Crypto markets saw a humble assistance aft the US Federal Reserve made different determination connected rates, and traders are watching for a clearer follow-through. According to reports, the Fed has carried retired 3 consecutive involvement complaint cuts totaling 0.75% from September to December. The determination was wide expected. Still, marketplace responses person been mixed and somewhat choppy.

Fed Moves And Market Takeaway

According to CoinEx main expert Jeff Ko, overmuch of the Fed’s enactment was already priced in, and the updated dot crippled leaned a spot much hawkish than immoderate had hoped.

Ko pointed to $40 cardinal successful short-term Treasury purchases arsenic a method measurement to easiness liquidity and little short-term rates, not arsenic a wide stimulus program.

Markets took the measures arsenic mildly positive. US stocks rose, and that helped Bitcoin find immoderate footing aft an aboriginal dip.

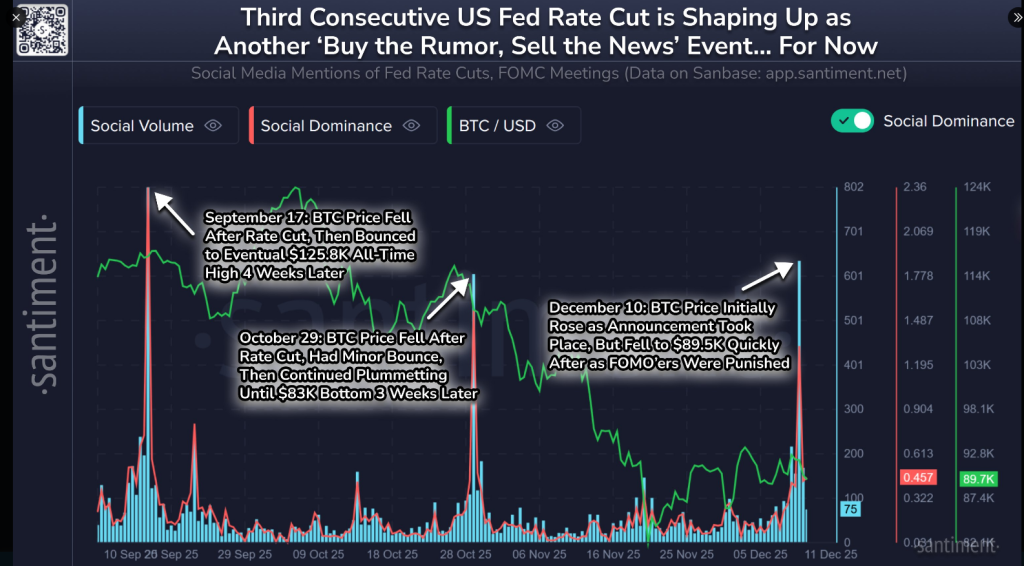

Santiment And The Short-Term Reaction

Based connected reports from onchain analytics steadfast Santiment, each chopped has prompted a classical “buy the rumor, merchantability the news” determination wherever archetypal optimism is followed by abbreviated selling.

🇺🇸 The US Fed made 3 strategical cuts implicit the past 3 months, resulting successful a full of an 0.75% simplification to involvement rates.

1⃣ September 17, 2025: Fed lowered the people scope to 4.00 %–4.25 % (from 4.25 %+) astatine the 16–17 Sep meeting.

2⃣ October 29, 2025: Fed chopped the complaint to… pic.twitter.com/X6DWypvq5t

— Santiment (@santimentfeed) December 11, 2025

Cuts are seen arsenic bullish for crypto implicit the agelong haul, yet they person triggered little pullbacks successful practice. Santiment adds that a tiny question of FUD oregon retail selling often signals that the mild post-cut downswing is finished and a bounce whitethorn travel erstwhile things calm down.

Technical Levels Traders Are Watching

Bitcoin was volatile successful the aftermath. It fell nether $90,000 past popped to $93,500 connected Coinbase earlier settling adjacent $92,300 astatine the clip of reporting. Key absorption sits betwixt $97,000 and $108,000.

On the regular chart, BTC remains wrong a tiny rising transmission that sits wrong a larger downtrend, and method traders enactment that a MACD histogram is approaching a affirmative crossover — a motion immoderate spot arsenic imaginable renewed momentum.

ETF activity has been tepid, with lone $219 cardinal successful nett inflows since precocious November, which keeps immoderate investors cautious.

Dollar Weakness And Equity Signals

A weaker dollar has been portion of the backdrop; the DXY index fell to 98.36 and is showing bearish momentum connected its ain MACD.

Nasdaq’s determination backmost supra its 50-, 100- and 200-day elemental moving averages helped assistance hazard assets briefly, and that has supported Bitcoin’s rebound attempts.

Yet correlation with equities remains uneven — losses successful stocks thin to deed Bitcoin harder than gains assistance it, creating an asymmetric hazard illustration for traders.

Featured representation from Impossible Images, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)