The speech stablecoin ratio (ESR) is an on-chain metric that indicates the equilibrium of liquidity betwixt Bitcoin and stablecoins held connected exchanges.

The metric is calculated arsenic the ratio of the full Bitcoin reserves to the full stablecoin reserves, fundamentally showing the market’s buying powerfulness and selling pressure.

A debased ESR indicates that stablecoin reserves importantly outweigh Bitcoin reserves, suggesting an abundance of liquidity acceptable to travel into BTC. This disparity has historically correlated with bull markets and rallies, arsenic stablecoins person ever been preferred for purchasing BTC connected exchanges.

Conversely, a precocious ESR suggests that BTC dominates reserves comparative to stablecoins, which usually means constricted buying powerfulness connected exchanges and a imaginable for important merchantability pressure.

While determination are galore antithetic indicators of bull markets, ESR is peculiarly invaluable arsenic it captures the readiness of superior to determination into Bitcoin. Unlike isolated terms metrics, the ratio reflects underlying liquidity trends and mirrors capitalist sentiment.

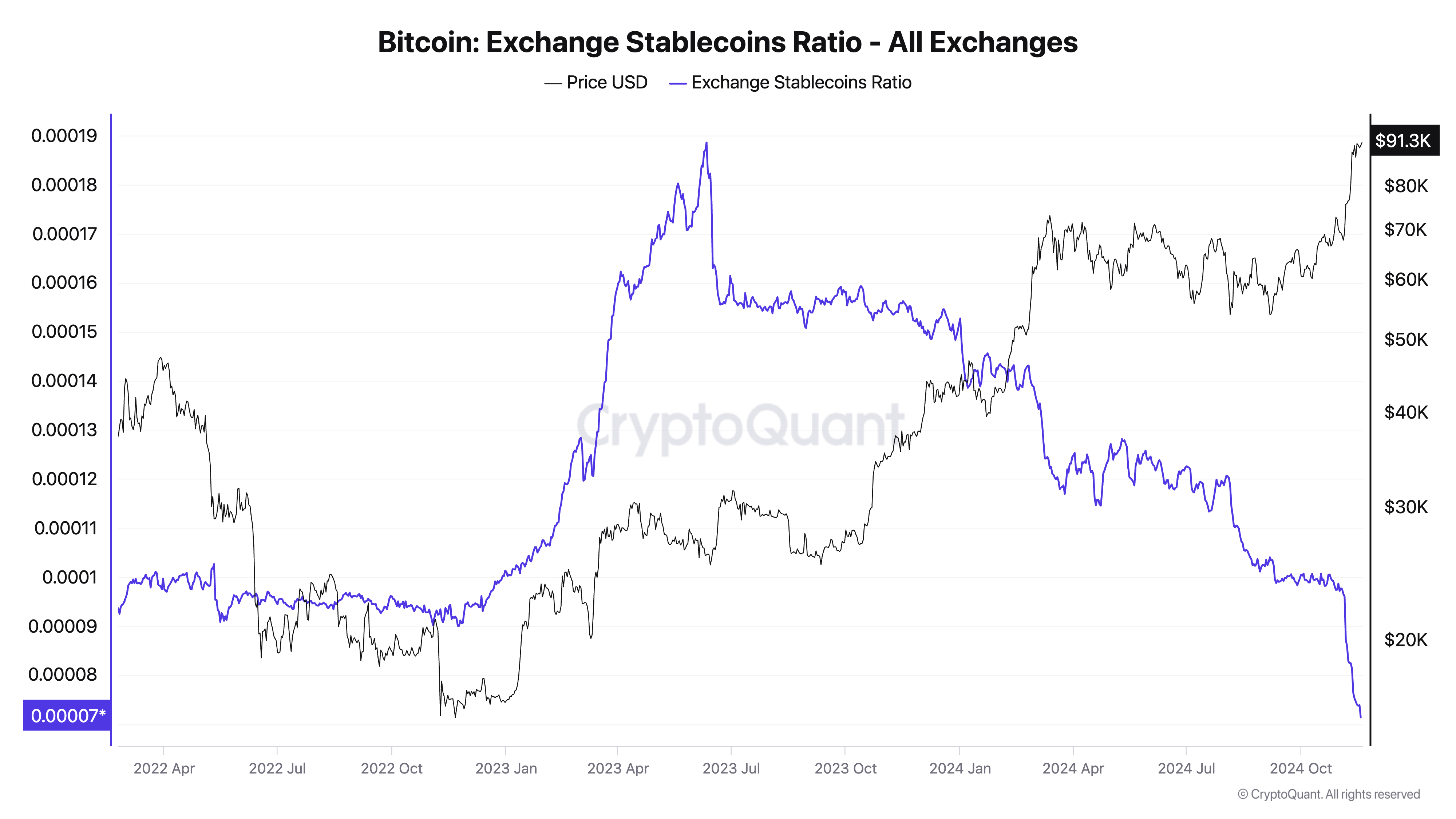

On Nov. 18, the ESR dropped to an all-time debased pursuing a declining inclination that intensified successful 2024. Since the opening of the year, the ESR decreased by conscionable implicit 95%, dropping from 0.0015276 connected Jan.1 to an all-time debased of 0.00007317 by Nov.18. During the aforesaid period, Bitcoin’s terms skyrocketed from $44,200 to $90,500, showing a wide inverse narration betwixt the ratio and price.

Graph showing the speech stablecoin ratio from Feb. 23, 2022, to Nov. 18, 2024 (Source: CryptoQuant)

Graph showing the speech stablecoin ratio from Feb. 23, 2022, to Nov. 18, 2024 (Source: CryptoQuant)The US statesmanlike predetermination connected Nov. 5 had a profound interaction connected the market, acting arsenic a catalyst for Bitcoin’s surge to its all-time precocious of $93,000. It triggered grounds trading volumes successful some spot and derivatives markets arsenic institutions and retail investors rushed to capitalize connected Bitcoin’s increasing communicative arsenic a hedge and store of value. These heightened trading activities drove Bitcoin’s terms higher portion stablecoin reserves accumulated, further compressing the ESR.

The all-time debased successful ESR paired with Bitcoin trading betwixt $90,000 and $92,000 shows a marketplace successful a unsocial position. A debased ESR during a play of terms maturation shows a robust request fueled by important superior reserves successful stablecoins.

Such an situation limits the downside hazard for Bitcoin, arsenic the abundance of stablecoins creates a benignant of liquidity cushion acceptable to sorb immoderate selling pressure. At the aforesaid time, the constricted BTC proviso connected exchanges exacerbates scarcity, pushing prices higher.

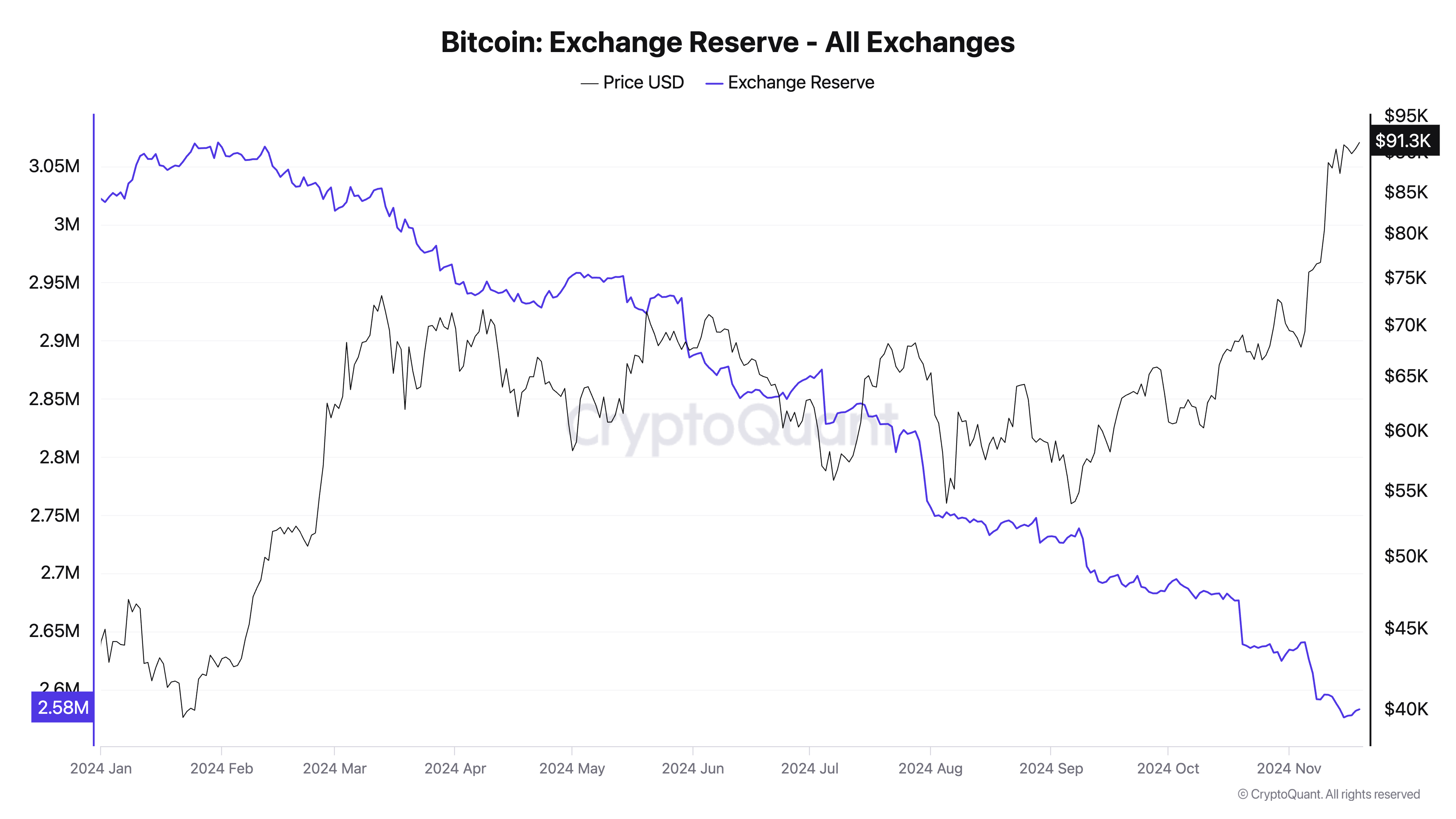

Graph showing the full magnitude of BTC held connected exchanges from Jan. 1 to Nov. 18 (Source: CryptoQuant)

Graph showing the full magnitude of BTC held connected exchanges from Jan. 1 to Nov. 18 (Source: CryptoQuant)Looking astatine the changes implicit the year, the sharpest driblet successful the ESR occurred close aft the US elections arsenic Bitcoin entered its astir assertive rally this year. This suggests that the marketplace was accumulating stablecoins during periods of terms consolidation earlier successful the twelvemonth and deployed them to acquisition BTC arsenic soon arsenic sentiment turned bullish.

The enactment we’ve seen betwixt stablecoin accumulation and rising prices shows that these reserves person a strategical quality — serving some arsenic a buffer and a maturation catalyst.

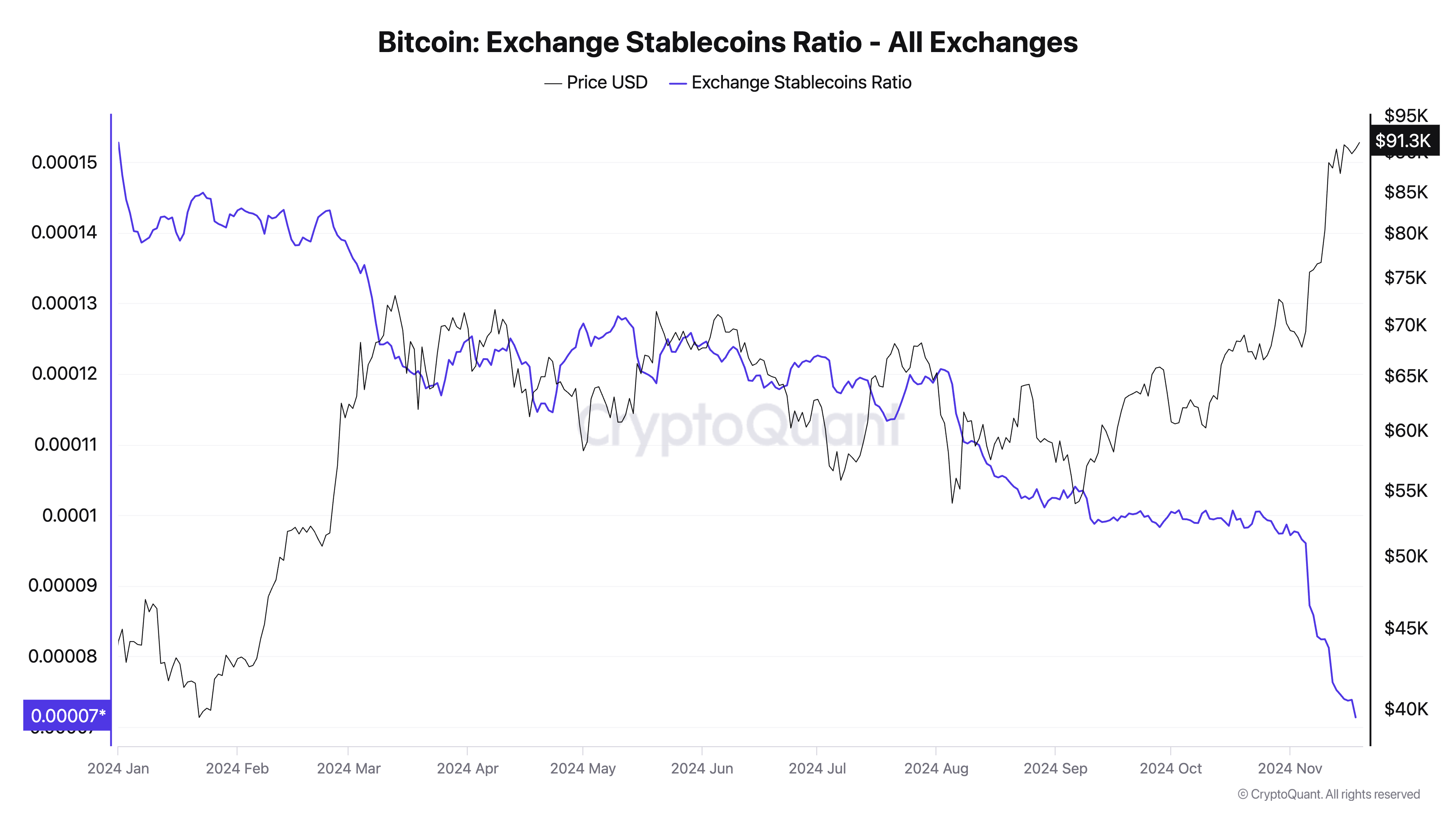

Graph showing the speech stablecoin ratio from Jan. 1 to Nov. 18 (Source: CryptoQuant)

Graph showing the speech stablecoin ratio from Jan. 1 to Nov. 18 (Source: CryptoQuant)The implications of this driblet successful ESR successful the coming weeks and months are significant.

If levels proceed to stay debased oregon driblet adjacent further portion Bitcoin’s terms climbs higher, it volition mean that the marketplace is heavy capitalized with adust powder. Under specified a scenario, we tin expect further unchangeable upward movement.

However, we could besides spot a overmuch much assertive deployment of stablecoins into BTC. While this would payment the marketplace successful the abbreviated word by driving the terms higher, it could besides permission exchanges with diminished stablecoin reserves — starring to higher volatility successful the future.

The station Exchange stablecoin ratio hits grounds low, fueling Bitcoin surge appeared archetypal connected CryptoSlate.

11 months ago

11 months ago

English (US)

English (US)