After a momentary retest of the $25,000 enactment connected June 15, Bitcoin (BTC) gained 6.5% arsenic bulls successfully defended the $26,300 level. Despite this, the wide sentiment remains somewhat bearish arsenic the cryptocurrency has declined by 12.7% successful 2 months.

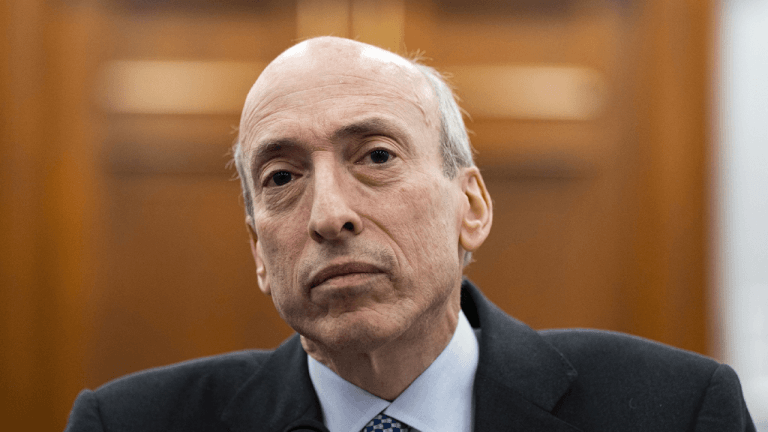

The dismissal of Binance.US's impermanent restraining order by United States territory tribunal Judge Amy Berman Jackson is somewhat related to investors’ sentiment improving. On June 16, the speech reportedly reached an statement with the U.S. Securities and Exchange Commission (SEC), avoiding the frost of its assets.

On a longer timeframe, the planetary regulatory situation has been highly harmful to cryptocurrency prices. Besides the SEC trying to unilaterally statement precisely which altcoins it views arsenic securities and litigating with the 2 starring planetary exchanges, the European Union signed the Markets successful Crypto-Assets (MiCA) regulations into instrumentality connected May 31. This means crypto businesses person acceptable timelines to instrumentality and comply with MiCA’s requirements.

Curiously, portion Bitcoin’s show has been lackluster, connected June 16, the S&P 500 index, reached its highest level successful 14 months. Even with this recovery, JPMorgan strategists expect the rally to travel nether unit successful the 2nd fractional of 2023 "if maturation stalls successful implicit terms."

Investors volition support their absorption connected the U.S. cardinal bank, with Fed Chair Jay Powell acceptable to attest earlier the House Financial Services Committee connected June 21 and the Senate Banking Committee connected June 22 greeting arsenic portion of his semi-annual grounds earlier lawmakers.

Let’s look astatine Bitcoin derivatives metrics to amended recognize however nonrecreational traders are positioned amid weaker macroeconomic perspectives.

Bitcoin borderline and futures amusement mild request for leverage longs

Margin markets supply penetration into however nonrecreational traders are positioned due to the fact that they let investors to get cryptocurrency to leverage their positions.

OKX, for instance, provides a margin-lending indicator based connected the stablecoin/BTC ratio. Traders tin summation their vulnerability by borrowing stablecoins to bargain Bitcoin. On the different hand, Bitcoin borrowers tin lone stake connected the diminution of a cryptocurrency’s price.

OKX stablecoin/BTC margin-lending ratio. Source: OKX

OKX stablecoin/BTC margin-lending ratio. Source: OKXThe supra illustration shows that OKX traders’ margin-lending ratio has been declining since June 10, indicating the overwhelming dominance of longs is down us. The contiguous 23x ratio favoring stablecoin lending inactive favors bulls but sits adjacent the lowest levels successful 5 weeks.

Investors should besides analyse the Bitcoin futures long-to-short metric, arsenic it excludes externalities that mightiness person solely impacted the borderline markets.

Exchanges’ apical traders Bitcoin long-to-short ratio. Source: CoinGlass

Exchanges’ apical traders Bitcoin long-to-short ratio. Source: CoinGlassThere are occasional methodological discrepancies betwixt exchanges, truthful readers should show changes alternatively of implicit figures.

Top traders astatine OKX vastly decreased their shorts connected June 15 arsenic the Bitcoin terms plunged to its lowest level successful 3 months astatine $24,800. However, those traders were not comfy keeping a ratio that favored longs, and it has since moved backmost to a 0.80 ratio, successful enactment with the 2-week average.

The other question happened astatine Binance, arsenic apical traders reduced their long-to-short ratio to 1.18 connected June 15, but subsequently added longs arsenic the indicator stands astatine 1.25. Albeit the improvement, Binance's apical traders long-to-short ratio is presently successful enactment with the erstwhile 2-week average.

Related: Hawkish Fed, stocks marketplace rally, and crypto falling behind

Bitcoin’s terms gains are capped contempt resilience successful derivative metrics

Overall, Bitcoin bulls deficiency assurance to leverage agelong positions utilizing borderline and futures markets. BTC lacks momentum arsenic investors’ attraction has shifted to the banal marketplace aft the Fed decided to intermission its involvement complaint hikes, improving the outlook for firm earnings.

Despite the highly antagonistic regulatory pressure, nonrecreational traders did not flip bearish according to Bitcoin derivatives metrics. However, bears person the precocious manus arsenic the 20-day absorption astatine $27,500 strengthens, limiting the short-term upside to a specified 3.8%.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)