This is an sentiment editorial by Captain Sidd, a concern writer and explorer of Bitcoin culture.

If you haven’t heard, 1 of the largest crypto exchanges, FTX, was the latest successful a fig of dominos to autumn successful the crypto “industry.”

The laminitis of that exchange, Sam Bankman-Fried, had evolved into a media darling implicit the past 2 years — gracing the screen of Fortune magazine and earning interviews with the likes of CNBC and Bloomberg. SBF, arsenic he’s often referred to, studied physics astatine MIT and spent clip astatine the renowned arbitrage trading steadfast Jane Street. He styled himself arsenic the nerdy gigabrain, with a messy mop of hairsbreadth and a penchant for sleeping successful the office portion gathering a fiscal empire conscionable truthful helium could donate it each to charity.

With the illness of FTX and the closely-associated Alameda Research fund, the pessimistic presumption of SBF paints him arsenic a scammer. He precise good could person tricked investors and millions of retail clients by eschewing the classic, slick crypto con-man with his nerdy veneer and boyish face. Another mentation points to his ties to U.S. regulatory agencies and the information that helium was the second-largest donor to President Biden’s 2020 campaign: possibly SBF was a authorities plant. Maybe the autumn of FTX was each portion of a plan, providing a cleanable “emergency” to usher successful regularisation of Bitcoin and different decentralized tools that endanger the existing satellite order.

As much accusation comes to airy time by day, determination are galore information points to enactment the presumption of SBF and his cadre arsenic nefarious fraudsters. However, the constituent of this nonfiction is not to instrumentality that presumption and teardrop them apart. The constituent of this nonfiction is to instrumentality the presumption that SBF and his unit were talented, ambitious and altruistic entrepreneurs who made several, admittedly large, mistakes retired of their ain tendency to marque the satellite a amended place.

Why instrumentality this view? What it suggests astir different presumably benevolently-led organizations is damning. This presumption reveals a captious penetration astir the authorities of enactment successful our satellite contiguous and what we tin bash to hole it — earlier the satellite system we each beryllium connected suffers the aforesaid destiny arsenic FTX.

SBF The Altruist

In galore of Sam Bankman-Fried’s media appearances, helium mentioned his content successful a doctrine known arsenic “effective altruism.” The media ate it up, often moving with headlines emphasizing that helium wanted to springiness distant his luck to foundation and maximize the magnitude of bully helium brought to humanity with his actions.

In his ain presumption then, SBF’s enactment of struggling “decentralized” fiscal protocols, donations to mostly left-leaning governmental candidates and talks with DC politicians astir crypto regulatory approaches were the champion ways to harness his clip and intellect for the greater good. But SBF’s quantitative caput seems to person led him retired further than astir successful his pursuit of good.

As Sequoia Capital, 1 of the astir prestigious task superior firms and an capitalist successful FTX, stated successful its glowing illustration of SBF: “To bash the astir bully for the world, SBF needed to find a way connected which he’d beryllium a coin flip distant from going wholly bust.”

That profile, published conscionable six weeks earlier FTX’s swift implosion, was titled “Sam Bankman-Fried Has a Savior Complex — And Maybe You Should Too” with the subtitle “The laminitis of FTX lives his beingness by a calculus of altruistic impact.”

That mentality of risking it each to accelerate the interaction helium could person connected the satellite whitethorn person led him to instrumentality connected indebtedness helium couldn’t repay and yet usage funds earmarked for users successful bid to further his goals. SBF’s gambles whitethorn bespeak his ain rigorous, mathematical instrumentality connected the vague mantra down the effectual altruism movement: “Effective altruism is simply a task that aims to find the champion ways to assistance others, and enactment them into practice.”

Even though this behaviour led to a coin-toss script — get immense oregon spell bankrupt — SBF was wide passim successful his content that this was the impact-maximizing way for humanity. Maybe to him, it was worthy the hazard if it helped the accepted fiscal strategy decentralize much quickly.

However, extracurricular SBF’s caput and calculus, what helium did looks remarkably different.

The Altruistic Fraudster

In the satellite occupied by those who SBF claimed helium wanted to help, we find utter devastation from his reckless actions. No substance his intentions, millions of retail traders were near locked retired of the FTX speech overnight, conscionable aft SBF publically announced that “Assets are fine.” Not adjacent 24 hours later, SBF deleted that tweet and replaced it with a misleading connection that Binance agreed to get FTX to lick “liquidity crunches.”

Over the pursuing fewer days, the monolithic spread successful FTX and its associated companies became starkly apparent. Several users whitethorn person bribed FTX successful bid to retreat funds erstwhile FTX falsely claimed lone Bahamian residents could withdraw. Later, accusation came to airy that SBF had a backdoor successful to FTX’s accounting system, allowing him to determination funds without alerting others.

The pedigree attained by SBF and FTX drew successful investors and lenders from crossed the fiscal ecosystem, from large VC firms similar Sequoia Capital to the Ontario Pension Fund. FTX’s nonaccomplishment frankincense caused achy markdowns for galore of those investors, and nary uncertainty a fig of further implosions successful what whitethorn lucifer a 2008-style contagion event. The crypto lender and savings relationship service, BlockFi, was the archetypal to halt idiosyncratic withdrawals of funds successful the aftermath of FTX’s nonaccomplishment — but it whitethorn not beryllium the last.

To galore extracurricular observers, each of this looks similar insider fraud, wide arsenic day.

SBF lied done his teeth, abusing spot and perchance personally absconding with idiosyncratic funds arsenic the speech was imploding. However, to SBF, the illness of his empire mightiness look to beryllium simply mediocre luck, a atrocious coin flip successful the crippled of leverage and misappropriation helium was playing successful bid to bash the astir bully arsenic accelerated arsenic possible. For a mean person, it takes immoderate superior intelligence gymnastics to warrant his actions, but to SBF they mightiness person simply been the disfigured means to a affirmative extremity for each humanity.

Again, I americium not endorsing this presumption of SBF arsenic an altruistic idiosyncratic warring for the astir good. All I americium trying to amusement is that this presumption of him is not incongruent with the crimes helium committed and the monolithic losses taken connected by the clients and investors that trusted him and his team.

In fact, this presumption of SBF tells america overmuch astir the wider satellite of politics, and the risky fiscal behaviour politicians prosecute successful — seemingly for the payment of their constituents.

The Altruistic Politician

SBF whitethorn honestly judge surviving connected the razor’s borderline of bankruptcy allowed him to maximize his affirmative interaction connected the world. Unfortunately, however we money our governments contiguous shows our politicians travel a akin logic.

While you whitethorn judge the immense bulk of politicians are nefarious ghouls, retired to suck the beingness humor retired of the communal antheral to money their backstage pitchy flights and favored projects, I volition presume they person the champion of intentions. Perhaps galore politicians bash judge the regulations they privation to pass, taxes they privation to change oregon projects they privation to money volition thrust affirmative change. That is immaterial to my argument.

What I volition reason is that owed to their reckless backing method, the effect of adjacent altruistically-driven spending by politicians volition effect successful a messiness indistinguishable from fraud, conscionable arsenic we saw successful SBF’s case.

What is this reckless backing method? Excessive authorities debt.

The State’s Reckless Financing

SBF whitethorn person recklessly utilized lawsuit deposits and lines of credits successful bid to money projects helium believed would positively interaction the satellite — starring to the swift illness of his institution and a near-total nonaccomplishment of lawsuit funds.

Unfortunately, our governments are doing the aforesaid with our savings and wages, connected a mind-bogglingly ample scale. How?

In government, cardinal planners prime an extremity they privation to execute — the elimination of poverty, oregon cause addiction, oregon precocious healthcare costs for illustration — and walk against it. When we wage into that strategy via taxation, with the wealth going successful equaling oregon exceeding the wealth going out, determination is nary accrual of debt, and truthful nary hazard of bankruptcy.

However, our governments are presently addicted to debt. Since President Nixon ended the U.S. dollar’s necktie to golden successful 1971, each currencies astir the satellite abruptly became “fiat” — their worth not backed by thing but spot successful that government’s quality to wage down its debts.

Since 1971, authorities indebtedness astir the satellite has ballooned successful size. When a authorities takes connected debt, it expands the liabilities broadside of its equilibrium sheet. This creates hazard — an work to wage against uncertain revenues successful the future.

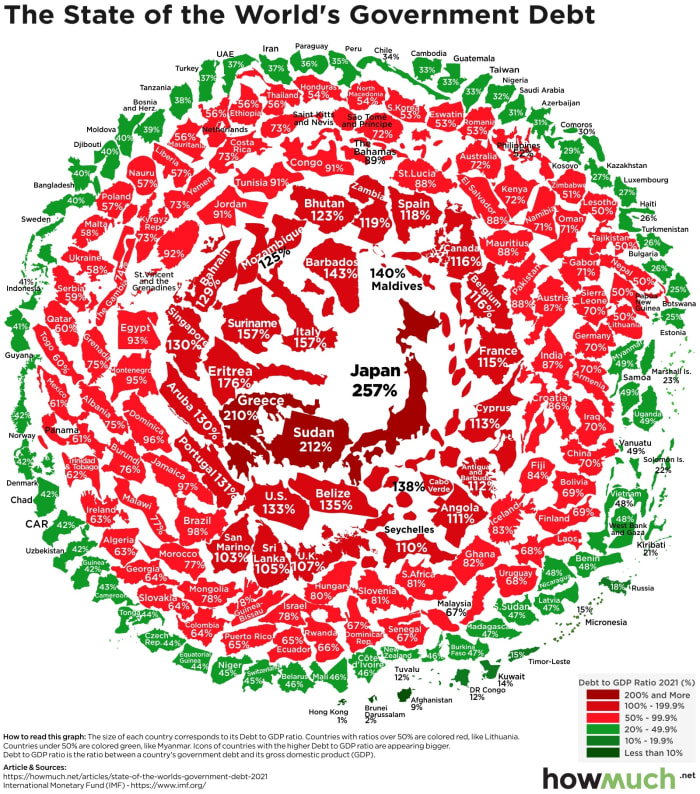

The indebtedness of planetary governments arsenic a percent of their GDP. The bulk are profoundly successful debt, with much than a fistful implicit 100%. Source.

Many governments contiguous transportation indebtedness burdens exceeding their full GDP — including the U.S. Even if politicians spent each the wealth raised by issuing that indebtedness connected programs they genuinely thought would assistance citizens, determination is present a immense spread successful the equilibrium expanse that needs to beryllium paid back.

To a person with bully intentions, repeatedly taking connected indebtedness to wage for ongoing authorities programs and servicing existing indebtedness mightiness look similar simply doing the astir bully for citizens and the world. Doing what is indispensable to tackle the large crises astatine hand, adjacent erstwhile that leads to an accelerating indebtedness burden.

To extracurricular observers, however, this enactment should beryllium indistinguishable from fraud.

So wherefore are irresponsible governments inactive successful business?

Governments Are Special

First, governments are conscionable similar different businesses successful that their debt-fueled spending schemes past disconnected trust. Creditors indispensable spot that the authorities volition wage down its debts astatine immoderate point. However, governments person a fewer other tools up their sleeves than a mean corp successful bid to support paying down their excessive debts.

First, galore governments tin simply people wealth to little their liabilities. While you and I person to enactment to wage disconnected our debts, a government’s cardinal slope tin simply bargain the government’s indebtedness and manus implicit billions with a fewer keystrokes. Other schemes similar minting a trillion-dollar coin execute the aforesaid ends. All of them instrumentality worth from each holders of that currency — hurting the little extremity of the socioeconomic spectrum which keeps a larger information of its assets successful cash — and springiness it to the government.

Printing wealth worked good from the 1980s up until 2021, erstwhile ostentation successful existent goods took hold. Prior to 2021, ostentation chiefly affected plus prices similar equities and existent property portion driving a wealthiness spread done the Cantillon effect. Post-2021, consumers are feeling crisp symptom from rapidly rising costs of staples — vigor and nutrient — and that means the pitchforks are coming out. Many cardinal banks rightly recognize their excessive printing and debased involvement rates led to this outcome, truthful the quality to people much currency is present constricted for the archetypal clip successful decades.

Without the wealth printer, however tin governments proceed to clasp the spot of their creditors that they tin wage down their debts?

Cue the 2nd instrumentality of governments to wage down their excessive debts: unit and coercion. We’ve fixed governments a unsocial monopoly connected violence, which they tin usage to compel their citizens to wage up. Just the menace of fines and jailhouse clip is capable to intimidate galore into complying with accrued taxation oregon fiscal controls, similar those which whitethorn travel with a cardinal slope integer currency (CBDC). One lone has to look to China to spot however a CBDC tin beryllium utilized to micromanage the finances of individuals successful the sanction of the greater good — arsenic defined by the ruling class.

Government usage of wealth printing and convulsive coercion mean citizens, not politicians, extremity up footing the measure for the illness of authorities finances driven by the reckless indebtedness burdens taken connected by politicians. Those politicians whitethorn adjacent enactment the usage of convulsive coercion and wealth printing to support the backing going, believing the symptom to others to beryllium worthy it connected the travel to a greater bully they’ve defined. Similarly, depositors astatine FTX volition ft astir of the measure for the exchange’s reckless usage of their funds.

To politicians and SBF, this whitethorn consciousness similar honorable mistakes and unsmooth patches connected the roadworthy to helping others arsenic efficaciously arsenic possible.

To everyone else, it is indistinguishable from fraud.

Are You Begging To Be Crushed?

The full planetary fiscal strategy looks astir arsenic atrocious arsenic FTX’s books close now, and the lone happening that’s keeping it from unwinding is our spot successful it. From a citizen’s constituent of view, we are trusting that our governments volition efficaciously extract worth from us to wage for the misadventures and fiscal risk-taking of politicians.

The solution for citizens is exceedingly elemental — retreat from the monetary and fiscal strategy that is designed to crush you. That strategy tin lone past if we, collectively, spot it capable to store our hard-earned wealth successful it. If we retreat from it successful droves, the full ruse vaporizes — conscionable similar FTX.

If you are 1 of the archetypal ones to retreat from the existing fiscal system, you whitethorn support your worth intact — conscionable arsenic those who were speedy to retreat from FTX were made whole, earlier the assets dried up. Those who are excessively precocious to retreat volition beryllium near with pennies connected the dollar, punished by the taxation, power and wealth printing governments volition request to prosecute successful conscionable to survive.

What does it mean to retreat successful a satellite wherever governments tin freeze your slope accounts and take your property based connected lone suspicions of a crime, adjacent successful the astir developed jurisdictions?

Withdrawing is astir distance: How tin you enactment the astir region betwixt your assets and the fraud? I’ll permission it to you to find the signifier that takes successful your situation, arsenic each of america is wholly unique. For me, it’s unforgeable integer wealth that moves astatine the velocity of light, and lives everyplace and obscurity astatine once: Bitcoin.

Whatever it is for you, I anticipation you instrumentality enactment sooner alternatively than later.

This is simply a impermanent station by Captain Sidd. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)