The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

LFG Exchange Inflows

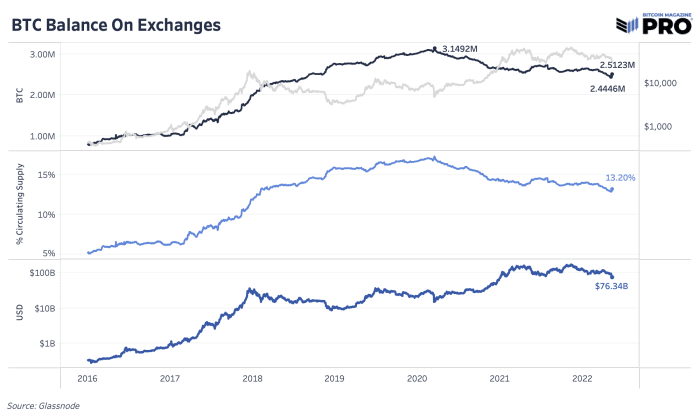

As a effect of this week’s chaos, exchanges had an estimated 52,333 of bitcoin inflows mostly driven by the depletion of the Luna Foundation Guard (LFG) reserve balance. This doesn’t alteration the larger macro inclination of speech outflows implicit the past 2 years, but it is the largest regular inflow of bitcoin to exchanges since November 2017 and the all-time highest USD worth of bitcoin moved.

From what we cognize truthful far, without a wide LFG connection yet connected the latest presumption of reserves, 52,189 bitcoin has near known addresses dropping the reserve equilibrium from 80,395 BTC to 28,206. At peak, that was astir $3 cardinal successful reserves (with a $10 cardinal goal) to enactment Terra’s erstwhile $18 cardinal marketplace cap. A ample chunk of 37,836 BTC (approximately $1.13B) looks to person been sent to Gemini.

Total reserves fell aft LFG announced that $750 cardinal successful bitcoin was deployed arsenic a indebtedness to marketplace makers with efforts to support the UST peg. It’s not arsenic wide arsenic to the nonstop percent of reserves that were wholly sold connected to the marketplace versus what’s been loaned to marketplace makers. The question present is however overmuch bitcoin volition marque its mode backmost to LFG’s reserves, oregon backmost to the marketplace amid different imaginable question of merchantability unit if the betterment efforts neglect and spot successful this stablecoin experimentation doesn’t return?

Although this was a historical inflow day, it’s a comparatively tiny full monthly inflow arsenic a percent of marketplace headdress truthful far. Similarly, connected a 30-day rolling basis, speech outflows are inactive ascendant with 15,012 BTC outflows from exchanges up from astir 100k BTC successful outflows astatine the caller peak.

April 2022 was the third-highest speech equilibrium outflow period of each time. Across some March and April, astir 161,000 BTC near exchanges portion truthful far, May has an estimated inflow of astir 51,000 BTC 9 days into the month.

With markets becoming much blase implicit time, balances connected exchanges unsocial don’t archer the full communicative — with reasonably noisy, insignificant correlations to short-term terms enactment erstwhile looking astatine rolling 90-day correlations utilizing 30-day flows. Exchange balances are inactive utile astatine knowing flows, monitoring economical enactment and analyzing longer-term trends, but they are surely nuanced.

Subscribe to entree the afloat Bitcoin Magazine Pro newsletter.

3 years ago

3 years ago

English (US)

English (US)