With the closing of withdrawals astatine Celsius and the quality of Three Arrows Capital being insolvent, it is much important than ever to clasp your ain keys.

The beneath is simply a escaped afloat excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Over the past week, we person extensively covered the contagion that has taken clasp successful the broader crypto market, highlighting the events starring to the closure of withdrawals astatine Celsius and present the insolvency of Three Arrows Capital (3AC), antecedently a elephantine successful the hedge money space.

This nonfiction volition further analyse immoderate of the imaginable knock-on effects of these events.

As the marketplace recovers from the contagion effects of aggregate insolvencies, it looks highly apt that each of the particulate has yet to settee from the large events.

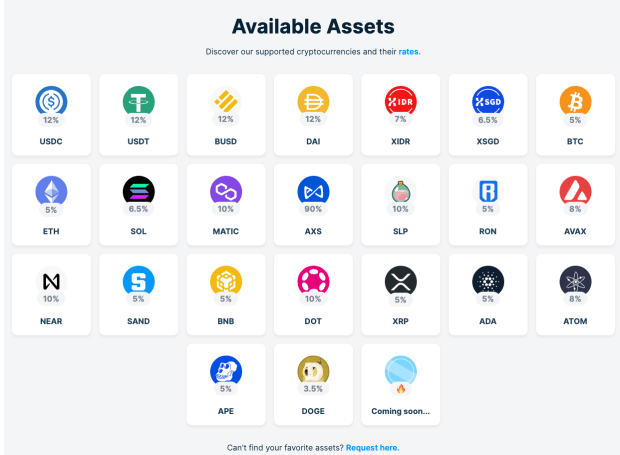

On June 17, 2022, crypto output work Finblox, announced it was limiting withdrawals to an equivalent of $1,500/month. The level offered highly precocious output connected crypto assets, and was a portfolio institution of 3AC.

(Source)

(Source)

Similarly, Deribit, an industry-leading crypto derivatives and options level announced it has sustained losses owed to “market developments.”

“We tin corroborate that Three Arrows Capital is simply a shareholder of our genitor institution since February 2020.

“Due to marketplace developments, Deribit has a tiny fig of accounts that person a nett indebtedness to america that we see arsenic perchance distressed.

"Even successful the lawsuit that nary of this indebtedness is repaid to us, we volition stay financially steadfast and operations volition not beryllium impacted.

“We tin corroborate each lawsuit funds are harmless and the afloat security money volition stay intact arsenic is. Any imaginable losses volition beryllium covered by Deribit.” - Statement posted to Deribit’s Twitter account

With Three Arrows Capital being an aboriginal capitalist connected the platform, if Deribit sustained losses from 3AC, it would look arsenic though the institution was letting the steadfast commercialized utilizing unsecured funds, fixed the collateralized quality of derivative trading platforms.

With the caller developments, rumors person been flying, with speculation that aggregate crypto lending/borrowing desks person been deed from insolvency.

This is simply a bully reminder for readers to larn the value of self-custody and the quality to clasp your ain wealth with nary counterparty risk.

While it is uncertain which firms whitethorn person experienced immoderate equilibrium expanse impairment, determination is simply a ample anticipation of losses crossed firms successful the industry, and it's apt that we haven’t seen the particulate settle.

Shares of crypto custody/borrowing steadfast Invest Voyager ($VOYG) person fallen 33% implicit the past 2 days. The firm’s latest quarterly merchandise showed that the institution had lent $320 cardinal to a Singapore-based entity (home of 3AC earlier relocation). Regardless of whether the indebtedness was to 3AC, the illness successful stock terms is surely not a ballot of assurance by the marketplace for a U.S.-based nationalist crypto lending platform.

Similarly, BlockFi’s CEO came retired with a connection saying the steadfast had liquidated an overcollateralized borderline indebtedness of a lawsuit who had failed to conscionable indebtedness obligations, with nary notation of lawsuit sanction oregon underlying collateral used.

There whitethorn beryllium definite counterparties that are safer than others, but the nonstop risks of astir output providers are opaque astatine best, and with nary crypto-native output procreation arbitrage accidental presently disposable (GBTC arbitrage, futures premium, etc.), the risk/reward of keeping your holdings with these platforms has apt ne'er been lower.

Market Implications

Over the coming days/weeks, determination apt volition beryllium much accusation arsenic to the harm done. Balance expanse contagion, portion natively a byproduct of accepted concern and fractional reserve banking, has deed the bitcoin/crypto market.

This means that ample amounts of dollar-denominated obligations beryllium against a fixed magnitude of crypto assets that tin beryllium pledged arsenic collateral/sold. This is peculiarly wherefore the marketplace has plunged successful the weeks pursuing the clang of UST, and present the nonaccomplishment of Celsius and 3AC.

While bitcoin is already down 70% from its each clip high, the progressively volatile quality of the bequest fiscal strategy precocious on with the contagion hazard spreading astir the crypto marketplace signals that much symptom is apt to come.

3 years ago

3 years ago

English (US)

English (US)