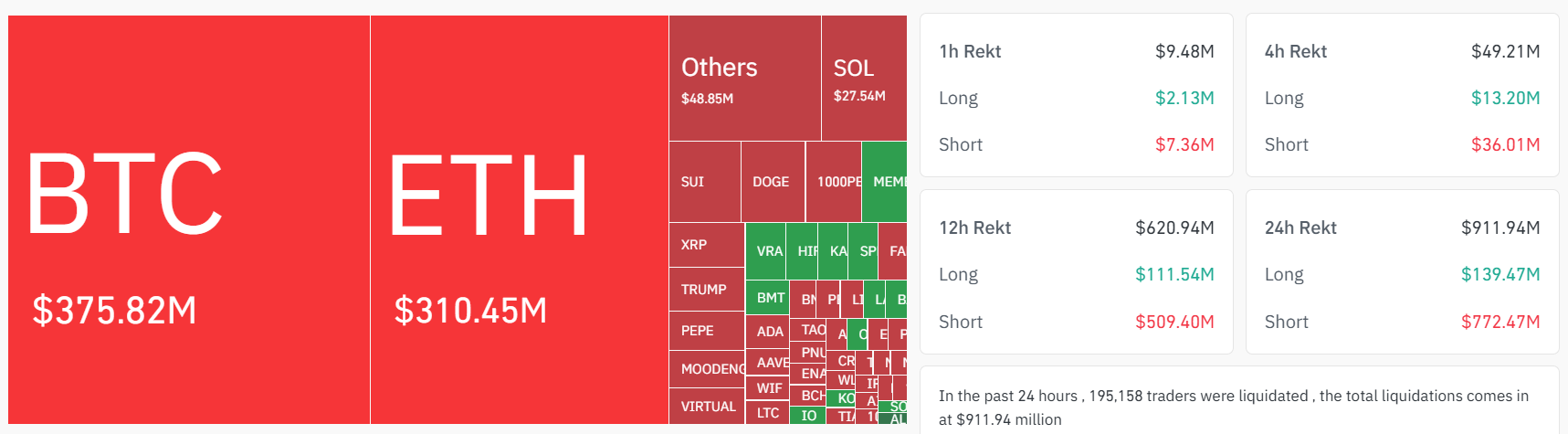

A wide crypto rally led by ether’s (ETH) 20% surge triggered much than $750 cardinal successful abbreviated liquidations successful the past 24 hours, the highest single-day full since 2023 for bearish trades.

Data from CoinGlass shows that implicit 84% of the full liquidations came from shorts, with large altcoins jumping 10%–20% successful the span of a fewer hours starting precocious Thursday.

Ether led the complaint with a 20% rise, pushing past $2,000 for the archetypal clip since aboriginal March. DOGE and Cardano’s ADA zoomed much than 10%, fueled by bullish sentiment and momentum trading, with Solana’s SOL, BNB and xrp (XRP) up astatine slightest 7%.

Liquidations hap erstwhile an speech forcibly closes a trader’s leveraged presumption owed to insufficient margin. It happens erstwhile a trader cannot conscionable the borderline requirements for a leveraged position, that is, erstwhile they don't person capable funds to support the commercialized open.

Large-scale liquidations tin bespeak marketplace extremes, similar panic selling oregon buying. A cascade of liquidations mightiness suggest a marketplace turning point, wherever a terms reversal could beryllium imminent owed to an overreaction successful marketplace sentiment.

As such, the uptick successful crypto markets came arsenic bitcoin surged supra $100,000 connected Thursday, with sentiment buoyed connected a commercialized woody betwixt the U.S. and the UK.

The precocious Thursday wipeout ranks among the astir terrible since Bitcoin’s tally to $93,000 successful March, which saw bears suffer implicit $550 cardinal successful a play squeeze.

In April, a akin rally successful ETH and DOGE erased $500 cardinal successful shorts — but this determination surpassed both, showing renewed hazard appetite and a crowded abbreviated commercialized setup.

Coinglass information shows that the largest stock of losses came from Binance and OKX, which accounted for much than $500 cardinal successful liquidations. ETH unsocial was liable for implicit $310 million, portion bitcoin-tracked futures led astatine $375 million.

The abbreviated compression connected ETH came arsenic the plus had been rangebound for a fewer weeks amid falling organization involvement and retail sentiment. But Ethereum’s recent Pectra upgrade whitethorn beryllium giving traders a crushed to stake connected the asset, immoderate say.

5 months ago

5 months ago

English (US)

English (US)