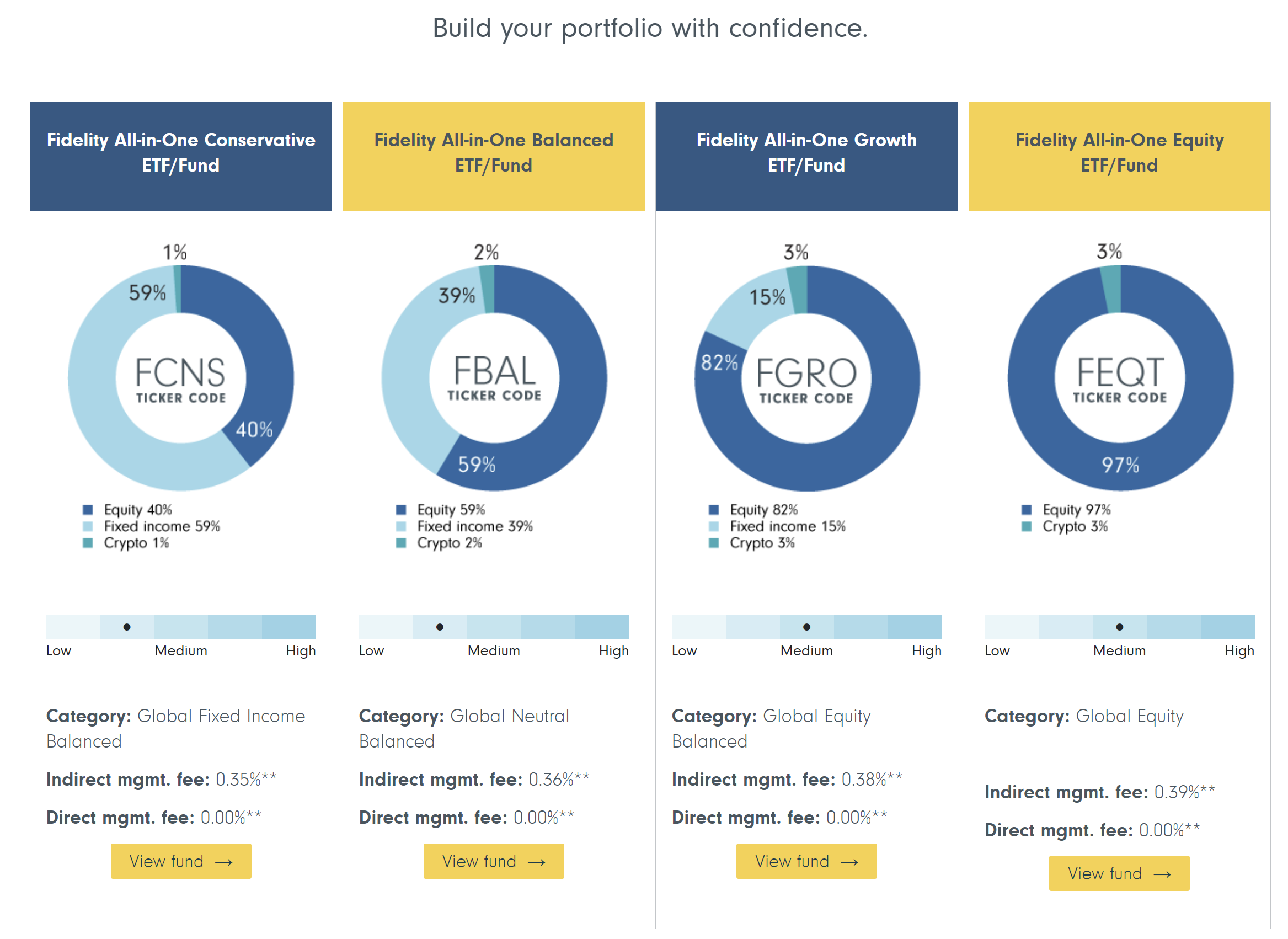

In a large displacement wrong the fiscal industry, Fidelity Investments, with its colossal $12.6 trillion successful assets nether administration, is present recommending that the accepted 60/40 portfolio exemplary should germinate to see a 1-3% allocation to crypto, specifically done its spot Bitcoin ETF (FBTC). This groundbreaking determination is not conscionable a motion to the burgeoning crypto marketplace but a imaginable catalyst for unprecedented demand, perchance channeling hundreds of billions of dollars into Bitcoin.

Fidelity recommends crypto allocation successful a 60/40 portfolio | Source: Fidelity

Fidelity recommends crypto allocation successful a 60/40 portfolio | Source: FidelityMatt Ballensweig, Head of Go Network astatine BitGo, took to X (formerly Twitter) to explicit his anticipation, stating, “I’ve said this since the time of ETF support – present that Pandora’s container has been opened, the multi-trillion dollar plus managers volition merchantability BTC and crypto done their monolithic organisation channels for us. Fidelity present creates blueprint portfolios with 1-3% crypto.”

Echoing this sentiment, Will Clemente III, a renowned analyst, remarked connected the imaginable ripple effects of Fidelity’s recommendation. “Fidelity present recommending a 1-3% crypto allocation successful your portfolio. Gateway drug. What happens erstwhile that 1-3% becomes 3-6%? Slowly past suddenly,” Clemente noted, highlighting the imaginable for maturation successful crypto allocation.

What This Could Mean For Bitcoin Price

Adam Cochran, a spouse astatine CEHV, further elaborated connected the implications of Fidelity’s determination for Bitcoin’s adoption and price trajectory. In a elaborate investigation shared connected X, Cochran laid retired an ambitious aboriginal wherever the inclusion of crypto successful accepted portfolios could pb to a important reevaluation of Bitcoin’s value. “How fucking chaotic is this to see. 60/40 portfolios are present 59/39/2,” Cochran began, underlining the historical milestone of crypto becoming a halfway plus class.

Cochran compares the adoption rates of the net to cryptocurrency, stating, “Hell, the net was 30 years successful the making and didn’t scope 10m users till 1995. But the astir non-conservative estimates enactment crypto ownership astatine 450M worldwide (conservative is much similar 200M) that’s similar the net successful 2001.”

He highlights the outsized economical interaction of integer advancements, “Today the net has determination astir 5.5B users – 12x what it did successful 2001. But according to BEA, the interaction of the integer system has been exponentially outsized with each twelvemonth of growth.” By drafting this parallel, Cochran sets the signifier for a crypto marketplace that could spot exponential maturation successful worth and influence.

Cochran’s attack to calculating Bitcoin’s aboriginal valuation involves analyzing the imaginable influx of funds from accepted investments. “If that follows the alteration to 59/39/2, you’re looking astatine $1.6T successful caller buying… Given the existent marketplace is $2.24 trillion full marketcap… we get a currency to worth complaint of 9.3%.”

The halfway of Cochran’s investigation lies successful his valuation prediction, wherever helium states, “Prorata betwixt coins astatine their existent ratios and that’s $748,500 BTC and $43,635 ETH successful earthy spot buying. But since we cognize notional causes things to run, and we’ve got things similar ETH’s output request and burn, we’re usually respective multiples supra the terms of our earthy spot demand.”

Cochran’s decision reflects a beardown content successful the transformative imaginable of cryptocurrencies wrong accepted concern portfolios. “At the extremity of the day, adjacent gold hasn’t breached into the 60/40 portfolio successful a meaningful way, truthful I deliberation blowing past the $12T mcap of golden by a bully aggregate implicit clip is simply a no-brainer.”

At property time, BTC traded astatine $57,175.

BTC terms needs to interruption the last absorption (0.786 Fib), 1-week illustration | Source: BTCUSD connected TradingView.com

BTC terms needs to interruption the last absorption (0.786 Fib), 1-week illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)