Transactions connected Fantom exceeded those of Ethereum for the archetypal clip ever connected Monday, arsenic investors question newer avenues to workplace yields and accrue value.

In the past 24 hours, implicit 1.2 cardinal transactions were processed connected the Fantom network, information from blockchain tracker Fantomscan showed. This was somewhat higher than Ethereum’s 1.1 cardinal transactions, arsenic per data from Ethereum tracker Etherscan.

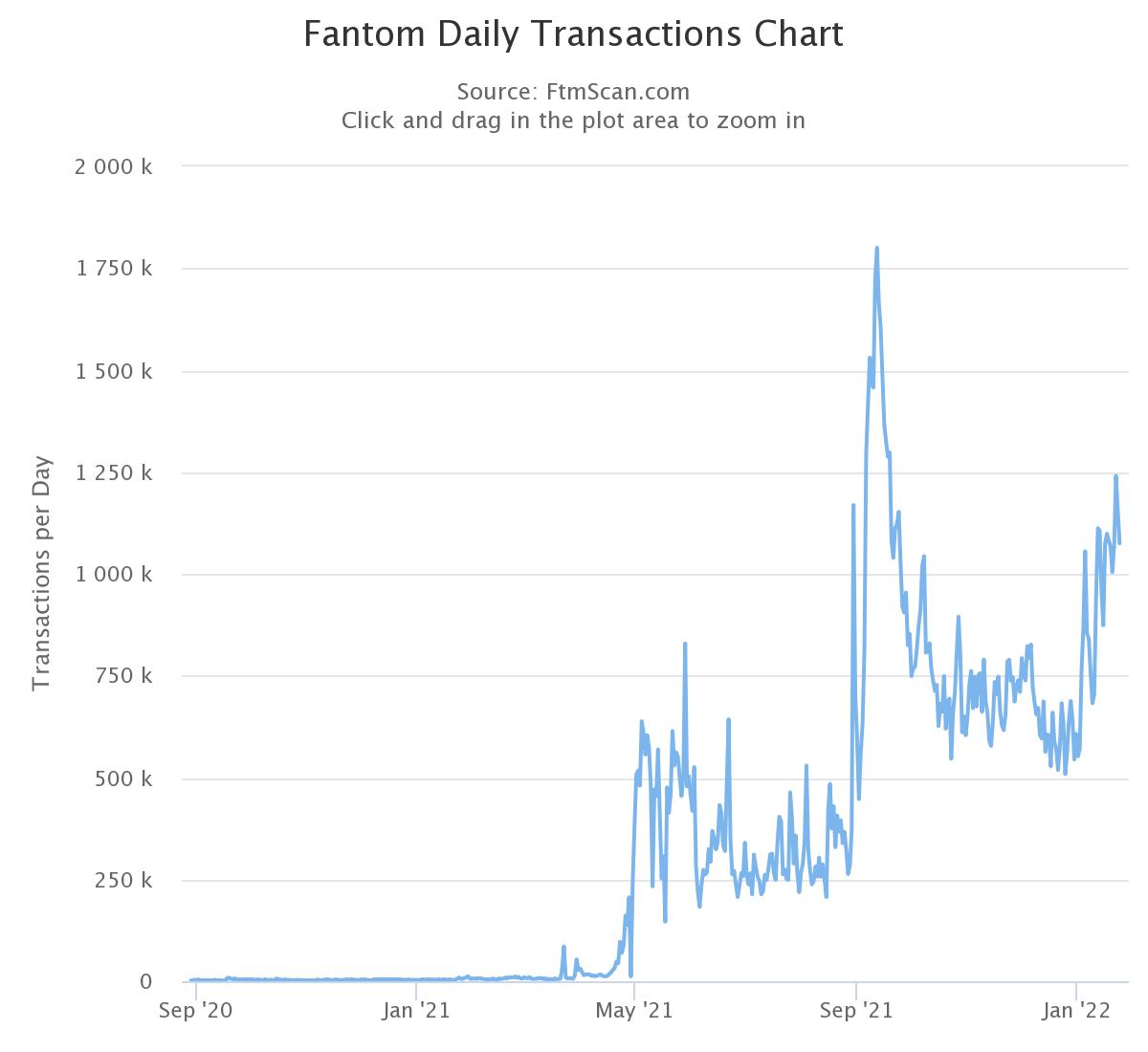

Fantom transactions crossed those of Ethereum connected Monday but stay beneath September's peak. (Fantomscan)

With fifty-five validators maintaining the network, Fantom processed upward of 8 transactions per 2nd (tps) connected Monday compared to Ethereum’s existent rates of nether 2 tps, data showed. Ethereum transactions are present astatine August 2021 levels, acold beneath the May 2021 highest of 1.7 cardinal regular transactions.

Fantom has present recorded a full of implicit 170 cardinal transactions since its motorboat successful December 2019, a fraction of Ethereum’s 1.4 cardinal transactions since its inception successful 2015.

However, Monday’s figures connected Fantom were inactive little than all-time precocious transaction counts of 1.8 cardinal successful September 2021, a period earlier FTM tokens reached a terms highest of $3.46.

Tokens of Fantom person emerged arsenic the apical performers successful caller months arsenic investors stake connected the tokens of furniture 1 projects – protocols with their autochthonal blockchains, specified arsenic Fantom oregon Solana – arsenic an alternate to Ethereum.

Fantom became the third-largest decentralized concern (DeFi) ecosystem by locked worth implicit the weekend, arsenic reported. It started 2022 astatine the eighth spot successful rankings but has since climbed to the 3rd spot amid expanding developer enactment and idiosyncratic involvement for products built implicit Fantom.

DeFi refers to fiscal services, specified arsenic trading, lending, and borrowing, that trust connected astute contracts alternatively of 3rd parties. Over $12.2 cardinal worthy of worth is locked connected 129 Fantom-based DeFi applications arsenic of Monday.

Why are transactions increasing?

Analysts accidental newer products and precocious output rewards are fuelling maturation connected the Fantom network. “Many projects similar Radial, veDAO, and 0xDAO came up with liquidity mining launches that vampire attacked different protocols to summation TVL. These projects stock a batch of resemblance to defi summertime projects successful 2020,” wrote crypto probe steadfast Delphi Digital successful a enactment connected Tuesday. Liquidity mining refers to users supplying liquidity to DeFi applications and receiving rewards for doing so.

“Mercenary superior came implicit to Fantom to workplace these projects arsenic they were providing unthinkable yields connected single-sided staking,” the analysts cautioned, suggesting existent enactment could beryllium short-lived arsenic yields autumn and investors exit to wherever much yields are connected offer.

For now, FTM traders are rejoicing. Prices of the token were among apical gainers successful Asian hours connected Tuesday, rising 8% to $2.30 successful the past 24 hours. However, determination was immoderate profit-taking with prices falling 7 cents astatine the clip of writing.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)