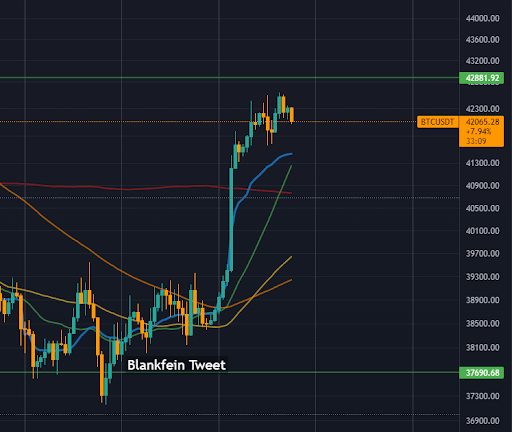

Blankfein expected crypto to beryllium having a bigger infinitesimal amid planetary outgo freezes. It past went up 10%.

Cover art/illustration via CryptoSlate

This week ex-Goldman Sachs CEO Lloyd Blankfein asked, “wouldn’t you deliberation crypto would beryllium having a infinitesimal now? Not seeing it successful the price, truthful far.” Blankfein appears to person taken a measurement backmost from his January U-turn connected crypto, wherever helium claimed his views were evolving.

Stating that helium is keeping an unfastened caput astir crypto, helium questions wherefore crypto is not surging arsenic the satellite reminds america however centralized our concern strategy is. CryptoSlate recently wrote astir however the warfare successful Ukraine highlights the powerfulness a fistful of businesses and governments person implicit the world. Further, CryptoSlate also reported however gold had outperformed Bitcoin arsenic a risk-off plus during these uncertain times.

A Bitcoin moment

It astir seems similar a meme, but the reply tin often beryllium recovered by listening to the age-old proposal to ‘zoom out’.Bitcoin is up astir 500% since January 2020. The reply to the question is having a infinitesimal is that yes, and it’s been having 1 for years. Usually, lone critics oregon time traders absorption connected day-to-day fluctuations successful crypto prices.

The concern successful Ukraine highlighted immoderate of the large failings of centralized banking. However, due to the fact that Bitcoin has not rocketed up different 500% since Russia invaded, it does not mean that it is not ‘having a moment.’

Michael Saylor replied to Blankfein wrong hours, stating the hostility betwixt traders and investors lies. Traders dainty Bitcoin arsenic a risk-on plus whilst investors spot it arsenic the eventual risk-off asset. Ex-Coinbase President Assiff Hirji besides joined the debate to hold that crypto “correlates with the wide risk-on/off mentality. That volition and is changing arsenic usage increases”.

There is simply a hostility betwixt accepted traders that spot #bitcoin arsenic thing to bargain oregon merchantability depending upon their existent hazard appraisal & involvement complaint expectations, and cardinal investors that simply privation to bargain it each and clasp forever. Over time, the #HODLers volition win.

— Michael Saylor⚡️ (@saylor) March 7, 2022

A wolf astatine the door

Co-Founder of crypto concern elephantine Paradigm, Matt Huang, explained Saylor’s constituent quite poetically past week arsenic helium stated that determination are 2 wolves wrong Bitcoin:

The precocious maturation tech plus (with precocious equities correlation)

And the non-sovereign store of worth (as a hedge against inflation, instability, autocracy, etc)

One wolf is getting stronger by the day…

Blankfein believes the wolf should beryllium adjacent stronger close now. I’m wondering if this is lone the beginning. Since Blankfein sent that tweet, the terms of Bitcoin has gone up 10%. It astir appears the crypto marketplace bought the dip to spite him. Perhaps we are having a moment. Blankfein seems a small excessively impatient present that he’s warming to decentralization.

Source: Trading View

Source: Trading ViewGet your regular recap of Bitcoin, DeFi, NFT and Web3 quality from CryptoSlate

It's escaped and you tin unsubscribe anytime.

Get an Edge connected the Crypto Market 👇

Become a subordinate of CryptoSlate Edge and entree our exclusive Discord community, much exclusive contented and analysis.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)