Amidst waves of interest surrounding the merchantability of Bitcoin by the US and German governments, manufacture experts person travel guardant to dispel fears, suggesting that these moves could beryllium bullish for the market.

Yesterday, the Bitcoin assemblage experienced heightened volatility pursuing actions by 2 large governments. The German Federal Criminal Police (BKA) continued with its sales of Bitcoin, reducing its holdings from 50,000 BTC to 45,264 BTC. Concurrently, the US authorities transferred 4,000 BTC to Coinbase, apt aiming for liquidation, retaining a important 213,546 BTC successful its reserves.

Why This Is Bullish For Bitcoin (Long-Term)

Travis Kling, laminitis of Ikigai Asset Management, remarked connected the synchronicity of these events. “All astatine the aforesaid time—US Govt selling seized Silk Road Bitcoin, US Govt selling seized Banmeet Singh BTC, German Govt selling seized Movie2k BTC, Mt Gox distributing BTC aft a decade. Interesting… I can’t assistance but look astatine each these actions and wonderment astir immoderate benignant of coordination/underlying intention,” Kling stated via X.

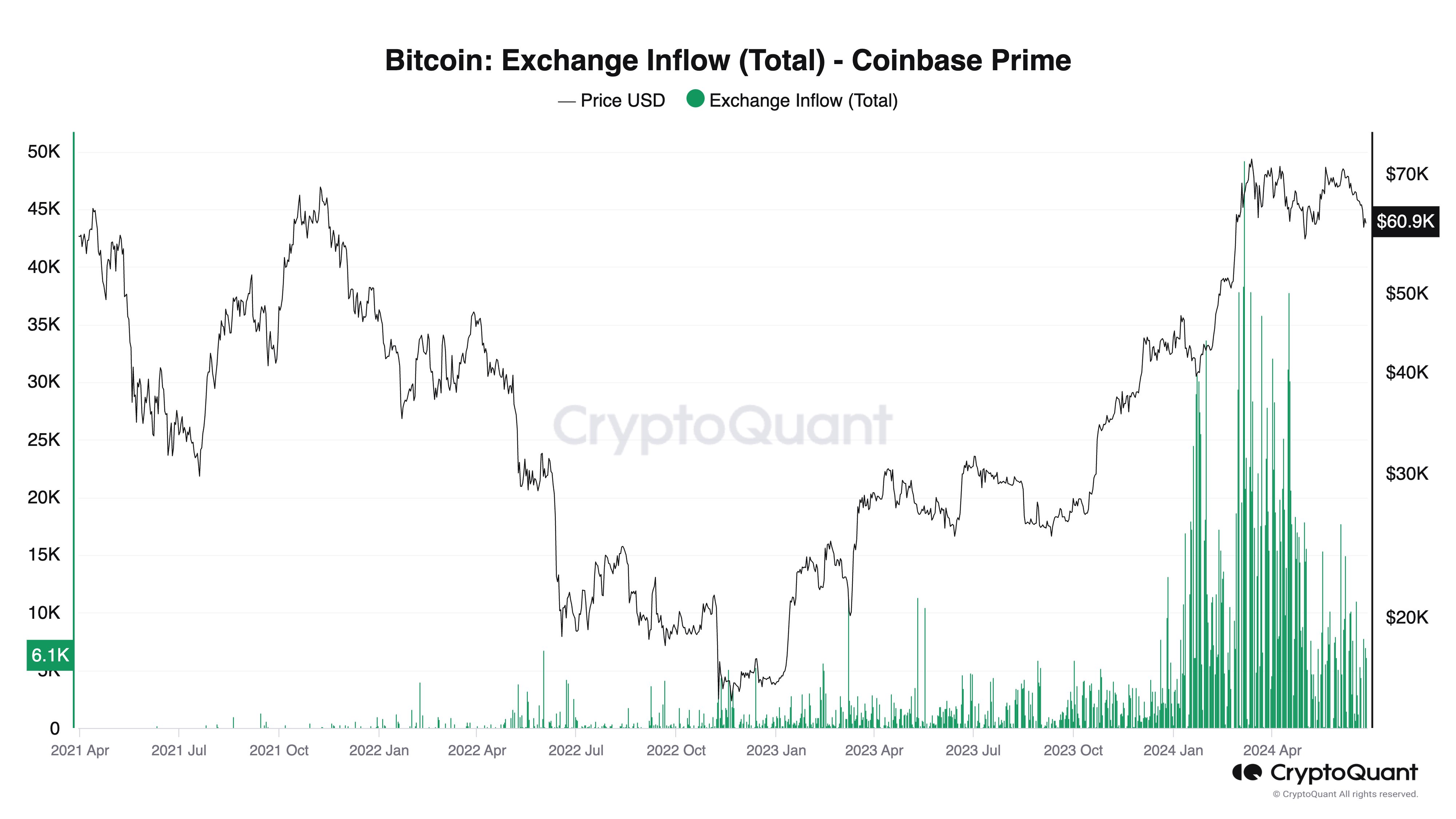

Despite concerns that these income could unit Bitcoin prices, experts reason that the interaction connected the marketplace is apt minimal. Ki Young Ju, CEO of CryptoQuant, countered the prevalent fear, uncertainty, and uncertainty (FUD). He noted, “US gov’t sold 4K Bitcoin today, but it’s little apt to interaction the market. Coinbase Prime handled 20-49K BTC successful sell-side liquidity regular during precocious spot ETF inflows and 6-15K regular during debased spot ETF inflows. Posting this due to the fact that I’m bushed of ‘gov’t selling’ FUDs,” arsenic shared via X.

Bitcoin Exchange Inflow – Coinbase Prime | Source: X @ki_young_ju

Bitcoin Exchange Inflow – Coinbase Prime | Source: X @ki_young_juCrypto expert Skew (@52kskew) provided insights into however these transactions typically occur, “US Gov sent 3.94K BTC to Coinbase Prime to beryllium handled by Coinbase Institutional. There’s typically 2 options here: OTC desks tin auction disconnected the BTC to clients (off-market buyers), oregon an unfastened marketplace auction (sold implicit clip connected the market).” Skew’s mentation makes it wide that the interaction connected the terms is apt to beryllium alternatively small.

Adam Cochran, managing spouse astatine CEHV, highlighted the resilience of Bitcoin successful airy of aggregate bearish catalysts, “Also with US Gov FUD, Mt Gox FUD, astir large airdrops finished, markets down, Nvidia disconnected highs, BTC has had each crushed to spell lower, and it’s inactive mostly held $60k. Negative quality struggling to marque a dent.”

Will Gold’s History Repeat Itself For BTC?

Echoing a historically bullish sentiment, Alistar Milne, CIO of Altana Digital, drew parallels to past authorities income of assets, “Government selling is bullish. Gordon Brown famously sold the UK’s Gold reserves for little than $300/ounce. One of the worst decisions made by a Chancellor of the Exchequer, ever. Germany & America are making acold worse mistakes by selling seized BTC now. They tin lone merchantability once.”

Government selling is bullish

Gordon Brown famously sold the UK’s Gold reserves for little than $300/ounce. One of the worst decisions made by a Chancellor of the Exchequer, ever

Germany & America are making acold worse mistakes by selling seized BTC now. They tin lone merchantability erstwhile pic.twitter.com/i0rZMpuiS0

— Alistair Milne (@alistairmilne) June 26, 2024

For context, during his tenure arsenic Chancellor of the Exchequer from 1997 to 2007, Gordon Brown made the determination to merchantability astir 60% of the UK’s golden reserves betwixt 1999 and 2002, a play known arsenic the “Brown Bottom.”

The income were conducted successful a bid of auctions astatine prices that ranged betwixt $256 and $296 per ounce—significantly beneath the golden terms successful consequent years, which saw a important rise. This enactment is wide regarded arsenic a fiscal misstep that outgo the UK treasury billions successful imaginable revenue, arsenic golden prices surged to implicit $1,500 per ounce successful the pursuing decades.

Moreover, there’s different bullish facet to this. The finalization of these BTC income could region a important overhang connected the marketplace arsenic these income are hanging supra the marketplace similar a Damocles sword; erstwhile done, there’s a large downside hazard for the marketplace everlastingly eliminated, amended aboriginal than late.

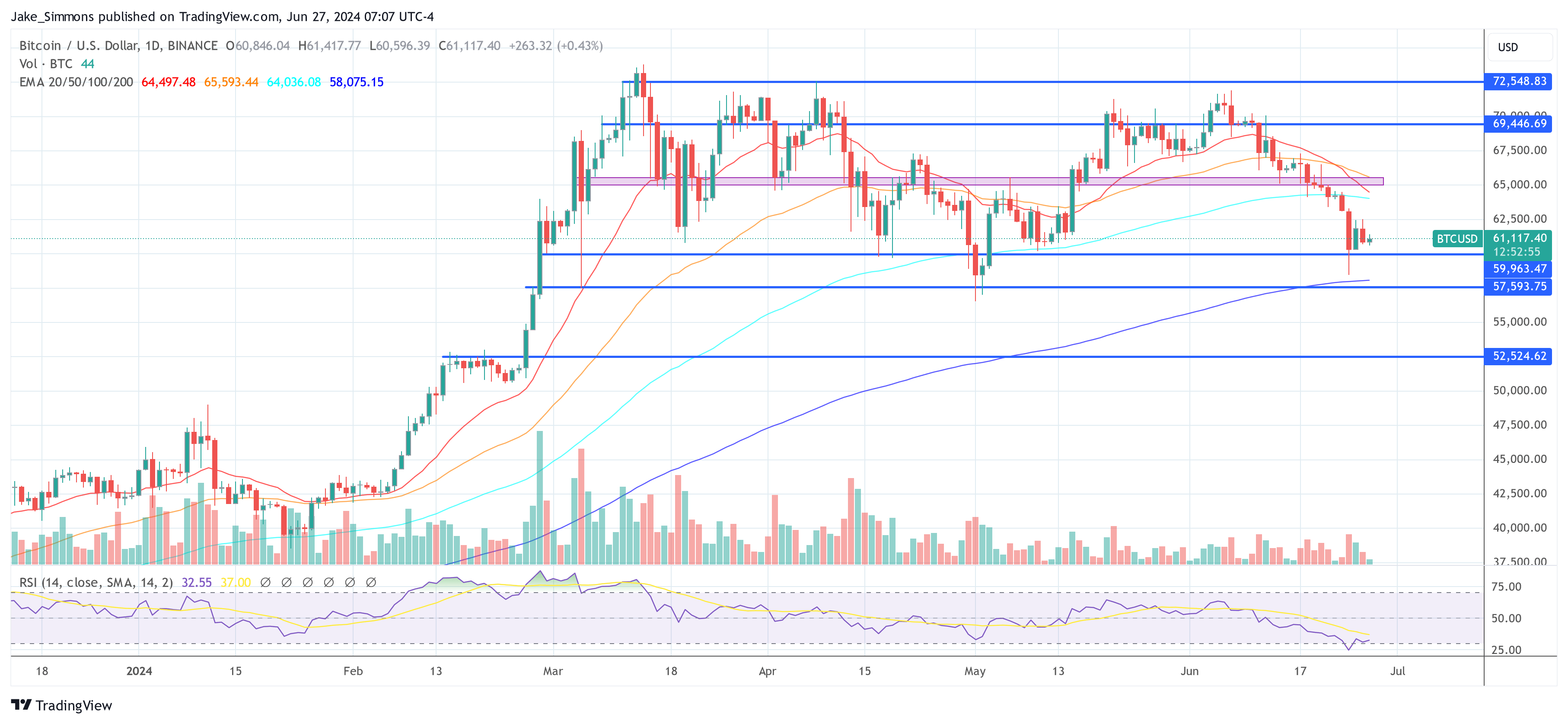

At property time, BTC traded astatine $61,117.

BTC terms hovers supra $61,000, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms hovers supra $61,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)