The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Word Of The Day: Volatility

Are you prepared for accrued volatility? It’s communal for markets to lone get much volatile arsenic we spell deeper into carnivore markets. As uncertainty, illiquidity and impatience grows, much marketplace participants commencement to anticipation for marketplace extremes: either that the marketplace has bottomed and a caller bull rhythm is 1 Federal Reserve pivot distant oregon that the bounds down, borderline telephone liquidation time volition hap imminently due to the fact that of a Credit Suisse collapse. Everyone hangs connected the borderline with each large marketplace determination to springiness them immoderate benignant of signal. Price ranges commencement to widen and immoderate (would-be) play oregon monthly moves are condensed into conscionable a azygous time of action.

Even arguably 1 of the champion investors of each time, Stanley Druckenmiller, finds contiguous to beryllium 1 of the hardest environments to fig out:

“I person been doing this for 45 years and betwixt the pandemic, the warfare and the brainsick argumentation effect successful the U.S. and worldwide, this is the hardest situation I person ever encountered to effort and person immoderate assurance successful a forecast six to 12 months ahead.”

For most, it’s champion to beryllium retired the enactment and person a ample risk-off position, acceptable to deploy aft markets person stabilized oregon calmed down.

We inactive clasp our aforesaid presumption that caller lows are apt to beryllium made and that we’ve yet to scope a last decision yet to the rhythm for equities, hazard assets and bitcoin.

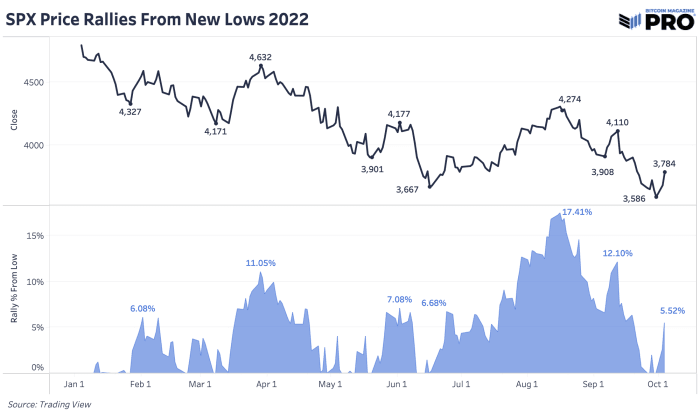

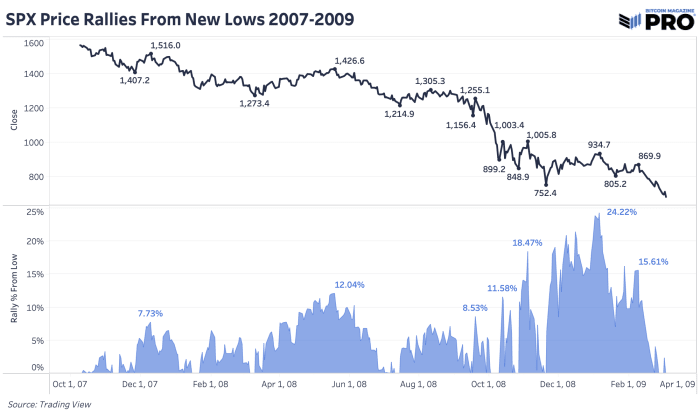

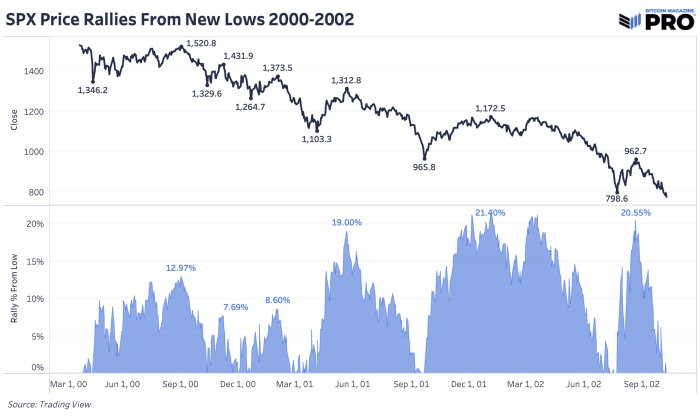

We volition punctual readers of the magnitude of carnivore marketplace rallies that we’ve seen truthful acold and the magnitude of these rallies successful 2000 and 2008 analogues. There are different cycles to survey and comparison but these are conscionable a fewer caller examples.

We’ve already seen a important 17.41% rally from lows for the SPX with bitcoin moving to $25,000. Yet, that didn’t alteration its adjacent reversion little and, what we think, is the medium-term downside trajectory playing retired still. Even successful the last-stage collapses of 2002 and 2009, the S&P 500 saw rallies implicit 20% earlier going lower. As the marketplace piles successful to overshort bloody conditions and doomsday quality connected higher leverage, retrieve that there’s nary escaped lunch.

Another absorbing constituent to enactment is that carnivore markets are typically short, lasting 10 months connected average. That 10-month benchmark would astir enactment america to wherever we are today. Yet, there’s a utile thought and thesis to beryllium made that the existent demolition we’ve seen truthful acold has been astir the readjustment to a unsocial and historical clip for rates, bonds and credit. We’ve hardly adjacent arrived astatine what is the classic and cyclical net carnivore market.

As bonds, currencies, and planetary equities each person continued trading with expanding levels of volatility, the caller humanities and implied volatility of bitcoin is eerily muted compared to humanities standards.

While the deficiency of caller volatility successful bitcoin could beryllium a motion that overmuch of the leverage and speculative mania of the bull marketplace has been astir wholly washed out, our eyes stay connected the outsized bequest markets for signs of fragility and volatility, which could service arsenic a short/intermediate-term headwind.

While the satellite astir bitcoin’s terms enactment looks to beryllium becoming progressively uncertain, the Bitcoin web remains wholly unaffected astatine the protocol level, continuing to bash its occupation arsenic a neutral monetary asset/settlement layer, contempt its speech complaint volatility.

Tick tock, adjacent block.

Relevant Past Articles

3 years ago

3 years ago

English (US)

English (US)