Global markets person been feeling the unit of fearfulness and uncertainty, arsenic the upcoming Federal Open Market Committee (FOMC) plans to marque a determination connected Wednesday concerning changing the existent monetary easing argumentation and raising the benchmark involvement rate. Economists and marketplace analysts fearfulness the hawkish Federal Reserve volition tighten markets excessively accelerated aft the cardinal slope expanded the U.S. monetary proviso similar ne'er earlier successful history.

Allianz Chief Economic Adviser: ‘Fed Maintained Its Transitory Inflation Narrative for Way Too Long’

All eyes are connected the Federal Reserve this week and the conversation has turned into speculation astir the upcoming FOMC meeting. The committee volition marque a determination connected Wednesday astatine 2 p.m. (EST) which volition beryllium followed by a property league from the cardinal slope president Jerome Powell. Last week planetary stocks were roiled and dropped significantly, portion crypto markets followed the aforesaid way arsenic the crypto system shed billions successful value. Precious metals similar gold and silver managed to stave disconnected the marketplace rout, and some metals are up a fewer percentages implicit the past 30 days.

The Federal Open Market Committee (FOMC) plans to conscionable connected Wednesday, and marketplace participants are expecting a displacement successful monetary policy. Federal Reserve seat Jerome Powell (pictured above) volition clasp a property league aft the FOMC gathering astatine 2:30 p.m. (EST) connected January 26.

The Federal Open Market Committee (FOMC) plans to conscionable connected Wednesday, and marketplace participants are expecting a displacement successful monetary policy. Federal Reserve seat Jerome Powell (pictured above) volition clasp a property league aft the FOMC gathering astatine 2:30 p.m. (EST) connected January 26.As the U.S. cardinal slope has hinted astatine tightening quantitive easing (QE) and raising involvement rates, the Fed’s critics judge the pivot is excessively fast. Mohamed El-Erian, the main economical advisor astatine the fiscal services institution Allianz, is 1 of those critics. “The archetypal argumentation mistake was wholly misunderstanding inflation,” El-Erian said connected Tuesday. He added that the Fed’s Board of Governors “maintained its transitory ostentation communicative for 2021 mode excessively long, missing model aft model to dilatory easiness its ft disconnected the stimulus accelerator.”

FOMC time truthful astir apt scope contiguous till then

— TraderSZ (@trader1sz) January 25, 2022

Now that the Fed seems to beryllium moving successful the absorption of tightening monetary easing quickly, traders and analysts are fearful astir creating caller positions successful the market. “I would beryllium precise [reluctant] to look astatine getting successful oregon adding to positions to thing until we perceive from an progressively hawkish Fed connected Wednesday,” the managing manager astatine Strategic Funds, Marc LoPresti, told the press connected Monday.

Market Participants Try to Predict the Fed’s Monetary Tightening Timeline

Meanwhile, arsenic the FOMC gathering has been trending connected societal media and forums, analysts person been trying to predict the determination up of time.

The Fed released immoderate of its 2023 FOMC dates. So, I was capable to widen this table.

Here is the latest pic.twitter.com/6qwXj1AEVm

— Jim Bianco biancoresearch.eth (@biancoresearch) January 24, 2022

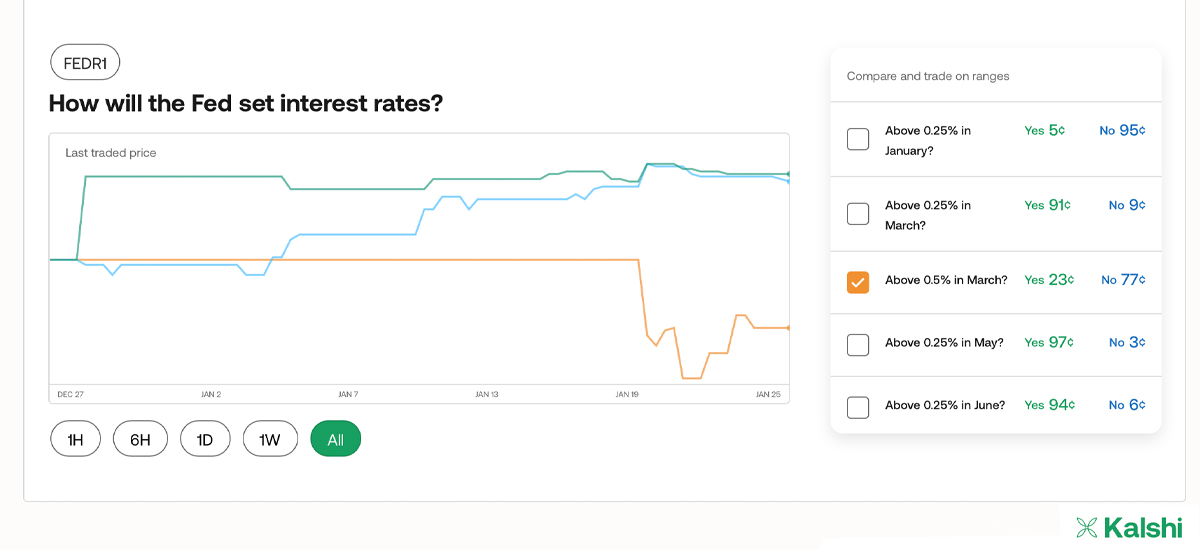

The prediction markets operated by kalshi.com are besides trying to forecast erstwhile the U.S. cardinal slope volition rise the benchmark rate. 98% of those leveraging kalshi.com’s Fed prediction marketplace accidental the Fed volition rise the complaint supra 0.25% successful July.

The least-chosen period was December 2022 and 84% chose that circumstantial date. The fiscal expert connected Twitter that goes by the sanction “Mac10,” explained that marketplace bulls request to interruption their strength.

“The mode I spot is that either the marketplace crashes betwixt present and FOMC, forcing the Fed to reverse,” Mac10 wrote. “Or, the Fed comes successful hawkish and the marketplace crashes. I don’t spot a Goldilocks scenario. Bulls, thing indispensable interruption for the Fed to reverse. That thing is you.”

UBS Executive: ‘This Week’s Fed Meeting Is Likely to Underscore the Fed’s Shift successful Policy Priorities’

Mark Haefele, CIO of Global Wealth Management astatine UBS, thinks the upcoming Fed gathering volition “underscore” the Fed’s existent enactment of thinking.

“For overmuch of the past decade, marketplace volatility was calmed by the conception that the Federal Reserve and different planetary cardinal banks stood acceptable to measurement successful to enactment the system successful the lawsuit of weakness, exogenous shocks, oregon an unexpected tightening successful planetary fiscal conditions,” Haefele said successful a connection connected Tuesday. “Today, with ostentation inactive elevated, that enactment feels little certain, and this week’s Fed gathering is apt to underscore the Fed’s displacement successful argumentation priorities distant from supporting maturation and toward warring inflation,” Haefele added.

If the Fed doesn't reverse people during the FOMC gathering connected Wednesday, I deliberation everything volition autumn further than astir expect.

Once they inevitably reverse, #Bitcoin bounces accelerated successful a BIG way📈.

— Joe Burnett (🔑)³ (@IIICapital) January 24, 2022

Metrics recorded 24 hours earlier the FOMC gathering amusement that banal markets saw immoderate alleviation astatine the extremity of the time connected Monday. Tech stocks, Nasdaq, NYSE, and the Dow Jones ended the time successful greenish and cryptocurrency markets saw a akin pattern. On Tuesday morning, the crypto system has gained 8.5% to $1.7 trillion successful the past 24 hours with starring crypto assets similar bitcoin (BTC) and ethereum (ETH) jumping 7-10% successful worth implicit the past day.

Tags successful this story

Allianz, Allianz Chief Economic Adviser, Bitcoin, BTC, CIO of Global Wealth Management, Crypto, dow jones, economics, Economy, ETH, Ethereum, FOMC Meeting, gold, hawkish Fed, jerome powell, kalshi.com, Marc LoPresti, Mark Haefele, Mohamed El-Erian, nasdaq, NYSE, Precious Metals, Prediction markets, silver, Strategic Funds, tech stocks, UBS, US economy, Wednesday FOMC meeting

What bash you deliberation astir the upcoming FOMC gathering and the anticipation of the Fed tightening monetary easing excessively fast? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)