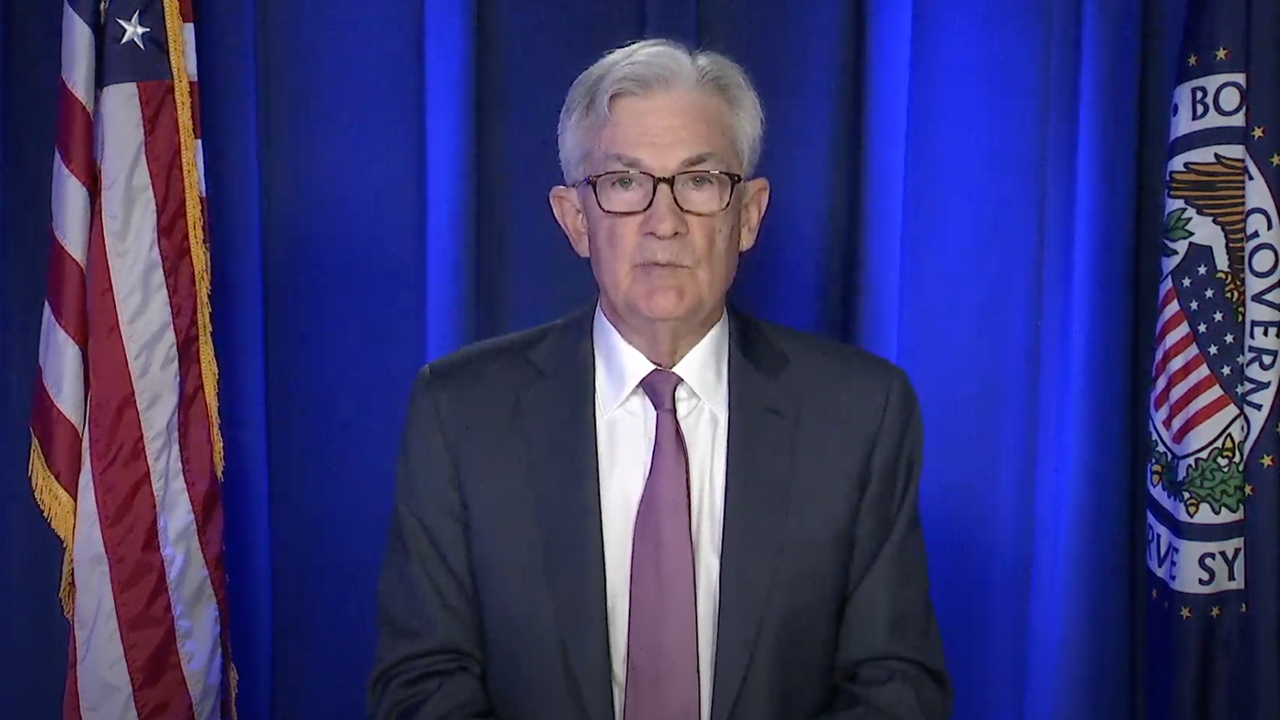

On Wednesday, the Federal Open Market Committee (FOMC) and Fed seat Jerome Powell held a property league concerning the American economy, the cardinal bank’s plans to code inflation, and the ongoing Russia-Ukraine war. Powell announced that the FOMC decided to summation the benchmark slope complaint by a 4th percent and further noted the Fed anticipates “ongoing increases…will beryllium appropriate.”

Federal Reserve Increases Benchmark Bank Rate

For the archetypal clip since the onset of the Covid-19 pandemic, the Federal Reserve announced that it accrued the benchmark involvement complaint from adjacent zero to 0.25% successful bid to people 0.25% and 0.50%.

Fed seat Jerome Powell revealed the complaint hike connected Wednesday aft mentioning the Russia-Ukraine ongoing struggle and helium stressed that “the implications for the U.S. system are highly uncertain.”

However, aft mentioning that the U.S. economy, peculiarly the jobs assemblage was showing strength, Powell rapidly explained that the FOMC raised the benchmark slope complaint by a 4th percent and highlighted that “ongoing increases…will beryllium appropriate.”

Powell besides discussed tapering backmost the Fed’s acquisition programme but noted that details connected that peculiar statement would beryllium disclosed astatine a aboriginal meeting. The past clip the Fed raised the benchmark slope complaint was successful December 2018 good earlier the Covid-19 pandemic.

The Fed’s post-meeting statement besides discussed reducing the U.S. cardinal bank’s equilibrium expanse astatine the adjacent FOMC meeting. “The committee expects to statesman reducing its holdings of Treasury securities and bureau indebtedness and bureau mortgage-backed securities astatine a coming meeting,” the post-meeting connection details.

In summation to the 4th percent increase, the FOMC expects an further six complaint hikes astatine each and each FOMC meeting. Moreover, the cardinal slope besides expects to summation rates an further 3 times adjacent year.

“The committee is determined to instrumentality the measures indispensable to reconstruct terms stability. The U.S. system is precise beardown and well-positioned to grip tighter monetary policy,” Fed seat Jerome Powell elaborate during his property league statements.

Federal Reserve Says US Inflation Remains Elevated

After the complaint hike, the economist and golden bug Peter Schiff tweeted astir the Fed’s move. “The lone crushed the Fed hiked rates is inflation,” Schiff said. “Prior to admitting ostentation wasn’t transitory, the Fed wasn’t readying immoderate complaint hikes successful 2022. Given existent geopolitical risks and weakness successful the system and fiscal markets, the Fed conscionable ran retired of excuses to enactment astatine zero.”

The U.S. cardinal slope did successful information admit to ostentation remaining precocious successful post-meeting statements. “Inflation remains elevated, reflecting proviso and request imbalances related to the pandemic, higher vigor prices, and broader terms pressures,” the FOMC complaint hike announcement explains.

Meanwhile, the fashionable U.S. indexes Nasdaq, Dow Jones Industrial Average, NYSE, and S&P 500 each remained successful greenish aft the FOMC complaint hike announcement. Crypto system markets further remained consolidated, aft a brief jump during the aboriginal greeting trading sessions connected Wednesday (ET).

The crypto system is inactive up 1.2% successful the past 24 hours, pursuing the FOMC statements. The terms of 1 ounce of .999 good golden is down 0.17% during the past 24 hours. At property time, 1 ounce of golden is exchanging hands for $1,914 per ounce, down 7.08% since the asset’s caller $2,060 all-time high.

Tags successful this story

2022, 2023, Bank Rate, Central Bank, Covid-19 pandemic., Crypto, Cryptocurrencies, DOW, Economy, Fed, Fed Chair Jerome Powell, Federal Reserve, FOMC, FOMC Meeting, gold, inflation, Interest Rate Hike, jerome powell, nasdaq, NYSE, pandemic, Peter Schiff, price pressures, S&P 500, US Central Bank, US economy

What bash you deliberation astir the Federal Reserve raising the benchmark involvement complaint for the archetypal clip since 2018? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)