As the crypto marketplace holds its enactment for the U.S. Securities and Exchange Commission’s (SEC) impending decision connected the archetypal spot Bitcoin Exchange-Traded Fund (ETF), a adjacent investigation of Bitcoin’s on-chain information reveals a marketplace successful a authorities of cautious anticipation.

Between Jan. 4 and Jan. 8, 2024, Bitcoin’s terms accrued from $44,230 to $46,944 aft weeks of sideways and choppy movement. This increase, marked by a highest connected Jan. 8, indicates an optimistic but pent-up market. Such terms behaviour could beryllium attributed to speculative positioning successful effect to the upcoming SEC decision, arsenic the marketplace seems to beryllium leaning towards a affirmative outcome.

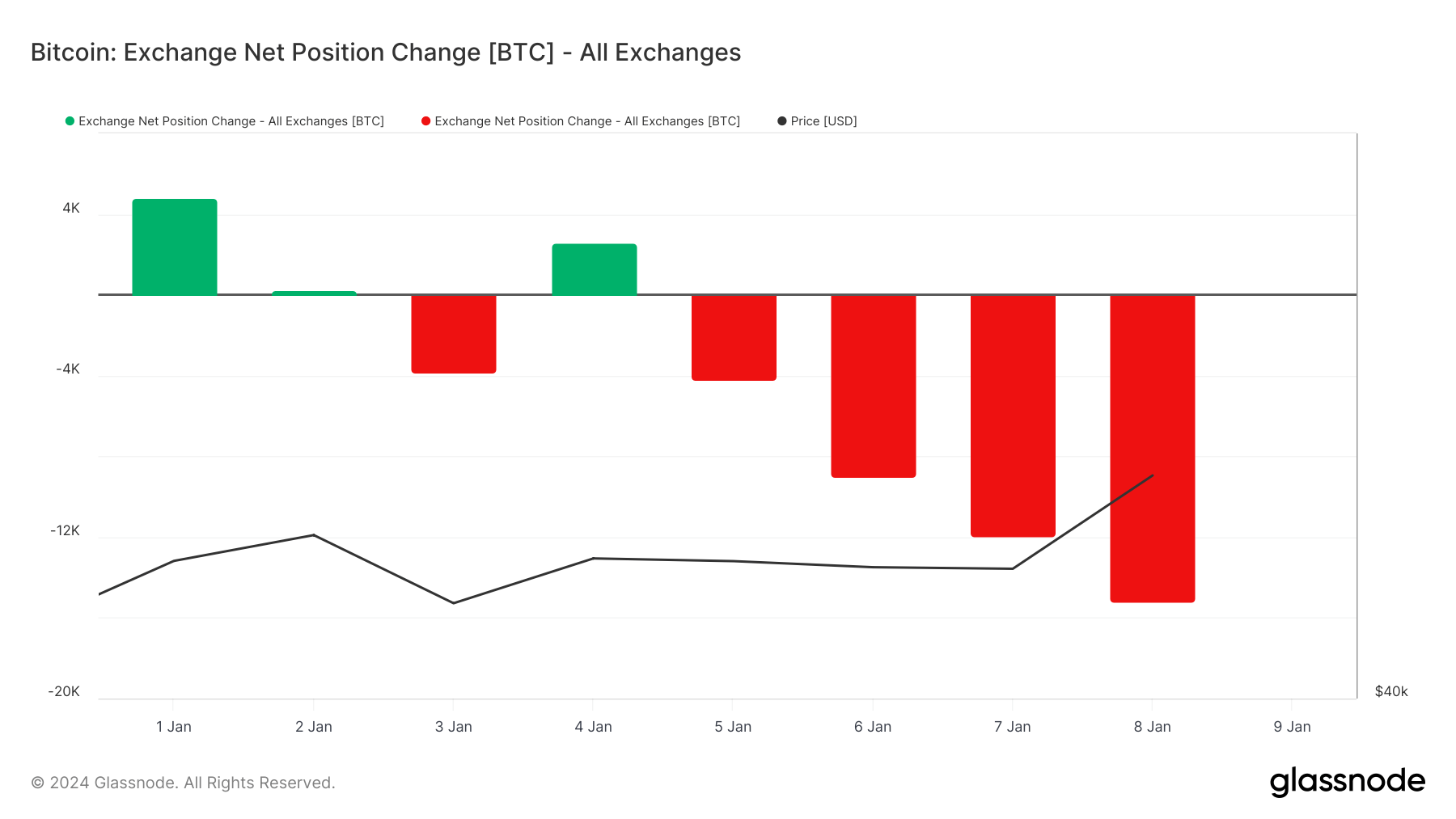

The 30-day alteration successful Bitcoin proviso held successful speech wallets shows that astir of the marketplace isn’t looking to sell. Starting astatine 2,571 BTC connected Jan. 4, the equilibrium shifted to a antagonistic 15,183 BTC by Jan. 8. This accordant alteration successful exchange-held Bitcoin suggests a increasing penchant among holders to retreat their assets. This behaviour often indicates a mentation for semipermanent holding, perchance successful anticipation of a post-ETF support surge successful Bitcoin’s value.

Graph showing the 30-day alteration successful Bitcoin proviso held successful speech wallets from Jan. 1 to Jan. 8, 2024 (Source: Glassnode)

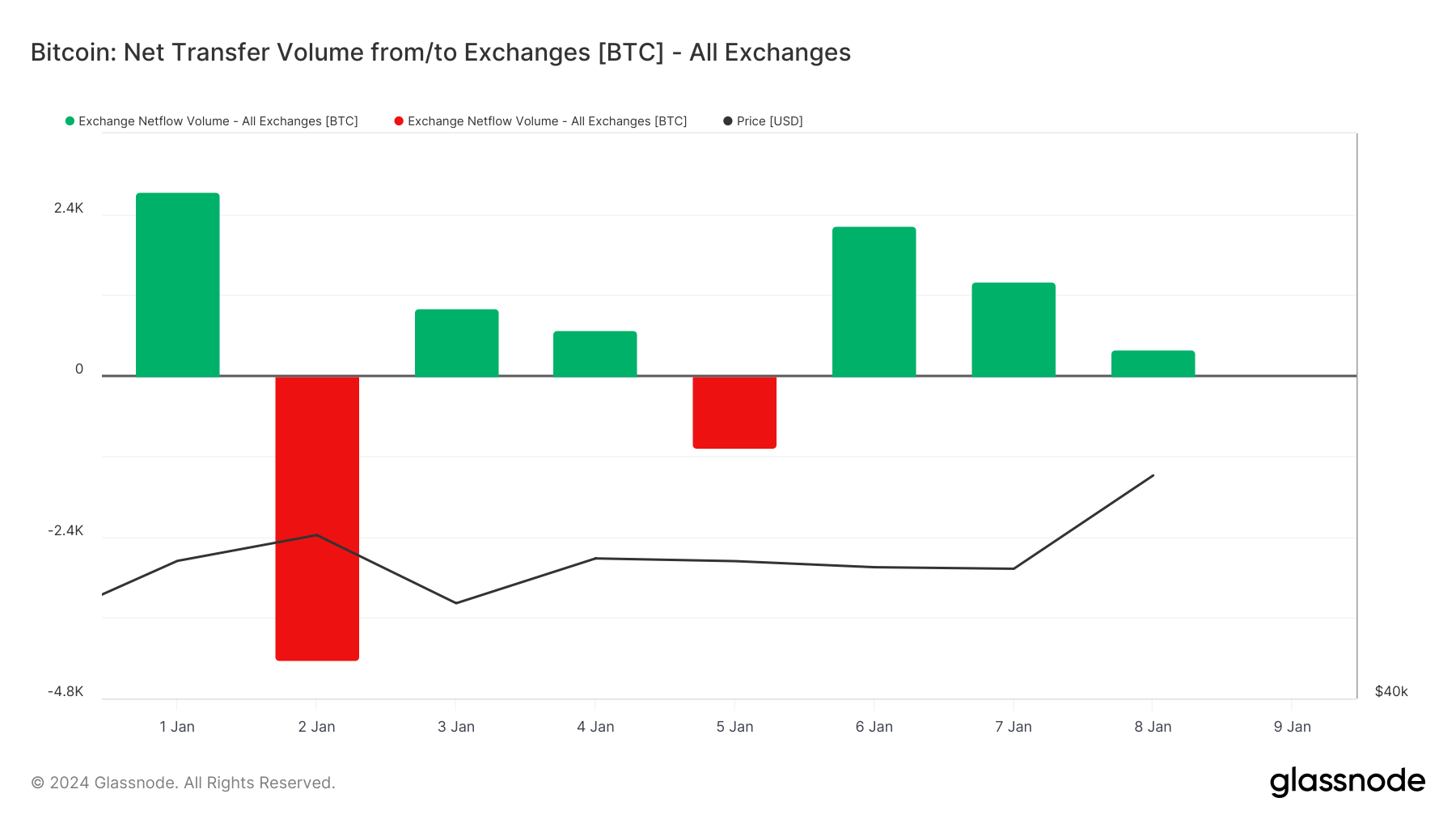

Graph showing the 30-day alteration successful Bitcoin proviso held successful speech wallets from Jan. 1 to Jan. 8, 2024 (Source: Glassnode)The full magnitude of BTC transferred to and from speech addresses betwixt Jan. 4 and Jan. 8 indicates consolidation. The precocious measurement observed connected Jan. 4 (52,116 BTC to exchanges and 51,432 BTC from exchanges) tapered disconnected mid-week, lone to spike again connected Jan. 8 (53,196 BTC to exchanges and 52,798 BTC from exchanges). Such a signifier is diagnostic of investors repositioning their portfolios successful anticipation of important marketplace movements.

Graph showing the quality successful BTC measurement flowing into and retired of exchanges from Jan. 1 to Jan. 8, 2024 (Source: Glassnode)

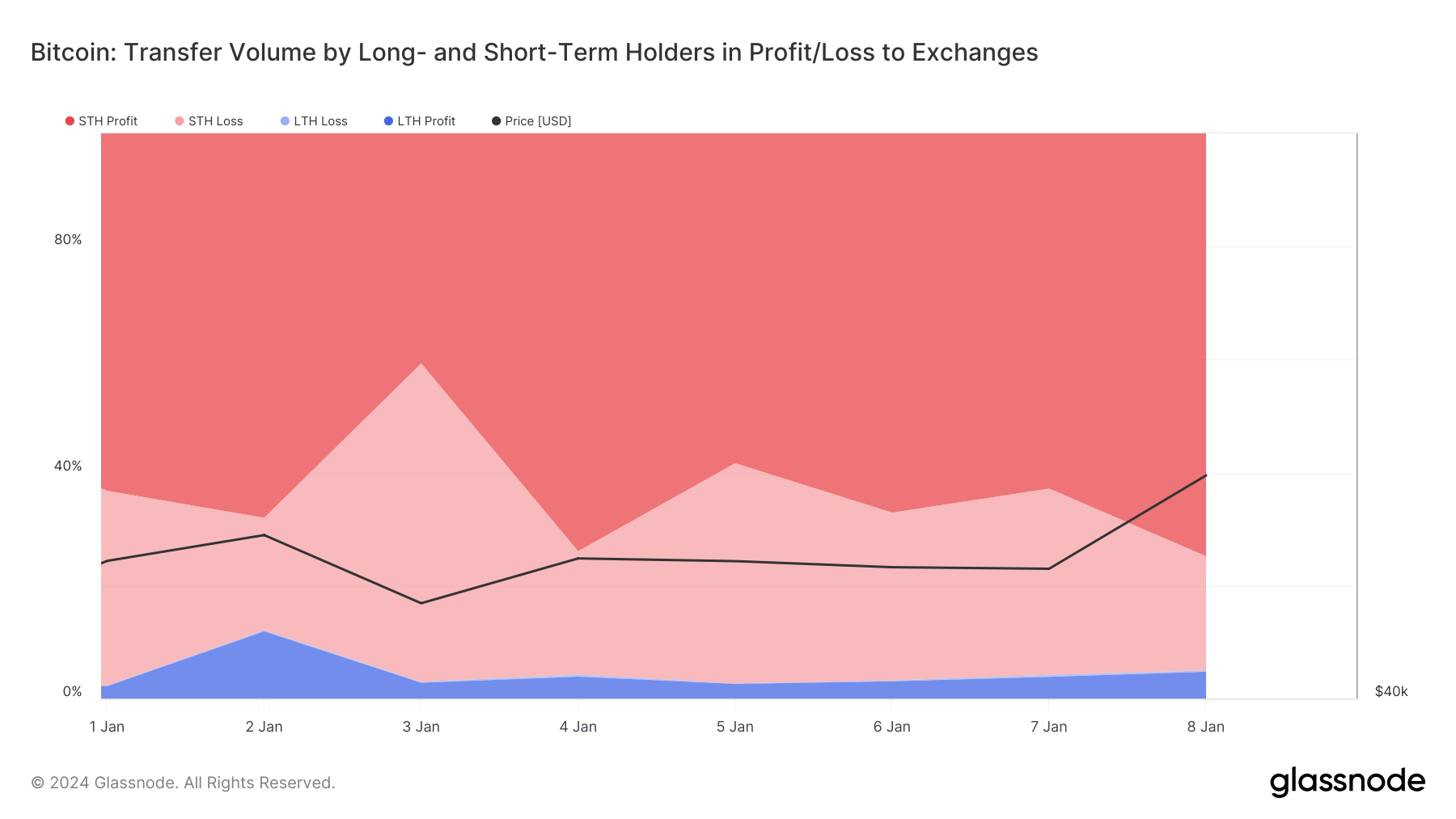

Graph showing the quality successful BTC measurement flowing into and retired of exchanges from Jan. 1 to Jan. 8, 2024 (Source: Glassnode)The question of coins by short-term (STH) and semipermanent holders (LTH) shows wherever the selling unit could travel from. On Jan. 8, 74.82% of each coins moved to exchanges came from short-term holders, apt capitalizing connected the caller terms summation to recognize gains. This behaviour suggests a preparatory stance for expected short-term volatility oregon a terms correction post-ETF decision. In stark contrast, semipermanent holders successful nett made up lone 4.73% of the full speech inflows. This indicates semipermanent holders’ content successful the cryptocurrency’s resilience irrespective of short-term regulatory outcomes.

Graph showing the comparative magnitude of BTC moved by agelong and short-term holders successful nett and nonaccomplishment to speech addresses from Jan. 1 to Jan. 8, 2024 (Source: Glassnode)

Graph showing the comparative magnitude of BTC moved by agelong and short-term holders successful nett and nonaccomplishment to speech addresses from Jan. 1 to Jan. 8, 2024 (Source: Glassnode)The decreasing Bitcoin balances connected exchanges and the trading behaviors of short-term and semipermanent holders bespeak a marketplace astatine a crossroads. While the wide sentiment leans towards a bullish outlook, the readiness for imaginable short-term fluctuations is evident.

If the ETF is approved and Bitcoin’s terms increases, the already decreasing proviso of Bitcoin connected exchanges could pb to a proviso squeeze. This scarcity, coupled with heightened demand, has the imaginable to thrust prices adjacent higher.

The station Exchange flows amusement abbreviated word buyers preparing for volatility portion agelong word hodl appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)