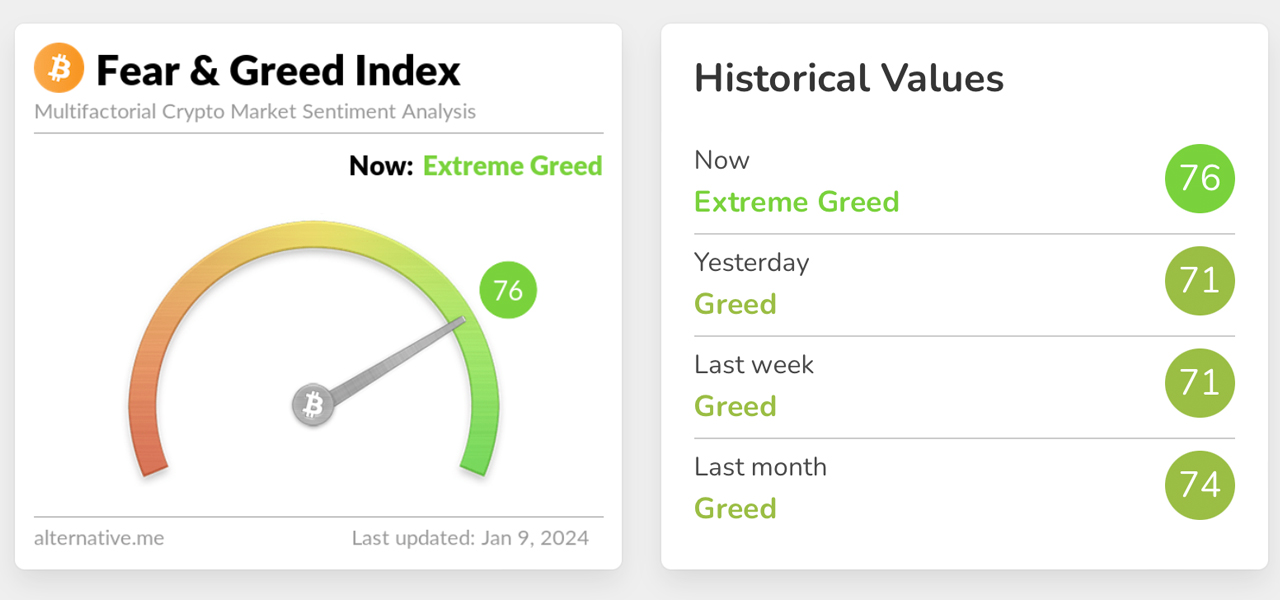

Hovering conscionable beneath the $47K mark, bitcoin’s terms emergence has coincided with the Crypto Fear and Greed Index (CFGI) reaching a notable 76 connected Jan. 9, 2024. This signals a signifier of “extreme greed,” a sentiment strength not witnessed since the cryptocurrency’s erstwhile bull tally successful November 2021.

Soaring Bitcoin Drives Greed Index to New Highs

On Jan. 9, 2024, the CFGI, disposable connected alternative.me, soared to its highest level of 76 retired of 100 since its past highest successful November 2021. The scale functions connected the premise that utmost fearfulness tin origin bitcoin (BTC) to commercialized importantly beneath its just value, whereas utmost greed mightiness pb to an overvalued state. The CFGI assesses assorted elements, including volatility, marketplace momentum and volume, societal media sentiments, dominance, and trends.

This instrumentality mirrors the banal market’s Volatility Index oregon Fear Index, commonly known arsenic the VIX. The VIX, overseen by the Chicago Board Options Exchange (Cboe), gauges the banal market’s expected volatility done S&P 500 scale options. The alternative.me Crypto Fear and Greed Index has shown a persistent “greed” sentiment since precocious October 2023.

On Tuesday, the CFGI metric escalated and flashed to “extreme greed,” climbing to 76 from the erstwhile day’s 71, which indicated specified “greed.” In comparison, coinmarketcap.com (CMC) besides presents a Crypto Fear and Greed Index, albeit with a flimsy variance, marking a 74 retired of 100 connected Tuesday day (2 p.m. ET), inactive wrong the “greed” category. While these fearfulness indexes are insightful tools, they are champion utilized alongside different analytical methods and assorted factors.

Many analysts reason that specified indexes are instrumental successful gauging marketplace sentiment by compiling divers indicators, leveraging the ‘wisdom of the crowd.’ Research suggests that this corporate attack yields a much nuanced and holistic position of marketplace emotions, perchance guiding investors toward much informed choices. Yet, it’s important to enactment that dependence connected these indexes is not without its pitfalls. The volatile quality of the crypto marketplace tin beryllium swayed by short-term events, which may not accurately bespeak the crypto market’s halfway fundamentals.

What bash you deliberation astir the latest CFGI metric for bitcoin? Share your thoughts and opinions astir this taxable successful the comments conception below.

2 years ago

2 years ago

![Top Bitcoin & Crypto Wallets [2026]: Privacy, Security & Usability Combined](https://static.news.bitcoin.com/wp-content/uploads/2026/01/best-bitcoin-crypto-wallets-february-2026-768x432.png)

English (US)

English (US)