Bitcoin volition execute similar Nvidia and grounds respective large corrections connected its way to caller all-time highs, expert Jordi Visser said.

The way to caller Bitcoin (BTC) all-time highs volition proceed to diagnostic large corrections of 20% oregon more, including imaginable corrections during Q4, contempt it typically being a bully 4th for crypto plus prices, according to marketplace expert Jordi Visser.

Visser said Bitcoin is portion of the AI commercialized and compared BTC to Nvidia, a high-performance machine spot shaper that has go the world’s most invaluable publically traded company and the archetypal nationalist institution to deed a $4 trillion valuation. Visser said:

“I conscionable privation to punctual radical that Nvidia is up implicit 1,000% since ChatGPT’s launch. During that clip period, which is little than 3 years, you've had 5 corrections of 20% oregon much successful Nvidia earlier it went backmost up to all-time highs. Bitcoin's going to bash the aforesaid thing.”As artificial quality takes implicit much sectors of the system and replaces quality labor, it volition erode accepted companies and marque stocks obsolete, driving investors to BTC, which volition beryllium the champion store of worth successful the integer age, Visser predicted.

The terms of Bitcoin is 1 of the astir debated and analyzed topics successful crypto, arsenic marketplace analysts effort to forecast the integer currency’s terms trajectory amid a clip of accelerated technological innovation, marketplace disruption, and fiat currency debasement.

Related: Bitcoin’s ‘biggest bull catalyst’ whitethorn beryllium the adjacent Fed seat pick: Novogratz

Analysts grapple with slow-moving Bitcoin performance

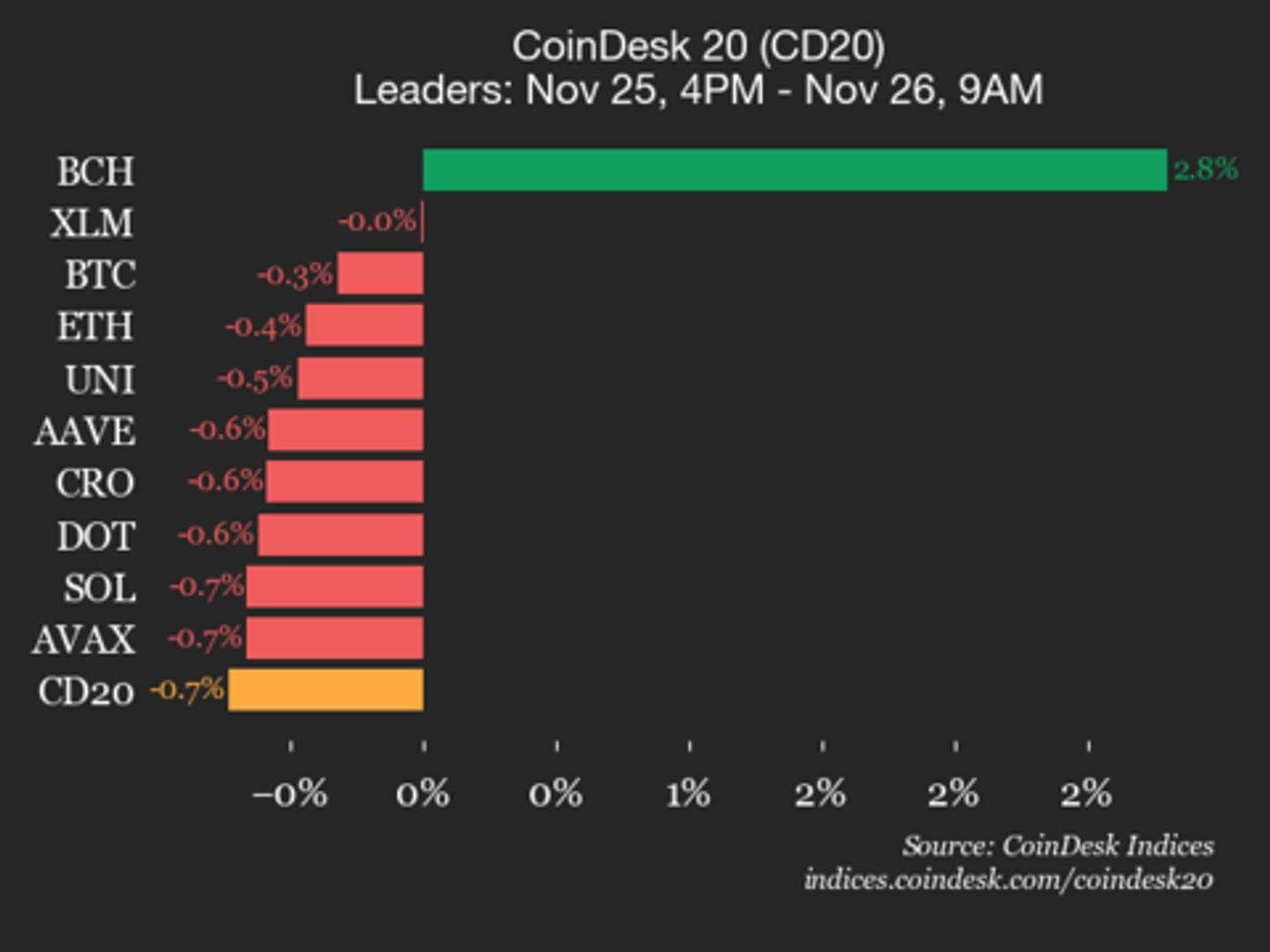

Market analysts are watching golden and stocks hit caller all-time highs portion Bitcoin’s terms remains adjacent the $110,000 level, down by astir 11% from its all-time precocious of implicit $123,000.

Investors are divided connected whether caller highs are imaginable successful Q4, catapulting BTC to astir $140,000, oregon if the caller drawdown represents the commencement of a prolonged carnivore marketplace that could instrumentality BTC’s terms down to $60,000.

Regulatory hurdles and the deficiency of advancement connected a Bitcoin strategical reserve successful the United States that grows done periodic marketplace purchases person dampened expectations for immoderate analysts.

Previously, immoderate analysts forecast that US authorities purchases of BTC for a nationalist Bitcoin reserve would beryllium a large terms catalyst for the integer plus successful 2025.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon

1 month ago

1 month ago

English (US)

English (US)