"Economics is the subject which studies quality behaviour arsenic a narration betwixt ends and scarce means which person alternate uses," the British economist Lionel Robbins wrote successful 1932.

Put simply: Every prime comes with tradeoffs that mightiness not beryllium truthful savory.

It's the presumption the Federal Reserve finds itself successful arsenic the U.S. cardinal bank's monetary-policy committee prepares to convene adjacent week. The dilemma present is whether to combat inflation, risking the anticipation that doing truthful triggers a recession, oregon to tolerate higher prices and support the momentum going. Making a prime is easier said than done, with the ongoing Russia-Ukraine warfare raising the specter of stagflation – a operation of debased maturation and precocious inflation.

Observers accidental Fed Chair Jerome Powell and his colleagues volition kick-start the tightening process with an interest-rate hike of 25 ground points (0.25 percent point) adjacent week portion besides signaling that they volition propulsion hard against ostentation for the remainder of the year. As always, they are expected to sphere their flexibility to set the gait if needed.

"Barring a precise abrupt tightening of fiscal conditions, arsenic per February/March 2020, the Fed sticks to program A, i.e., hike rates by 25 ground points adjacent week," Marc Ostwald, main economist and planetary strategist astatine London-based ADM Investor Services International (ADMISI), said successful an email.

"I deliberation the Fed is precise overmuch going to echo the European Central Bank successful trying to connection an constituent of predictability successful what are precise uncertain circumstances, portion retaining optionality and flexibility," Ostwald added.

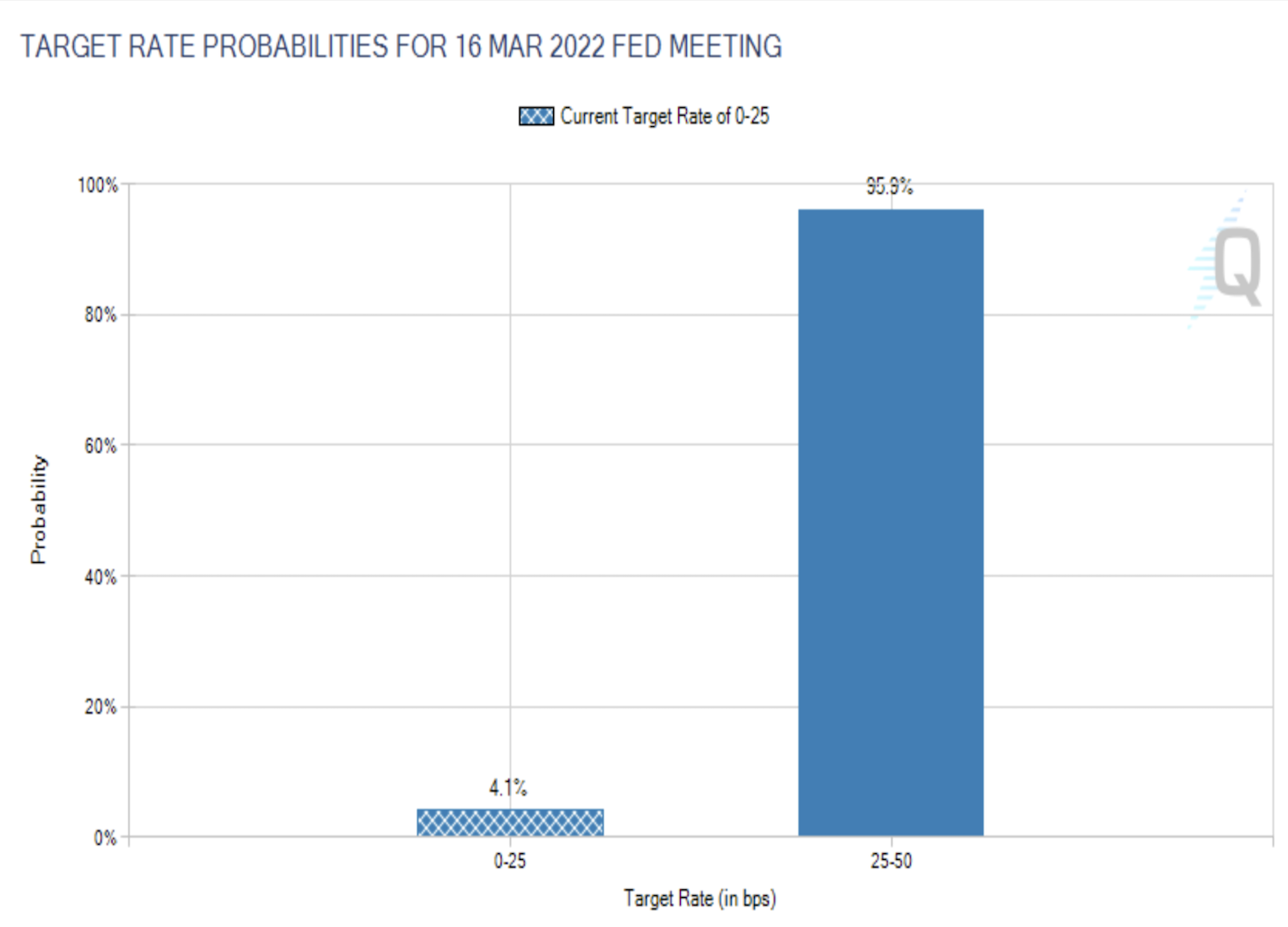

Futures contracts connected Fed funds connote a 25 ground constituent complaint hike is already baked successful to the market; it would beryllium the archetypal complaint summation since December 2018. Two years ago, the cardinal slope chopped rates adjacent to zero and launched an open-ended, liquidity-boosting, asset-purchasing programme to antagonistic the adverse economical effects of the coronavirus pandemic.

Fed money futures (CME's FedWatch tool)

Fed's dot crippled to awesome much complaint hikes

Traders volition look to Powell and the Fed statements for clues connected however accelerated rates mightiness emergence successful the coming months. The absorption volition beryllium connected the "dot plot" – a pictorial practice of Fed officials' projections for the cardinal bank's cardinal short-term involvement rate. The officials besides effort to task the alleged terminal rate, which is the theoretically neutral involvement complaint that would some maximize employment and support unchangeable prices.

In December, Fed officials contemplated 75 ground points of tightening for 2022 and a terminal complaint of 2.5%. According to Marc Chandler, main marketplace strategist astatine Bannockburn Global Forex, these numbers could beryllium revised higher adjacent week.

"In the mediate of December, 10 of the 18 officials expected that 75 ground constituent successful hikes would beryllium due this year. Consider the terminal rate. In December, 5 officials expected that the Fed funds people astatine the extremity of 2024 would beryllium supra wherever the median viewed astatine the semipermanent equilibrium complaint of 2.5%," Chandler said. "The median is apt to emergence by 50 ground points and possibly 75 ground points for this year."

In different words, the Fed officials were down the curve – oregon other the dynamic shows conscionable however worrisome ostentation has go successful the past mates months. At property time, the Fed money futures were anticipating a full of 5 4th percent constituent complaint hikes for this year.

While immoderate successful the marketplace fearfulness that the Russia-Ukraine struggle volition bring stagflation and unit the Fed to hike aggressively, Michael Englund, main manager and main economist astatine Action Economics LLC, suggests otherwise.

"Our presumption is that the updraft successful commodity prices volition diminish into mid-year, and basal effects volition yet let an emerging downtrend successful the year-over-year ostentation metrics," Englund told CoinDesk successful an email. "This should diminish unit connected the Fed to code inflation, and should let for quarter-point hikes astatine conscionable each different meeting, leaving 5 hikes for 2022 wide (in March, May, June, September and December)."

Risk assets typically driblet erstwhile a cardinal slope is expected to hike rates. That's because, portion connected the 1 hand, complaint hikes bring down inflation, connected the other, they measurement implicit idiosyncratic and firm spending, starring to an economical slowdown.

That said, the impending complaint hikes whitethorn beryllium aged news, arsenic the Fed has been preparing markets for the aforesaid since November. Bitcoin has declined implicit 40% since mid-November, predominantly connected Fed complaint hike fears.

"The involvement complaint marketplace has already priced successful arsenic galore arsenic six complaint hikes, and the crypto marketplace is lone pricing successful more," Griffin Ardern, a volatility trader from crypto-asset absorption institution Blofin, said. "In my opinion, investors person not afloat priced successful the anticipation of an aboriginal shrink of the equilibrium expanse oregon quantitative tightening, accidental starting successful April."

Focus connected quantitative tightening

Quantitative tightening (QT) is the process of equilibrium expanse normalization, besides a mode of sucking retired liquidity from the system.

The Fed's equilibrium expanse has ballooned from $4 trillion to $9 trillion successful 2 years, acknowledgment to the plus acquisition program, known arsenic quantitative easing, terminated connected Thursday.

The process allowed the cardinal slope to people wealth retired of bladed aerial and summation the proviso of slope reserves successful the fiscal strategy hoping that lenders would walk connected the excess liquidity to the system successful the signifier of loans, bringing economical growth.

With ostentation moving hot, the cardinal slope intends to reverse the process via quantitative tightening. It fundamentally means reducing the proviso of reserves.

With the Fed apt to statesman the hiking rhythm adjacent week, much details of quantitative tightening whitethorn emerge, arsenic precocious signaled by Powell.

"The process of removing argumentation accommodation successful existent circumstances volition impact some increases successful the people scope of the national funds complaint and simplification successful the size of the Federal Reserve's equilibrium sheet," Powell said successful his recent testimony to Congress.

"As the FOMC noted successful January, the national funds complaint is our superior means of adjusting the stance of monetary policy. Reducing our equilibrium expanse volition commence aft the process of raising involvement rates has begun and volition proceed successful a predictable mode chiefly done adjustments to reinvestments," Powell added.

There are galore opinions connected however and erstwhile the Fed should commencement quantitative tightening and the gait of the unwind, with statement ranging from $100 cardinal per period to $150 cardinal per month.

According to ADMISI's Ostwald, the Fed whitethorn similar gradual unwinding of the equilibrium sheet. "My conjecture is they whitethorn opt for a tapering into QT to springiness themselves other flexibility, though with larger increments, $25 cardinal past $50 billion, $75 cardinal and past $100 billion," Ostwald said. "Their large situation is that they privation to person a beardown constituent of predictability, but the existent circumstances are precise overmuch antithetical to this."

Bannockburn's Chandler said, "the Fed volition instrumentality the passive attack and let the equilibrium expanse to shrink, which means extinguishing immoderate reserves by not reinvesting each of the maturing proceeds."

Last week, Lorie Logan, enforcement vice president astatine the Federal Reserve Bank of New York, said the main payments connected Treasury bonds coming owed scope from astir $40 cardinal to $150 cardinal a period implicit the adjacent fewer years and mean astir $80 billion. There's besides an mean of astir $25 cardinal per period of mortgage-backed securities maturing for the adjacent fewer years.

Risk assets whitethorn look selling unit if the Fed hints astatine assertive complaint hikes oregon an aboriginal commencement to quantitative tightening. The Fed discussed QT successful December and past pushed retired the large equilibrium expanse unwinding to the 3rd 4th conscionable earlier the warfare broke retired successful Europe.

"The hawkish hazard is that the Fed's connection wording is much assertive than assumed, with small hazard of either a larger complaint hike and the commencement of quantitative tightening," Action Economics' Englund noted.

The evident dovish result would beryllium the Fed lasting pat connected involvement rates and offering fewer clues connected quantitative tightening. "Risk would rally if the Fed were not to rise rates," Bannockburn's Chandler said.

Many successful the crypto assemblage look convinced that the Russia-Ukraine warfare and the caller plus marketplace volatility would deter the Fed from raising rates. Some experts suggest otherwise.

"The Fed enactment is surely retired of action, supra each due to the fact that they are down the curve connected inflation, arsenic they person implicitly admitted, and due to the fact that of the plus terms bubble that they person been feeding for truthful agelong (again indirectly admitted erstwhile talking astir stretched valuations)," ADMISI's Ostwald said.

The "Fed put" is the conception that the cardinal slope volition travel to the rescue if assets tumble. The steadfast content was evident successful 2021 erstwhile retail investors consistently bought the dip successful banal markets.

However, the Fed is improbable to halt tightening unless signs of liquidity accent look successful the planetary fiscal system.

"If fiscal conditions deteriorated sharply and abruptly successful the discourse of different headwinds oregon risks materializing, yes, I deliberation the Fed put, which means trying to offset the undesirable deterioration successful fiscal conditions, broadly understood, is inactive there," Bannockburn's Chandler said.

"It says thing astir a 10% oregon 20% autumn successful a large equity scale successful absolute, but the caller drop, the Fed judged, successful the existent discourse not to adversely oregon unfairly tighten fiscal conditions," Chandler added.

Goldman Sachs' U.S. Financial Conditions Index (Marc Ostwald, Bloomberg)

The supra illustration by Goldman Sachs shows that portion fiscal conditions successful the U.S. person tightened somewhat successful caller weeks, the wide concern is inactive overmuch amended than the March 2020 crash.

It simply means the Fed is improbable to clasp occurrence adjacent week.

"As agelong arsenic determination is nary menace to the banking system, they [Fed] volition not beryllium unhappy seeing immoderate of the leverage squeezed retired of markets, but would surely measurement backmost successful (Fed enactment style), if feedback loops from the tertiary/shadow banking assemblage commencement to endanger the superior banking sector," ADMISI's Ostwald quipped.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)