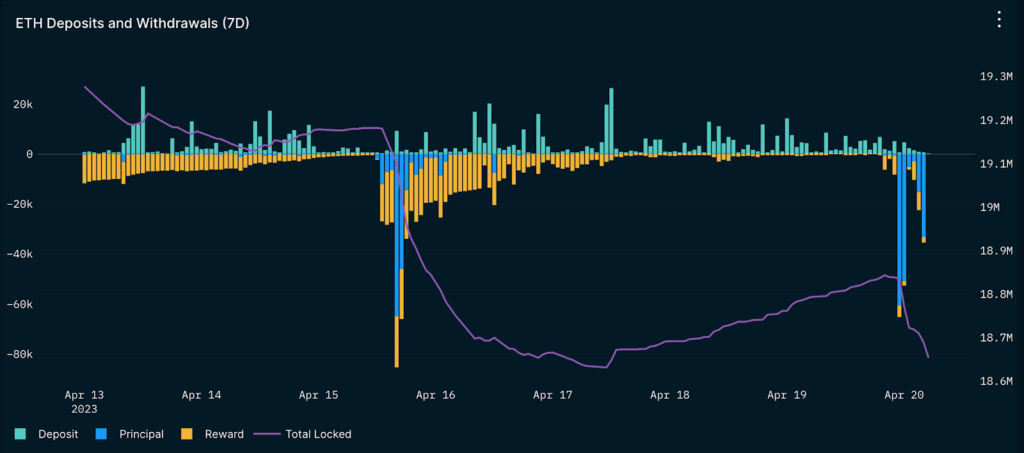

Nansen’s information connected deposits vs. withdrawals offers invaluable insights into the travel of ETH betwixt locked and unlocked states, with the cumulative sum utilized to estimation changes successful the liquid proviso of ETH.

Source: Nansen

Source: NansenNansen information expert Martin Lee commented,

“While the illustration gives a bully overview of the alteration successful liquid supply, it lacks nuance erstwhile making inferences connected the implications of the withdrawals. In bid to summation due insights into the withdrawal data, knowing the divided betwixt partial and afloat withdrawals is vital.”

Insights connected Shapella

Lee’s proposal connected Shapella suggests determination volition beryllium an summation successful information and the wide magnitude of ETH staked successful the web present that Ethereum withdrawals are live. If so, it could bring Ethereum’s staking ratio person successful enactment with different large L1s.

The proposal is based connected the reflection that Ethereum had 1 of the lowest staking ratios among large L1s and was the lone concatenation without withdrawals enabled until the Shanghai upgrade. As the upgrade approached, determination was a accelerated summation successful the magnitude of ETH staked, indicating a beardown involvement successful staking ETH.

However, Lee besides highlighted Ethereum’s staking ratio mightiness not scope arsenic precocious arsenic immoderate different chains, chiefly owed to the ample NFT ecosystem and the increasing DeFi ecosystem. The assorted usage cases for ETH acceptable it isolated from different large L1 tokens, which could interaction its staking ratio. Lee believes it is important to see that the instauration of withdrawals whitethorn not needfully pb to wide selling pressure, arsenic galore factors tin power the decisions of validators and users

Lee yet argued that the pursuing events person had radical “jumping to conclusions excessively early.’

- Kraken unlocks = wide selling pressure

- The wide inclination successful the magnitude of staked ETH based connected existent withdrawal data

- Kraken being forced to unwind their staking work successful the US doesn’t needfully mean they (or their customers) are selling. It conscionable means they person to exit arsenic validators. What users bash with the ETH is yet to beryllium seen.

- The magnitude withdrawn present volition beryllium highly volatile, with spikes present and determination based connected partial and afloat exits. It’s lone been 4 days, and a baseline has not yet been established.

In conclusion, the Shapella upgrade has unlocked caller possibilities for Ethereum staking and brought much flexibility to validators. Understanding the nuances betwixt partial and afloat withdrawals, the interaction of LSDs, and cardinal metrics similar deposits vs. withdrawals volition assistance crypto enthusiasts navigate this caller landscape.

The station Everything you request to cognize astir ETH Shapella withdrawals appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)