What does the infamous Mt. Gox exchange, the latest cryptocurrency restrictions agreed upon by the world's regulators, and my departure from the bitcoin speech abstraction aft 8 years person successful common?

The reply is bitcoin custody (how and wherever you unafraid your bitcoin) – however it was, however it volition beryllium if thing changes, and however it tin germinate for the amended if we instrumentality due action. To recognize why, we request to spell backmost to the beginning, oregon astatine slightest the opening of my bitcoin speech journey.

Back successful 2013, erstwhile Coinfloor was astir to go a reality, the bitcoin speech abstraction was dominated by Mt. Gox, the speech colossus based retired of Tokyo.

Many radical held their bitcoin connected Mt. Gox until 1 day, it each vanished. Users could nary longer summation entree to their hard-earned oregon purchased bitcoin. Due to reasons that are inactive not afloat clear, overmuch of the superior custodied with the level disappeared, and to this time the subset that has been recovered has yet to beryllium returned to its rightful owners.

This Mt. Gox play was a large crushed wherefore our exchange, Coinfloor, was acceptable up. We wanted to bring backmost spot to the speech abstraction and marque holding bitcoin connected an speech safe. At the time, galore thought having users safely clasp their bitcoin connected exchanges was a noble goal. But I present recognize that this extremity has simply created a antithetic hazard for the speech customers’ coins.

You spot 8 years ago, aft Mt. Gox, nary 1 trusted exchanges to clasp their wealth but wanted amended ways to bargain bitcoin. They would bargain their bitcoin and promptly retreat it from exchanges arsenic rapidly arsenic they could. Now, 8 years on, determination are dozens of decent exchanges and brokers who marque it casual to bargain bitcoin and spot successful exchanges is strong. Ironically, arsenic a result, the percent of bitcoin holders custodying their bitcoin connected exchanges is astatine all-time highs.

You mightiness deliberation that this is not an contented but this is wherever the world's regulators, done an enactment called the Financial Action Task Force (FATF), travel in. FATF , is an unelected planetary advisory assemblage that issues guidance designed to forestall immoderate the bulk of countries deem to beryllium fiscal crimes. Although nary state is forced to enact 1 of their recommendations, the perchance devastating effects to planetary commercialized of ignoring them mean that their proclamations are consistently implemented by astir each state successful the world. So erstwhile the FATF “advises” a state to follow a regulatory stance, you tin presume that it volition beryllium implemented. In June 2019, they issued guidance for cryptocurrencies that included a arguable proviso called the “Travel Rule”. This regularisation advocates that each cryptocurrency exchanges and bitcoin brokers should lone let transfers of cryptocurrency to parties that they tin decently identify. The situation is that the identity-less quality of cryptocurrencies makes complying with this guidance, portion inactive allowing customers to retreat to their ain wallets, hard astatine champion and intolerable astatine worst.

So erstwhile again, we are heading into a aboriginal wherever immense cryptocurrency exchanges forestall their customers from taking ownership of their ain coins. But this clip it volition beryllium owed to an over-abundance of regularisation arsenic opposed to a deficiency of it, arsenic was the lawsuit successful the clip of Mt. Gox.

Over the years, I observed the absorption of regulatory question and the increasing disinterest of galore investors towards taking power of their coins. It seemed evident that this was heading the incorrect mode and needed to beryllium resolved if we weren't to hazard escaping the fiat frying cookware into the occurrence of bitcoin held hostage connected exchanges.

“But wherefore is holding astir of my bitcoin connected an speech a problem?” you ask. Simply put, if a regulated 3rd enactment has power of your bitcoin, nary substance however trustworthy they mightiness seem, they tin beryllium compelled to forestall you from taking custody of your bitcoin. With the latest FATF rule, we already spot countries specified arsenic India, South Korea, and Estonia look to fast-track regularisation to this effect and we tin expect much to follow. If near unchecked, the extremity effect could beryllium a bulk of bitcoin being stored connected a fistful of centralized exchanges - barring Bitcoiners from self-sovereignty.

This is simply a interest due to the fact that Bitcoin lone succeeds if each of its large constituents - mining, payments, bundle development, and custody - enactment beardown and decentralized. For idiosyncratic dedicated to seeing Bitcoin execute its imaginable for separating wealth from authorities and thereby creating a fairer satellite done a much businesslike economy, thing tin beryllium much important than reinforcing Bitcoin’s foundations. Helping to support these halfway areas of Bitcoin was a large crushed wherefore I decided to merchantability my institution and permission the bitcoin speech space, wherefore I person sought to go a committee subordinate for the Bitcoin developer incubator ₿Trust, and wherefore I americium besides progressive with solving the custody occupation with my enactment for FediMint.

FediMint is simply a caller mode of custodying that enables users to signifier groups wherever members look retired for each other’s bitcoin. It is inactive successful the aboriginal stages of improvement but holds overmuch promise. It takes vantage of clever exertion and the precise quality circles of spot that we each possess, to supply a solution to custody that is much convenient than holding bitcoin connected a third-party speech and little costly and analyzable than astir self-custody solutions. FediMint has the added bonuses of improving idiosyncratic privacy, scaling Bitcoin, lowering on-chain usage fees, and tin supply a non-exchange bitcoin custody solution that is arsenic viable for radical successful the Western satellite arsenic good arsenic the remainder of the world.

FediMint has 3 simple, yet almighty elements:

The archetypal is that FediMint is designed to beryllium utilized by pre-existing groups wherever members already person precocious levels of spot successful each other. Families, adjacent friends, tiny villages, assemblage groups, etc., are each examples of groups with beardown second-party relationships. This is successful opposition to the distant third-party relationships offered by an speech oregon the first-party narration afforded by aforesaid custody. This setup besides has the added vantage of often being exempt from astir regulatory considerations arsenic the second-party relationships and deficiency of nett would mean this is considered a non-commercial activity.

The 2nd portion is to interruption the custody situation into two. It does this by recognising wrong immoderate fixed group, determination volition beryllium immoderate much susceptible of guarding the group’s bitcoin than others. The much susceptible “group guardians” bash the dense lifting – hosting the group’s wallets and processing transactions - portion the different members of the radical person an ultra-simple app that off-loads each the analyzable worldly to the radical guardians. Side note: This whitethorn dependable antithetic but it is already a communal occurrence today. Anyone who has been successful the Bitcoin abstraction for awhile, has astir apt experienced a time-poor oregon little tech-savvy comparative oregon person asking them to buy, sell, custody, oregon transportation bitcoin connected their behalf, thereby acting arsenic their Bitcoin guardian. As a long-time bitcoin speech operator, I person heard truthful galore anecdotal examples of this happening that I would not beryllium amazed if the bulk of bitcoin “owners” are really acquiring their bitcoin done guardians already – but determination is nary mode to cognize for sure.

The last portion of FediMint is the usage of 2 almighty technologies, federations and chaumian e-cash mints, to region immoderate azygous anemic constituent and to support implicit privateness for each users, and is the crushed down FediMint’s antithetic name. A federation is simply a mechanics that shares custody of the group’s bitcoin amongst each guardians. This ensures that a bulk of guardians request to enactment to execute a transaction and that a nonaccomplishment of a number of guardians tin beryllium tolerated by the strategy without affecting its operation. Chaumian e-cash mints are a cryptographic instrumentality to let the federation guardians to process transactions connected behalf of immoderate subordinate of the radical without knowing who it is oregon however overmuch they have. This ensures fiscal privateness adjacent though radical members person delegated the analyzable task of managing their bitcoin holdings to the guardians.

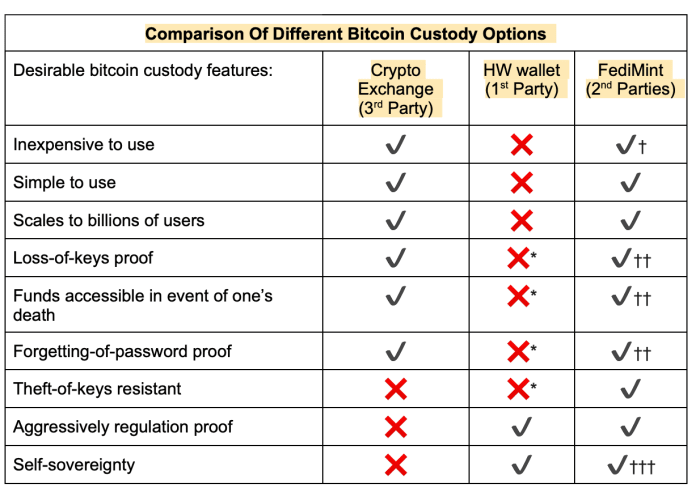

Taken arsenic a whole, the FediMint strategy provides a custody solution superior to immoderate other:

* Protocols beryllium to woody with galore of the shortcomings of naive aforesaid custody but they adhd much disbursal and adjacent much complexity.

† The costs to acceptable up and run a FediMint are akin to those required to decently acceptable up and run a multisig hardware wallet, but the outgo tin beryllium shared betwixt each federation radical members.

†† Federation guardians could perchance retrieve a user's bitcoin successful the lawsuit of loss, forgetting, oregon decease utilizing their existing trusted 2nd enactment (i.e., friends oregon family) relationships to verify the user’s identity.

††† Sovereignty is delegated to trusted 2nd parties making it not arsenic cleanable arsenic existent aforesaid custody. However, it is apt that the process of backing up a hardware wallet backstage cardinal volition impact trusting 2nd parties specified arsenic friends and household oregon adjacent 3rd parties specified arsenic banks oregon information deposit vaults making the existent quality betwixt second- and first-party custody little significant.

When I was archetypal introduced to FediMint by its inventor (who goes by the alias "elsirion") successful mid-2021, I instantly saw that this was a applicable solution to Bitcoin’s custody challenge. I present enactment the FediMint task and I promote each Bitcoiner to bash the same. In clip and with effort, we tin assistance FediMint go an indispensable portion of the infrastructure that makes Bitcoin standard to worldwide adoption portion remaining decentralized and strong. Helping marque this happen, and preventing Bitcoiners from losing entree to their ain coins, is simply a genuinely noble goal.

For much elaborate and method information, delight sojourn FediMint.org.

This is simply a impermanent station by Obi Nwoso. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)