Tuur Demeester, a Bitcoin OG and researcher for Adamant Research shared his bullish outlook for Bitcoin via X (formerly Twitter), anticipating its terms could escalate to betwixt $200,000 and $600,000 by 2026. Demeester’s prediction is predicated connected the influx of trillions of dollars done planetary bailouts and stimulus measures, which helium believes volition importantly propel Bitcoin’s valuation.

He remarked via X (formerly Twitter), “In ’21 bitcoin topped astatine $69k. I’m targeting $200-$600k by 2026. Fueled by $ trillions successful planetary bailouts/stimulus,” indicating a beardown condemnation successful the cryptocurrency’s aboriginal amidst expansive monetary policies.

In '21 bitcoin topped astatine $69k. I'm targeting $200-$600k by 2026. Fueled by $ trillions successful planetary bailouts/stimulus. https://t.co/ULslIMgzee

— Tuur Demeester (@TuurDemeester) February 12, 2024

In effect to the question of whether the Bitcoin terms volition highest successful 2025 oregon 2026, Demeester added: “It’s hard to say. We mightiness get a bull rhythm successful 2 parts, similar successful 2013 – that could gully it retired longer.”

Demeester’s way grounds lends value to his forecasts. Notably, successful September 2019, helium accurately anticipated the erstwhile bull run’s momentum, suggesting Bitcoin could scope $50,000 to $100,000. The world surpassed expectations arsenic Bitcoin peaked supra $69,000 successful November 2021, validating his prediction range’s precocious end.

Why The Bitcoin Rally Is Far From Over

Adding extent to his latest prediction, Demeester pointed to Google trends data, which often serves arsenic a barometer for retail capitalist involvement successful Bitcoin. Despite Bitcoin hitting $50,000 yesterday, Yassine Elmandjra, a researcher astatine Ark Invest, highlighted that Google hunt volumes comparative to Bitcoin’s terms are astatine all-time lows, suggesting a deficiency of wide retail frenzy astatine this stage.

Bitcoin deed $50k.

Meanwhile, Google hunt volumes comparative to terms are astatine each clip lows.

This is simply a caller era. pic.twitter.com/8DnsadIclt

— Yassine Elmandjra (@yassineARK) February 12, 2024

This reflection led Demeester to suggest, “I expect for retail to commencement waking up soon. Remember, determination is nary fever similar Bitcoin fever,” indicating his anticipation of a surge successful retail engagement erstwhile Bitcoin’s terms momentum gathers pace.

Demeester besides shared sage proposal for investors, cautioning against the perils of indebtedness and overexposure fixed Bitcoin’s notorious volatility. He emphasized the intelligence resilience required to ‘HODL’ done marketplace turbulence, stating, “The HODL attitude requires intelligence & affectional work. The unprepared capitalist cannot beryllium tight, lone the 1 who has worked to ideate the marketplace relentlessly punching him successful the face.”

Addressing inquiries astir the aboriginal trajectory of Bitcoin, Demeester expressed uncertainty regarding the continuation of the four-year rhythm pattern, suggesting that marketplace dynamics are excessively analyzable for specified predictable cycles to persist indefinitely. “I don’t cognize if the four-year rhythm volition hold. That sounds excessively bully to beryllium existent tbh. All patterns look to yet break,” helium commented, highlighting the unpredictable quality of markets.

On the taxable of the anticipated economical bailouts, Demeester clarified his stance, pointing to the unsustainable fiscal practices of banks and governments arsenic a catalyst for monetary expansion.

“Of banks and governments. For example, the US authorities contiguous is already spending much connected involvement payments than connected their military. Only mode to support going is to people an water of money,” helium explained, providing a grim outlook connected the fiscal stableness of cardinal institutions and the imaginable for BTC to payment from these conditions.

Money Printing = Numbers Go Up

To recognize Demeester’s claims, it’s indispensable to recognize the broader economical dynamics astatine play. Economic stimulus packages and bailouts, peculiarly successful effect to crises, inject liquidity into fiscal markets, perchance devaluing fiat currencies done inflation.

Hard assets similar Bitcoin, with their capped supply, basal successful opposition to imaginable inflationary pressures, offering a hedge against currency devaluation. This dynamic, coupled with expanding organization adoption by spot ETFs and the increasing designation of Bitcoin arsenic a ‘digital gold,’ could nonstop BTC’s worth to unprecedented heights, aligning with Demeester’s projections.

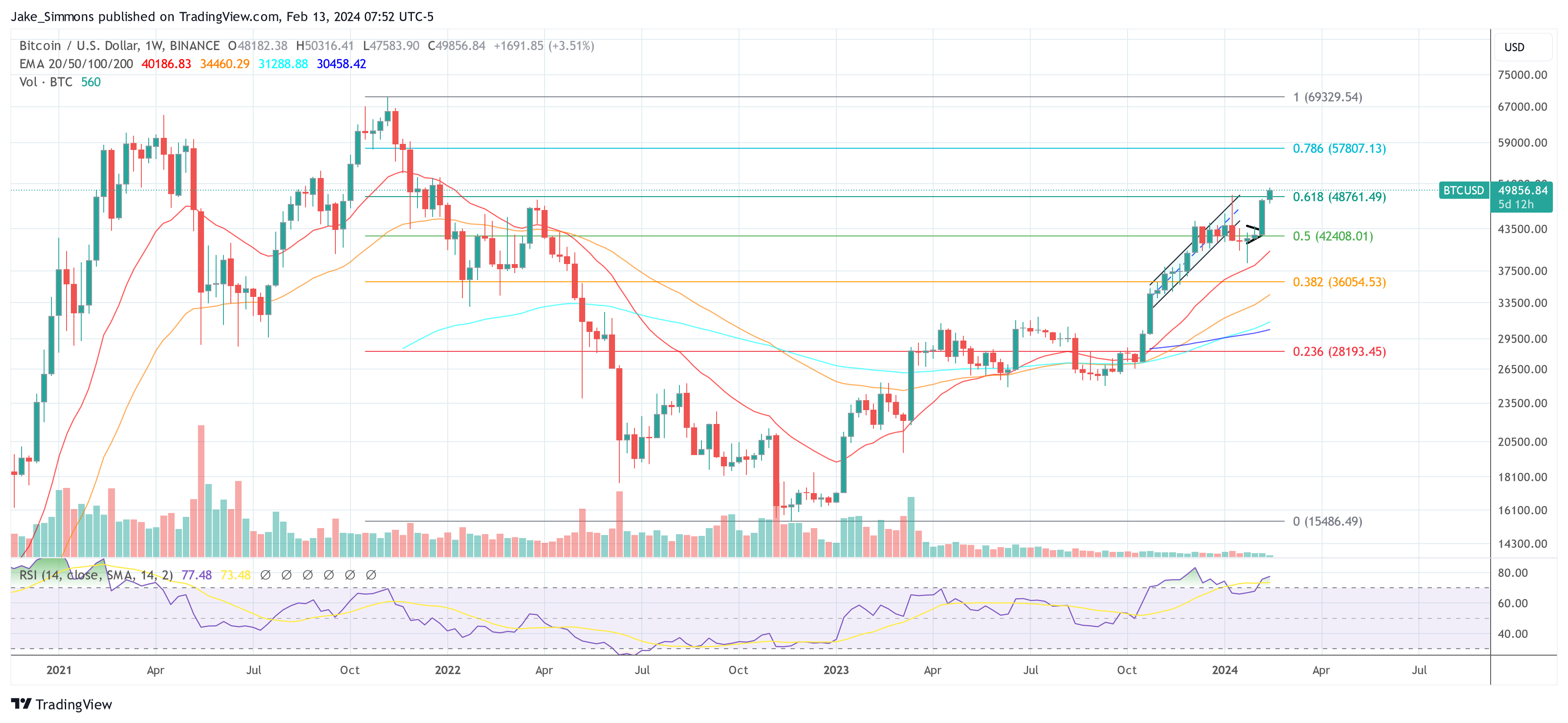

At property time, BTC traded astatine $49,856.

BTC price, 1-week illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-week illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)