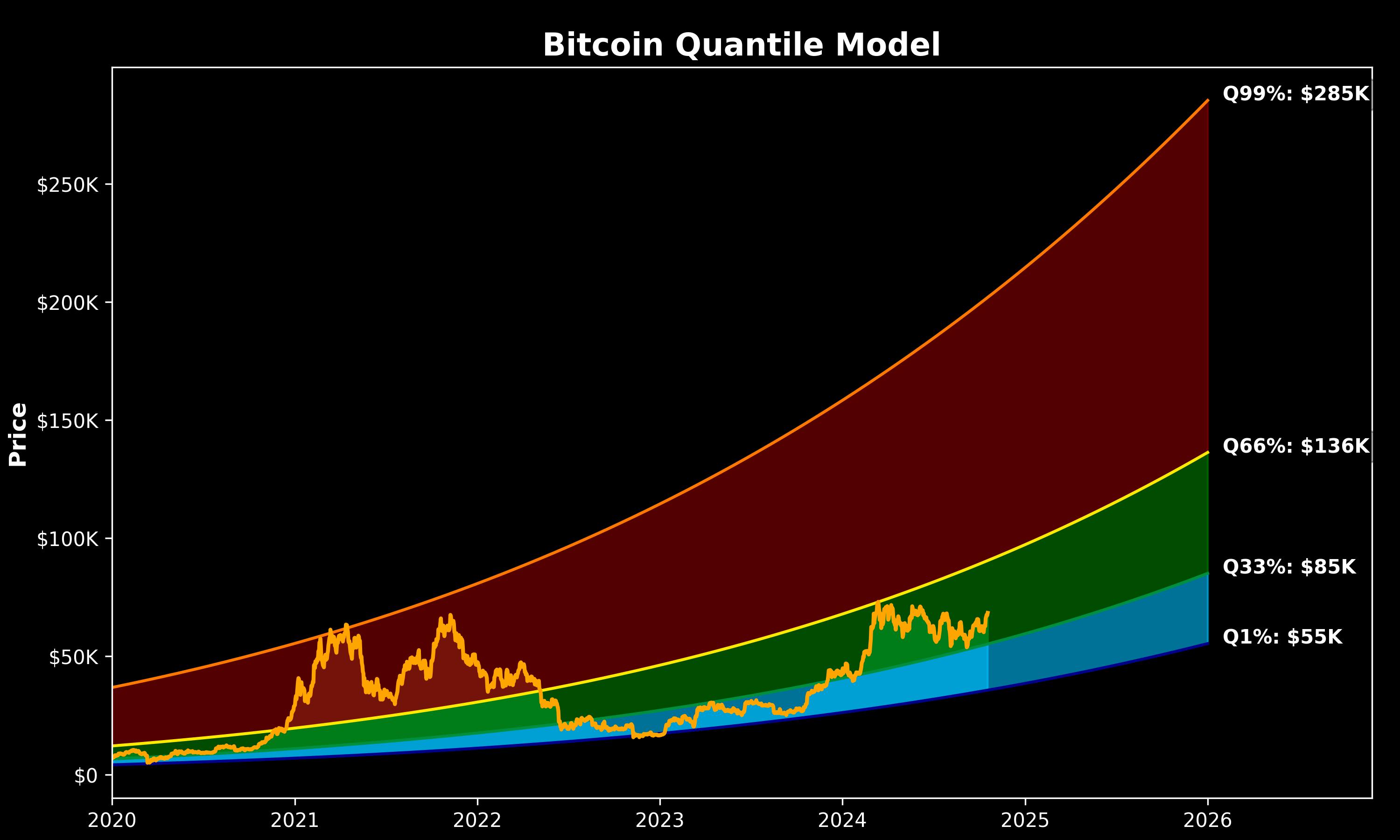

Sina—a professor, consultant, and co-founder & COO of 21stCapital.com—is projecting that the Bitcoin terms could emergence arsenic precocious arsenic $285,000 by the extremity of 2025 successful a caller investigation shared connected X. Utilizing a quantile regression model, Sina identifies chiseled phases successful Bitcoin’s marketplace cycle.

Can Bitcoin Price Skyrocket Above $200,000?

The model identifies the Cold Zone (<33%) arsenic the terms scope betwixt $55,000 and $85,000. This portion represents the lowest imaginable scope by the extremity of 2025 and suggests a play perfect to “aggressively accumulate.”

The Warm Zone (33-66%), spanning from $85,000 to $136,000, marks a play wherever the marketplace gains momentum, and mainstream attraction intensifies. During this phase, accelerated terms maturation is expected arsenic the “train leaves the station.” Sina recommends a modular accumulation strategy here, specified arsenic dollar-cost averaging (DCA), to steadily summation holdings.

The astir captious phase, the Hot Zone (>66%), ranges from $136,000 to $285,000. This portion is characterized by heightened volatility and important terms swings arsenic wide adoption peaks and leveraged positions go prevalent.

Bitcoin Quantile Model | Source: X @Sina_21st

Bitcoin Quantile Model | Source: X @Sina_21stWhile determination is important country for upside, the hazard of reversals escalates rapidly. Sina advises investors to either clasp and bask imaginable gains oregon see gradually exiting positions based connected hazard assessments, peculiarly since historical tops hap successful the 90th to 99th quantile range. Notably, the 90th quantile starts astatine $211,000.

What astonishes Sina is however these 33% quantile ranges align seamlessly with Bitcoin’s humanities signifier transitions. He notes that Bitcoin tends to walk precisely one-third of its clip successful each portion earlier transitioning to the next, astir similar clockwork. This signifier means that astir of the carnivore marketplace occurs beneath the 33% quantile, portion bull marketplace euphoria begins supra the 66% quantile.

Renowned crypto expert PlanC (@TheRealPlanC) acknowledged Sina’s model, commenting that it is simply a “perfect explanation—super clear.” Sina, successful turn, credited PlanC for the foundational enactment that influenced his ain model.

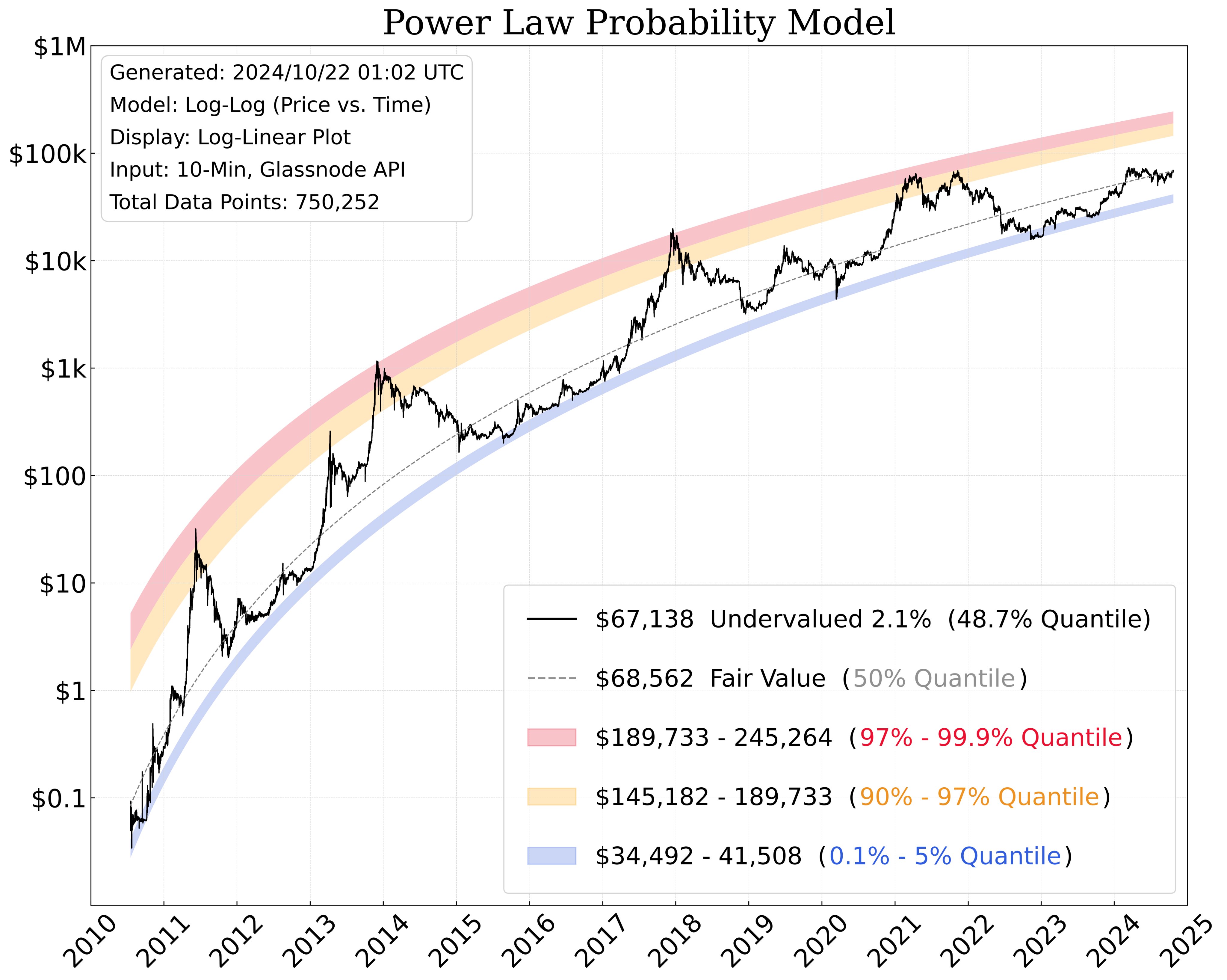

PlanC has besides precocious updated his “Power Law Probability Model,” which forecasts Bitcoin prices ranging from $189,733 to $245,264 for the 97% to 99.9% quantile and $145,182 to $189,733 for the 90% to 97% quantile. He emphasizes that contempt appearances, the underlying information follows a power-law relationship, autarkic of however it’s plotted—be it linear, log-linear, oregon log-log scales.

Power Law Probability Model | Source: X @TheRealPlanC

Power Law Probability Model | Source: X @TheRealPlanC“The information follows a log-log narration with quantile regressions, whereas the rainbow illustration uses logarithmic regression with a log-linear relationship. […] I americium not ‘drawing’ these lines. These are quantile regressions of the log of terms vs. time, based connected each the information we person to date,” helium explains.

To contextualize the model’s predictive capabilities, PlanC elaborates connected the value of assorted quantiles. The 99.9% quantile means the terms has been supra this enactment lone 0.1% of the time, equating to conscionable 1 time retired of each 1,000 days—a precise uncommon event. The 99% quantile indicates the terms has exceeded this enactment 1% of the time, oregon 1 time retired of each 100 days, besides considered rare. Conversely, the 0.1% quantile reflects that the terms has fallen beneath this enactment lone 0.1% of the time.

At property time, BTC traded astatine $67,121.

BTC terms hovers supra $67,000, 1-day illustration | Source: BTCUSDT connected TradingView.com

BTC terms hovers supra $67,000, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

![Why Crypto Market Is Crshing Today [Dec 16, 2025] | Live Updates](https://image.coinpedia.org/wp-content/uploads/2025/11/21175056/Crypto-Market-Crash-Shows-Signs-of-More-Declines-Ahead-1024x536.webp)

English (US)

English (US)