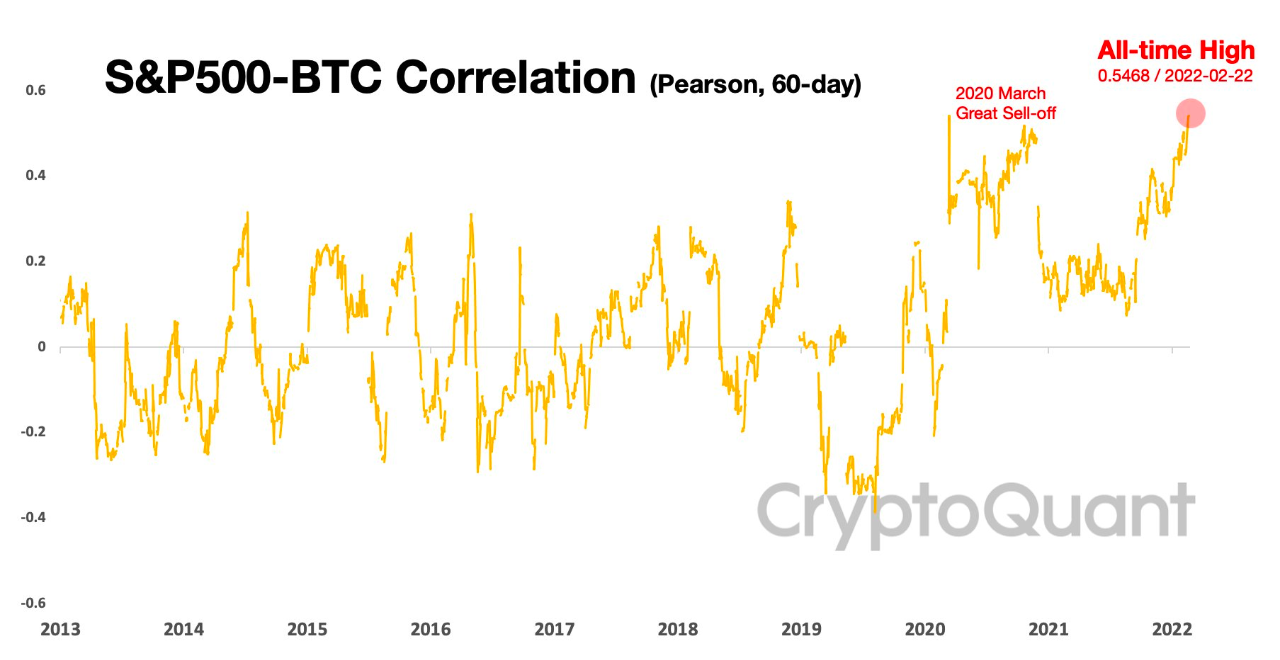

Data shows the Bitcoin correlation with S&P 500, and hence the banal market, has present acceptable a caller all-time precocious (ATH).

Bitcoin Correlation With S&P 500 Reaches New High

As pointed retired by an expert successful a CryptoQuant post, the BTC correlation with the banal marketplace is presently astatine an all-time high, further damaging the “safe haven” narrative.

The “Bitcoin correlation with S&P 500” is an indicator that measures however powerfully the terms of BTC reacts to volatility successful S&P 500, arsenic good arsenic the absorption of the response.

When the indicator has values greater than zero, it means determination is simply a affirmative correlation betwixt the banal marketplace and the terms of the crypto astatine the moment. “Positive” present means that BTC moves successful the aforesaid absorption arsenic S&P 500.

On the different hand, correlation values little than zero connote that BTC reacts to S&P 500’s terms changes by moving successful the other direction.

Related Reading | Bitcoin Plunges Below $40 As Russia Has Reportedly Given Its Forces Order To Attack Ukraine

Values of the indicator precisely adjacent to zero people mean that determination is nary correlation betwixt the 2 assets. Now, present is simply a illustration that shows the inclination successful the S&P 500 and Bitcoin correlation since the twelvemonth 2013:

As you tin spot successful the supra graph, the correlation betwixt Bitcoin and S&P 500 swung betwixt affirmative and antagonistic portion remaining debased for the astir portion of BTC’s history.

Related Reading | Why Bitcoin Won’t Crack Over Fresh Bear Assault, Next Potential Target For BTC

However, since precocious 2019-early 2020, the 2 assets person go strongly, positively correlated. During 2020, the metric had a clang owed to the COVID merchantability off, but the indicator sharply roseate during the 2nd fractional of 2021 and 2022 truthful far.

The correlation betwixt the Bitcoin and the banal marketplace has present acceptable a caller all-time precocious (ATH) of +0.5468 this month.

Such precocious correlation betwixt the assets has further enactment a dent connected the communicative of “digital gold” arsenic the crypto is nary longer the harmless haven it erstwhile was.

BTC Price

At the clip of writing, Bitcoin’s price floats astir $39k, down 12% successful the past 7 days. Over the past month, the crypto has gained 10% successful value.

The beneath illustration shows the inclination successful the terms of BTC implicit the past 5 days.

A fewer days back, the terms of Bitcoin plunged down, touching arsenic debased arsenic $36.4k. Since then, the worth of the coin has shown immoderate recovery, breaking supra the $39k level again today. At the moment, it’s unclear whether this caller uptrend volition last.

Featured representation from Unsplash.com, charts from TradingView.com, CryptoQuant.com

3 years ago

3 years ago

English (US)

English (US)