Bitcoin dropped to $96,000 connected dense selling Friday, and falling hazard appetite, leaving traders and analysts parsing whether this is mean profit-taking oregon a larger turning constituent for the market.

According to on-chain and marketplace reports, the driblet wiped retired much than $700 cardinal successful agelong positions and near November down by much than 10%.

Whale Transfers Draw Focus

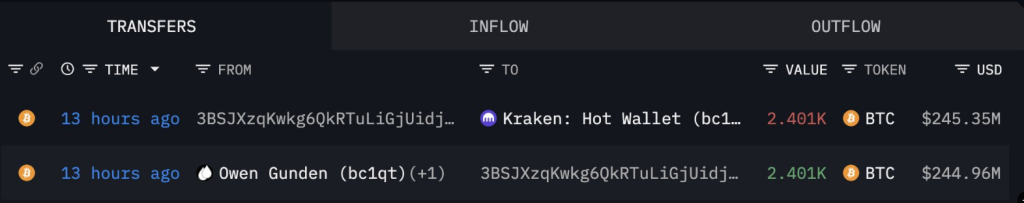

Reports person disclosed that a wallet tied to trader Owen Gunden moved 2,400 Bitcoin — astir $237 cardinal — onto the Kraken exchange, a transportation tracked by blockchain watcher Arkham.

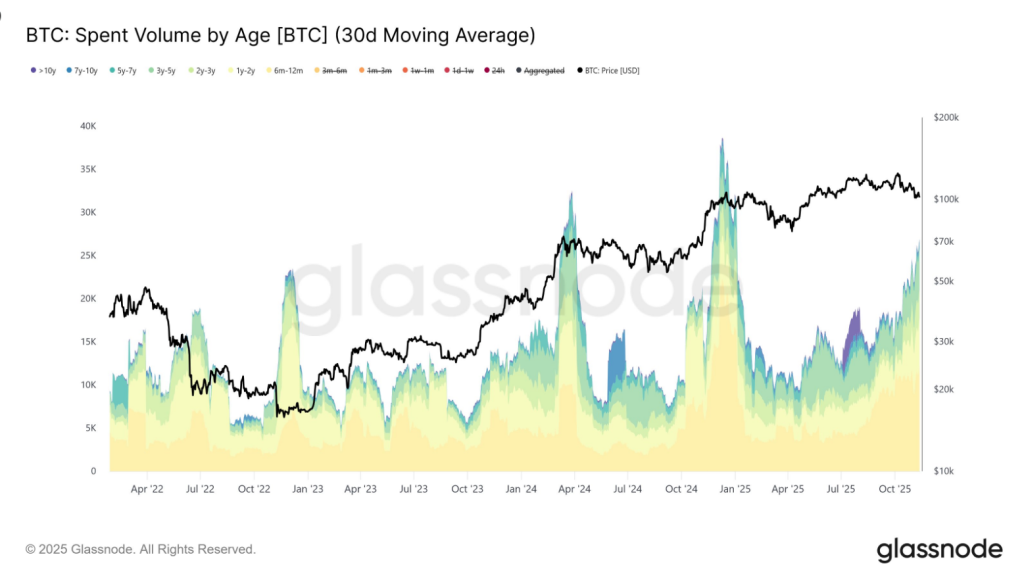

Based connected investigation by Glassnode, semipermanent holders’ mean regular spending roseate from implicit 12,000 BTC per time successful aboriginal July to astir 26,000 BTC per time arsenic of this week.

OWEN GUNDEN JUST SOLD ANOTHER $290M BTC

Owen Gunden conscionable moved each of the remaining BTC retired of his accounts. He deposited implicit HALF of his holdings straight into Kraken, depositing a full of $290.7M of BTC into Kraken.

He present has lone $250M of Bitcoin remaining. pic.twitter.com/ZUB3aToAgH

— Arkham (@arkham) November 13, 2025

That pattern, Glassnode analysts say, looks similar orderly organisation by older holders alternatively than a abrupt wide exit. It is being framed arsenic late-cycle profit-taking: regular, steady, and dispersed out.

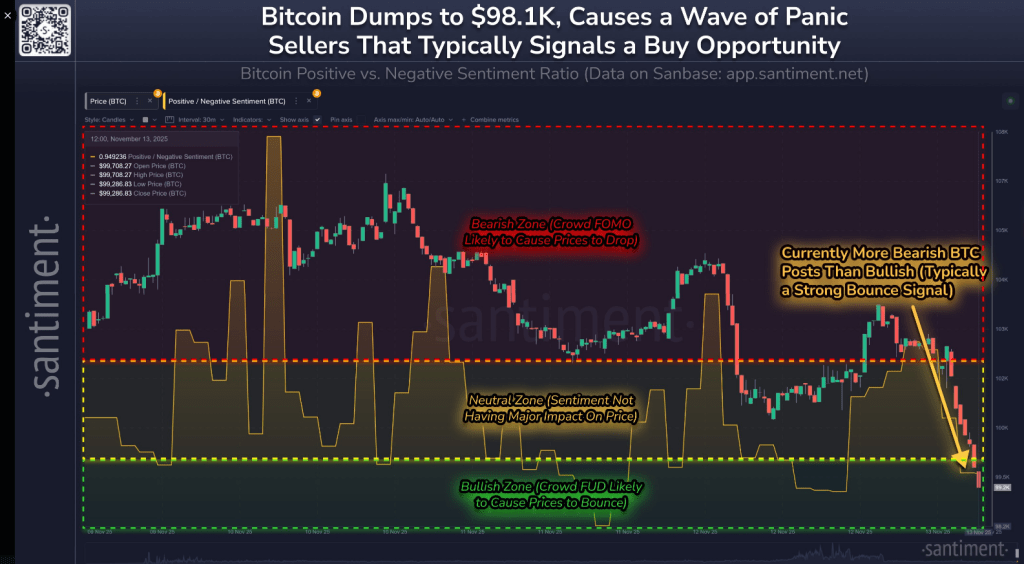

According to Santiment, Bitcoin has fallen beneath $100K for the 2nd clip this month, triggering a burst of fearfulness and disquieted posts from retail traders.

Bitcoin has dumped beneath $100K for the 2nd clip this month. Predictably, this has caused a question of FUD and acrophobic societal media posts from retail traders. As shown below:

Bitcoin has dumped beneath $100K for the 2nd clip this month. Predictably, this has caused a question of FUD and acrophobic societal media posts from retail traders. As shown below:

: Significant bullish/greedy bias (usually erstwhile markets are getting excessively overmuch FOMO, prices volition go… pic.twitter.com/rowUv3xIMd

: Significant bullish/greedy bias (usually erstwhile markets are getting excessively overmuch FOMO, prices volition go… pic.twitter.com/rowUv3xIMd

— Santiment (@santimentfeed) November 13, 2025

No Meltdown: Late-Cycle Signals And On-Chain Readings

Vincent Liu, CIO astatine Kronos Research, disclosed that structured selling and dependable rotation of gains often amusement up successful late-cycle phases.

He cautioned that this signifier doesn’t automatically awesome a last peak, provided determination are inactive buyers acceptable to instrumentality successful the other supply.

Being successful a precocious rhythm doesn’t mean the marketplace has deed a ceiling, helium pointed out. It conscionable shows momentum has eased, and bigger forces similar macro trends and liquidity are present successful control, helium said.

“Rate-cut doubts and caller marketplace weakness person slowed the climb, not ended it,” Liu said. In different words, there’s nary meltdown oregon thing similar it.

On-chain indicators are being watched closely; Bitcoin’s nett unrealized nett ratio stood adjacent 0.476, a level immoderate traders construe arsenic hinting astatine short-term lows forming.

That speechmaking is lone 1 of respective signals, Liu added, and indispensable beryllium tracked alongside liquidity and macro conditions.

A person look astatine the monthly mean spending by semipermanent holders reveals a wide trend: outflows person climbed from astir 12.5k BTC/day successful aboriginal July to 26.5k BTC/day contiguous (30D-SMA). This dependable emergence reflects expanding organisation unit from older capitalist cohorts — a… pic.twitter.com/wECe58CV66

— glassnode (@glassnode) November 13, 2025

The cryptocurrency sell-off came arsenic crypto-related stocks plunged. Broader markets were anemic arsenic well, with the Nasdaq down 2% and the S&P 500 disconnected 1.3%.

Cipher Mining fell 14%, Riot Platforms and Hut 8 dropped 13%, portion MARA Holdings and Bitmine Immersion slid implicit 10%. Coinbase and Strategy were down astir 7%.

Based connected reports, ample organization flows person pressured prices. Firms including BlackRock, Binance and Wintermute reportedly sold much than $1 cardinal successful Bitcoin, a question of selling that produced a speedy 5% driblet wrong minutes.

Meanwhile, societal sentiment turned sharply negative, and the Crypto Fear & Greed Index deed 15, reflecting “extreme fear” among traders.

Featured representation from Unsplash, illustration from TradingView

2 hours ago

2 hours ago

English (US)

English (US)