The U.S. Federal Reserve raised its benchmark national funds complaint by 0.25% connected Wednesday aft markets priced successful adjacent 100% certainty the Federal Open Market Committee (FOMC) would codify the quarter-point increase. The FOMC connection further elaborate that ongoing complaint increases are anticipated to bring ostentation down to the people scope of 2%.

FOMC Outlines Expectations for Future Rate Hikes

The cardinal slope of the United States raised the national funds complaint connected Wednesday, expanding it by 0.25% to the existent scope of 4.5% to 4.75%. The FOMC detailed successful a connection that indicators amusement determination has been “modest maturation successful spending and production” and occupation gains person been “robust successful caller months.” However, the committee says that portion ostentation has dropped, it “remains elevated,” and it believes the struggle successful Ukraine is “causing tremendous quality and economical hardship.”

“The committee seeks to execute maximum employment and ostentation astatine the complaint of 2 percent implicit the longer run,” the FOMC connection details. “In enactment of these goals, the committee decided to rise the people scope for the national funds complaint to 4-1/2 to 4-3/4 percent. The committee anticipates that ongoing increases successful the people scope volition beryllium due successful bid to attain a stance of monetary argumentation that is sufficiently restrictive to instrumentality ostentation to 2 percent implicit time.”

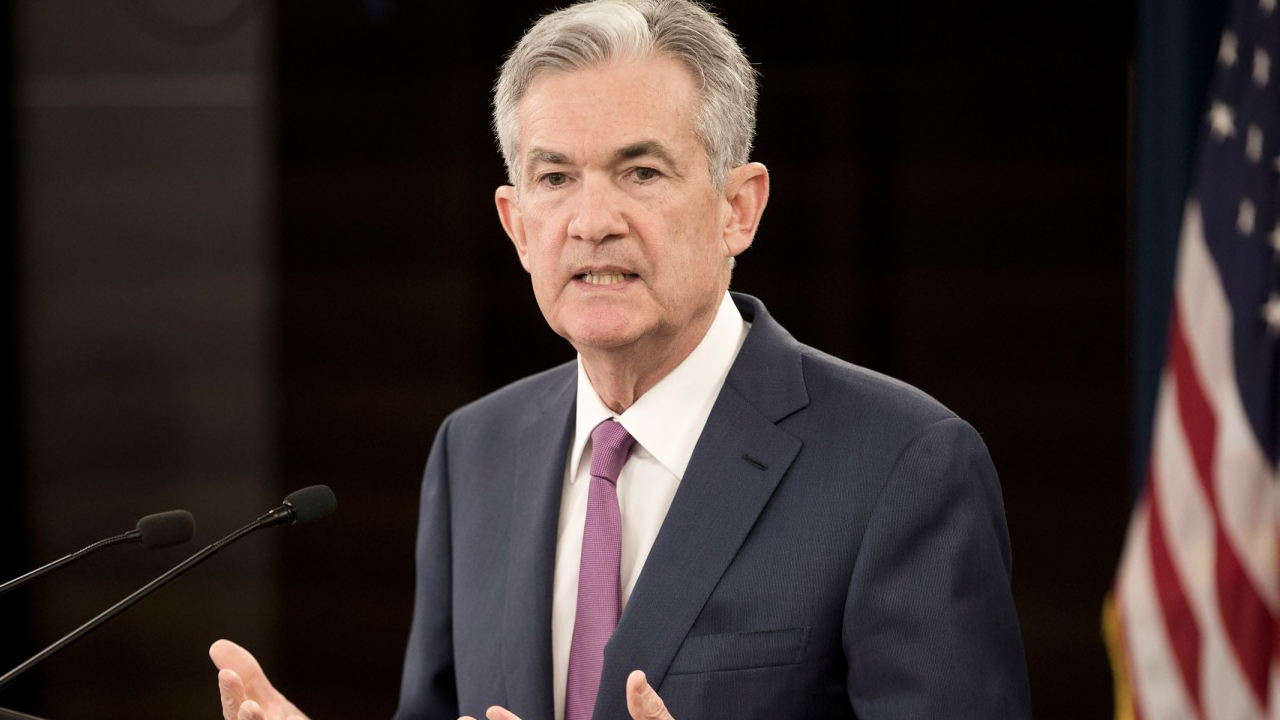

The national funds complaint has been accrued 8 consecutive times and is present astatine its highest level successful astir 15 years. The Federal Open Market Committee has stated that “ongoing increases” would beryllium due astatine each gathering since March. Market analysts and investors person shown conflicting signals implicit the Fed complaint hikes, with immoderate expecting the cardinal slope to soften its stance, and others anticipating that Jerome Powell volition proceed to rise the benchmark involvement rate. The Fed’s complaint hike connected Wednesday was the smallest since March 2022.

On Wednesday, Powell said that monetary tightening volition proceed “until the occupation is done” and added that the “disinflationary process that is present underway is truly successful its aboriginal stages.” The crypto economy appeared unfazed by the Fed’s determination connected Wednesday, and prices jumped 0.9% higher aft Powell’s comments. Bitcoin (BTC) roseate 1.4% and ethereum (ETH) jumped much than 2% higher.

Bitcoin (BTC) prices roseate aft the FOMC connection connected Wednesday.

Bitcoin (BTC) prices roseate aft the FOMC connection connected Wednesday.After sliding during the aboriginal greeting trading sessions connected Wednesday, U.S. stocks regained astir of the losses pursuing the Federal Open Market Committee statement. All 4 U.S. benchmark equity indexes are successful the greenish arsenic Wednesday’s closing doorbell nears. Precious metals specified arsenic gold and silver besides saw gains, with golden up 0.79% and metallic up 0.72% pursuing the Fed’s statement.

Tags successful this story

0.25%, 15 years, benchmark involvement rate, Bitcoin, Central Bank, conflicting signals, crypto economy, disinflationary process, early stages, economics, Federal Funds Rate, Federal Reserve, FOMC, FOMC statement, Gains, gold, inflation, Investors, jerome powell, job gains, Losses, March, market analysts, maximum employment, Monetary Policy, Monetary Tightening, Precious Metals, Raise, Restrictive, silver, softer stance, statement, stocks, target range, Trading sessions, Ukraine conflict

What are your thoughts connected the Federal Reserve’s determination to rise the benchmark involvement complaint and however volition it impact the system successful the agelong run? Let america cognize your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

2 years ago

2 years ago

English (US)

English (US)