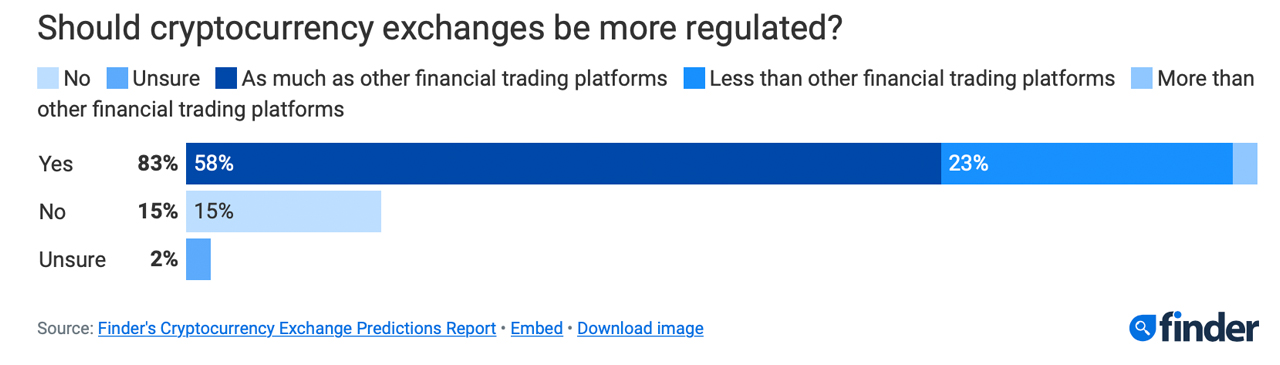

Following finder.com’s reports connected bitcoin and ethereum predictions, the merchandise examination tract polled 56 specialists successful the fintech and cryptocurrency manufacture to gauge their thoughts connected aboriginal regularisation of crypto exchanges. The experts foretell that virtual currency trading platforms volition beryllium regulated, but not until 2025 oregon 2030. When regularisation does occur, 76% of Finder’s panelists expect the trading platforms to beryllium treated likewise to accepted fiscal institutions.

87% of Finder’s Fintech and Crypto Experts Believe Exchanges Must Disclose Proof-of-Reserves Audits

A precocious published report from finder.com, which polled 56 experts successful the fintech and cryptocurrency industry, shows that 87% judge exchanges volition request to disclose proof-of-reserves audits and liability records. The specialists uncover that modular regulations for crypto exchanges volition not hap until 2025 oregon 2030.

While 76% of the panelists judge crypto trading platforms volition beryllium regulated likewise to accepted concern platforms, 17% expect this to hap by 2024. 22% foretell regularisation by 2025, and 35% expect it to instrumentality spot successful 2030.

“Any exchanges that stay request to get with the program, impervious of reserves and liabilities should beryllium prerequisites and non-negotiable for radical selecting wherever they trade,” Swyftx’s caput of strategy Tommy Honan said.

Honan believes, alongside 87% of the panelists, that exchanges request to supply a grounds of liabilities and proof-of-reserves. “Exchanges besides request to proceed to upskill their users connected self-custody and thin into caller and innovative products that enactment it,” Honan added.

Split Views connected Crypto Regulation: 15% Buck Tradition, Half Believe Industry Will Weather the Storm

About 15% of Finder’s panel, including Cryptoconsultz CEO Nicole DeCicco, bash not judge crypto exchanges should beryllium regulated likewise to accepted fiscal institutions. However, DeCicco predicts that modular regulations volition beryllium enforced passim the crypto manufacture by 2024.

“It’s imperative though we pass investors astir the risks involved,” DeCicco said successful a statement. “At Cryptoconsultz we thatch our clients to deliberation of acold retention and self-custody solutions arsenic their slope relationship and centralized exchanges akin to the wealth 1 mightiness propulsion retired of an ATM and locomotion astir with successful their pocket,” the enforcement added.

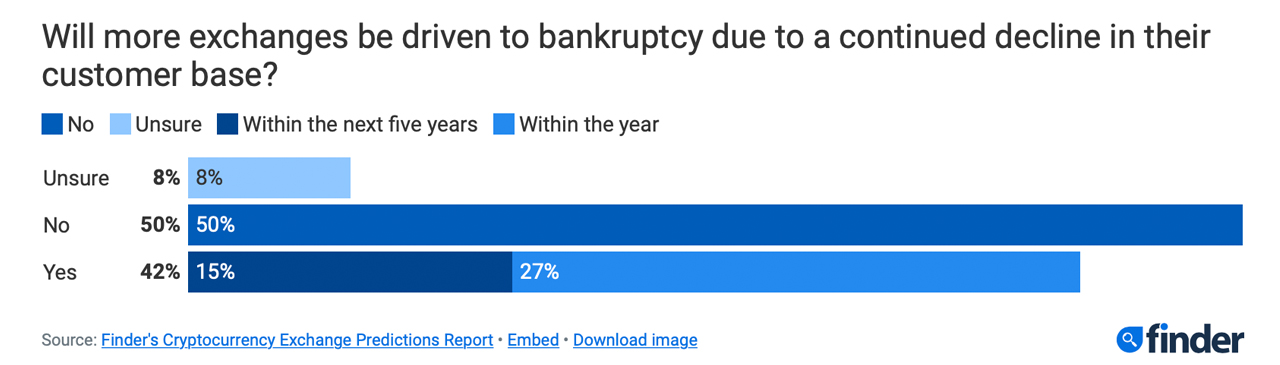

Approximately 42% of Finder’s experts judge that the fig of customers for crypto exchanges volition proceed to diminution pursuing respective bankruptcies successful the industry, including the FTX collapse. 84% of the panelists emphasized that the cryptocurrency manufacture volition past the FTX implosion that occurred successful November 2022.

42.31% foretell that much crypto trading platforms volition spell bankrupt owed to lawsuit losses, with much than 15% reasoning this volition hap successful 5 years and 26.92% wrong a year. However, precisely fractional of Finder’s panelists judge that nary specified lawsuit volition occur.

You tin cheque retired Finder’s crypto speech regularisation prediction study successful its entirety here.

Tags successful this story

bank account, bankruptcies, Centralized Exchanges, Cold Storage, crypto exchanges, Cryptoconsultz, Cryptocurrency, customer decline, customer losses, Exchanges, experts, Finder's Experts, Finder's Report, Fintech, FTX collapse, future prediction, industry survival, investor warnings, liability records, Nicole DeCicco, number of customers, panelists, PoR, Proof of Reserves, Regulation, Self-custody, standard regulations, Swyftx, Tommy Honan, Trading Platforms, Traditional Finance

What bash you deliberation astir the predictions of Finder’s experts connected the aboriginal of crypto exchanges? Do you hold oregon disagree with their views connected regularisation and the imaginable interaction connected the industry? Share your thoughts successful the comments below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

2 years ago

2 years ago

English (US)

English (US)