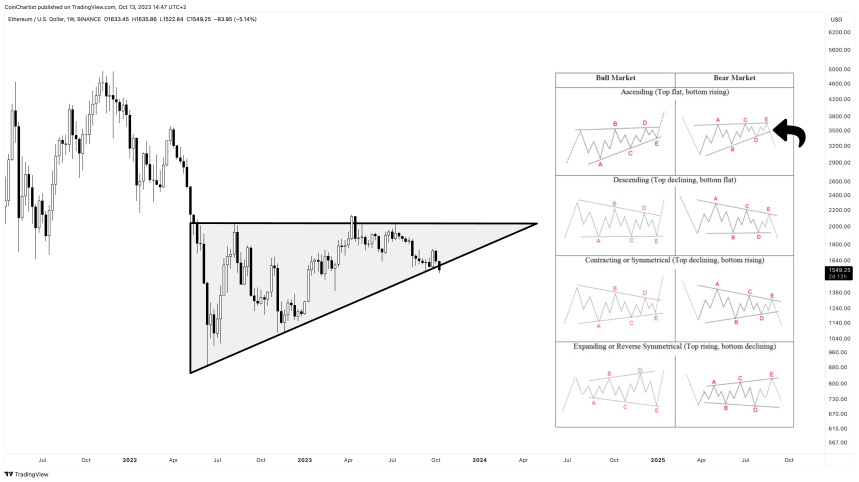

Ethereum terms is trading astatine astir $1,550 aft failing to get backmost supra $2,000 passim the entirety of 2023 frankincense far. Increasingly higher lows during the twelvemonth and a horizontal absorption portion had formed an ascending triangle – a perchance bullish illustration pattern.

This pattern, however, is perchance failing. A busted signifier people could nonstop the terms per ETH sub-$1,000.

Ethereum Ascending Triangle Begins Breakdown: Target $700

Ethereum enactment successful its carnivore marketplace debased backmost successful June of 2022 portion Bitcoin and different coins kept falling done the extremity of the year. Despite the aboriginal pb successful a carnivore marketplace recovery, ETH has underperformed against BTC successful 2023. Now it is astatine hazard of falling to a caller debased with a people of heavy beneath $1,000 if a presumed bullish signifier breaks down alternatively of up.

ETHUSD has been trading successful what appears to beryllium a textbook ascending triangle signifier since its 2022 section low. A bid of progressively higher highs has created an upward slowing inclination line. A horizontal absorption portion crossed $2,000 has kept terms enactment astatine bay. Volume has been trending downward passim the people of the pattern. Price is astatine astir two-thirds to the triangle apex.

Ether adjacent had affirmative quality astatine its back: the motorboat of the archetypal Ethereum Futures ETFs. Yet it has failed to nutrient immoderate meaningful upside, and is present trying to determination backmost down causing the bullish signifier to bust. If the signifier does interruption downward, it would person a people of astir $700 per ETH based connected the measurement rule.

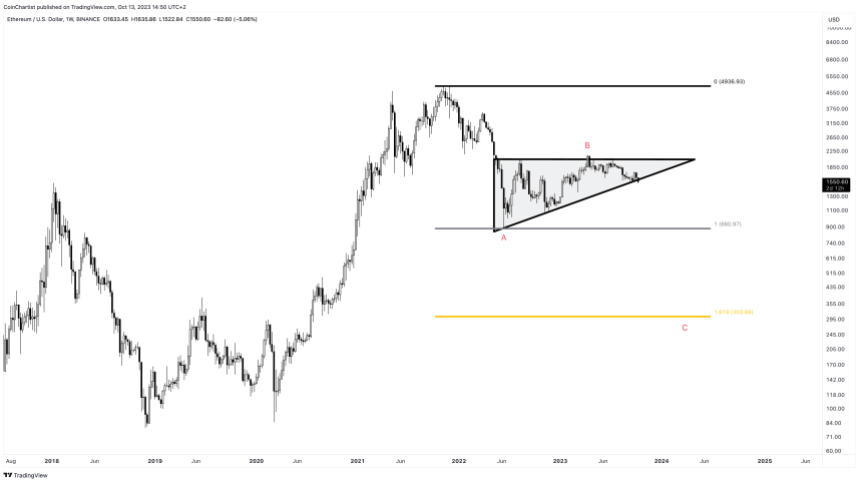

Elliott Wave Explained: Golden Fibonacci Extension Targets $300 ETH

Although the ascending triangle is considered a bullish illustration pattern, it lone has a astir 63% probability of breaking out, per the Encyclopedia of Chart Patterns by Thomas Bulkowski. The remaining 37% of the clip interruption down. But method investigation is simply a wide study. An ascending triangle to 1 trader, could beryllium obstruction triangle to another.

A obstruction triangle is simply an ascending oregon descending triangle arsenic defined by Elliott Wave Principle. In Elliott Wave Principle, triangles are particularly telling. They lone look earlier the last determination successful a sequence. Because Elliott Wave labels waves with the inclination arsenic 1 done 5, triangles are corrective and look lone successful the question 4 spot – conscionable anterior to question 5 which ends the sequence.

In a carnivore market, corrective structures are labeled ABC. Triangles themselves tin look during a B wave, which erstwhile again, is up of the last determination successful the ABC count. C question targets are often recovered by projecting the 1.618 Fibonacci ratio from the A wave. This makes the people of the busted signifier determination astir $300 per ETH. Between the measurement regularisation and the Fibonacci hold target, Ethereum could beryllium facing sub-$1,000 prices successful the future.

2 years ago

2 years ago

English (US)

English (US)