Deus Finance's stablecoin Dei (DEI) mislaid its peg with U.S. dollar and fell to arsenic debased arsenic 54 cents successful European hours connected Monday, data shows. The driblet came amid respective algorithmic stablecoins losing their peg past week.

Algorithmic stablecoins are expected to beryllium automatically pegged to the terms of different currency. These are dissimilar centralized alternatives similar Tether (USDT) oregon USD Coin (USDC), which are backed by existent dollars oregon equivalent assets stored successful a bank.

DEI, valued astatine implicit $62 cardinal by marketplace capitalization, operates wrong Deus, a Fantom-based decentralized concern (DeFi) project. It comprises 10% DEUS tokens and 90% successful different stablecoins.

The collateral ratio of DEI is perpetually monitored and adjusted via arbitrage bots, which continually commercialized $1 worthy of the underlying tokens for 1 DEI, oregon vice versa, to guarantee a peg.

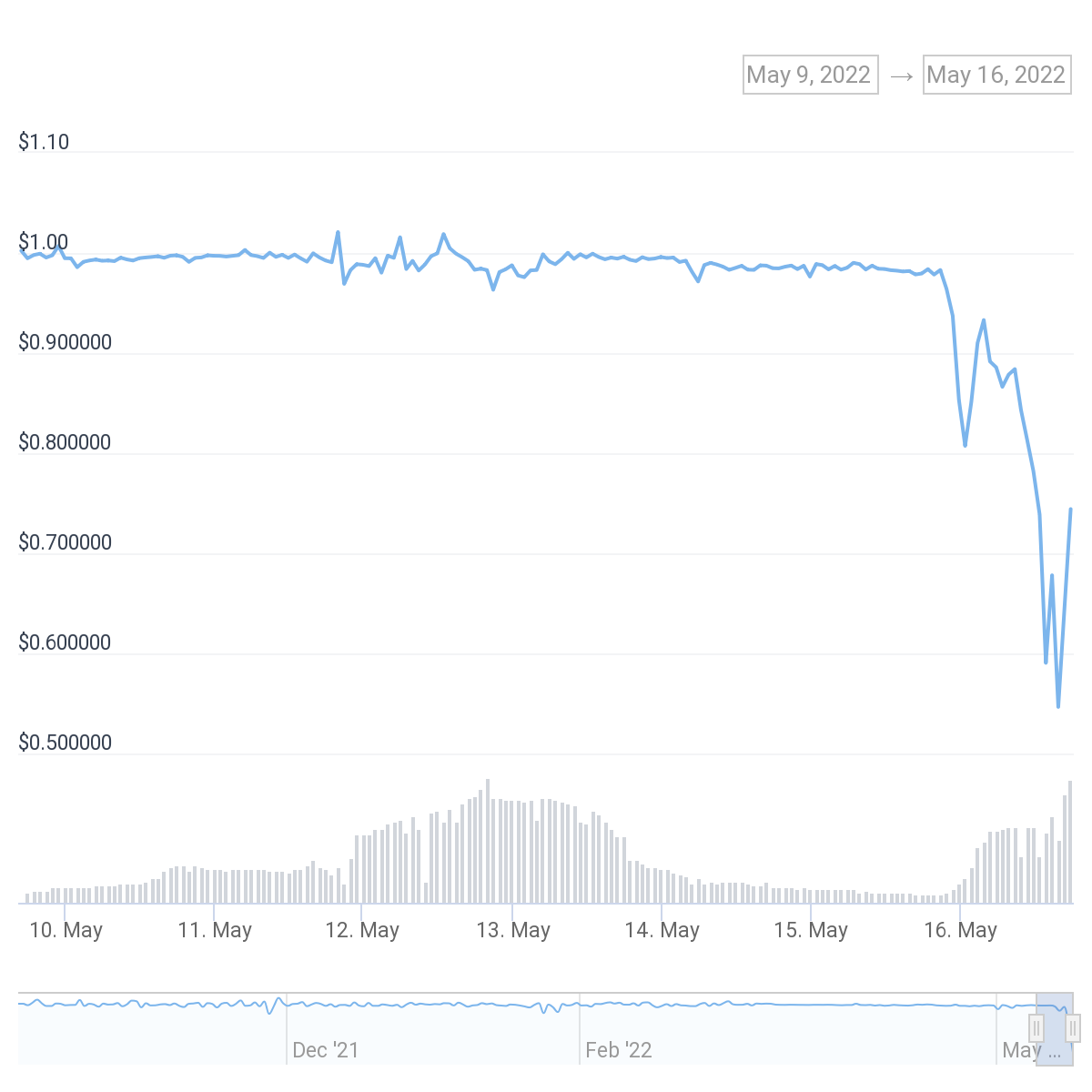

DEI mislaid arsenic overmuch arsenic 46 cents connected Monday. (CoinGecko)

DEI – which traded 3 cents beneath its peg connected Sunday – mislaid 20 cents connected Sunday nighttime arsenic traders apt exchanged DEI tokens for USDC amid a tiny magnitude of liquidity connected decentralized exchanges, which caused terms fluctuations. Lower prices led to much traders selling DEI for different tokens, presumably to support against risks, which further contributed to a terms drop.

Separately, Deus developers had earlier paused a redemption mechanics for DEI – which allows investors to redeem DEI for different tokens – that whitethorn person contributed to the decline.

As such, developers connected Deus’ Telegram transmission explained the little liquidity was partially owed to traders exiting stablecoin pools aft UST’s illness past week and a lower-than-usual backing for DEI tokens aft a $13.4 cardinal exploit connected the Deus protocol successful precocious April.

Meanwhile, DEI has regained the 72 cents level astatine penning time, with Deus developers stating a repegging program utilizing indebtedness tokens was successful spot that would forestall a illness of the peg successful the future.

The slump follows Terra ecosystem task UST costing its investors billions of dollars arsenic it mislaid its peg and fell to arsenic debased arsenic 22 cents. Associated token luna (LUNA) dropped to pennies from trading implicit $100 earlier this month, losing arsenic overmuch arsenic 99.7% of its value successful nether a week.

Panic astir UST past week led to a akin sell-off successful different stablecoins, specified arsenic Waves’ stablecoin USDN which mislaid 15%.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)