Mike Novogratz expects Bitcoin to proceed trading betwixt the $30k scope and $50k scope passim this year.

Cover art/illustration via CryptoSlate

While galore analysts foretell that the hiked involvement complaint by the Feds would pb to a affirmative question successful the terms show of Bitcoin, a starring billionaire investor, however, disagrees with this notion.

Bitcoin would proceed to commercialized betwixt $30k to $50k

Michael Novogratz, the CEO of Galaxy Digital Holdings Ltd., successful a caller interview, has ruled retired immoderate accidental of Bitcoin breaking its grounds precocious this year. According to him, the flagship integer plus is much apt to commercialized betwixt the $30k to $50k portion passim this year.

Novogratz pointed retired that contempt the Feds raising the involvement rates, it is improbable that investors would beryllium consenting to put the magnitude of liquidity they poured into the abstraction during the pandemic, which helped Bitcoin scope caller highs.

Per his statement, with the Feds considering tightening the marketplace successful its attempts to woody with inflation, investors are besides evaluating the risks. This means the probability of pumping wealth into Bitcoin is little this year.

In his words,

“Bitcoin is simply a communicative story. It’s bringing radical into the community. It’s hard to bring successful caller radical erstwhile their location is connected fire.”

He continued that the ongoing warfare successful Ukraine would besides impact investors’ choices.

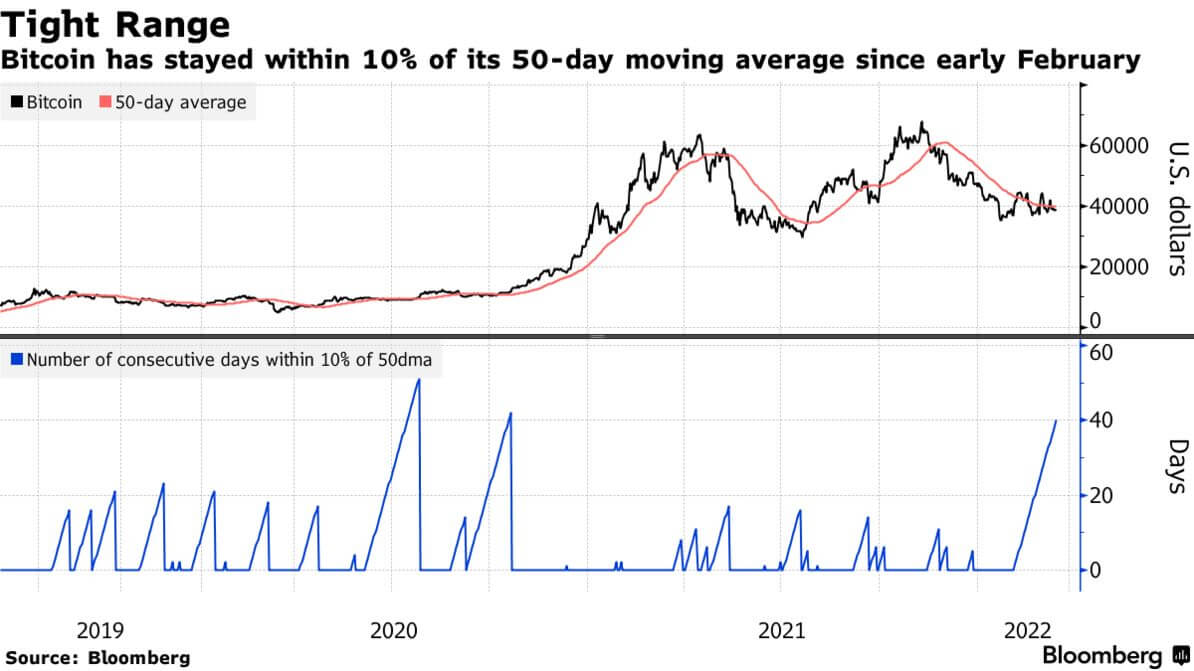

Bitcoin keeps trading successful a constrictive range

The ongoing warfare has led the banal and crypto markets into a bid of unpredictable movements. The worth of Bitcoin, during the aboriginal days of the war, reacted positively arsenic it was believed that Russian oligarchs could usage the plus people to evade sanctions.

However, disposable accusation shows that this is not imaginable owed to the transparent quality of the marketplace and different reasons.

Source: Bloomberg

Source: BloombergThis has led analysts who person been watching the marketplace to reason that semipermanent holders person continued to bargain BTC whenever the terms falls, but short-term investors merchantability arsenic soon arsenic there’s a rally successful a bid to get backmost what they invest.

In essence, this is what has led to the constrictive trading scope for the past mates of weeks.

Is Novogratz right?

The Galaxy Digital Holdings CEO appears to beryllium the lone pro-crypto expert who believes that Bitcoin would not beryllium positively affected by the hiked Fed rates.

According to a caller CryptoSlate report, Elon Musk and Michael Saylor advised their followers to hedge against the rising ostentation by owning assets similar Bitcoin and carnal things similar existent property oregon stocks successful well-regarded companies.

Apart from those two, a erstwhile CryptoSlate report besides stated that “the worth of Bitcoin has been deflationary successful nature” during the past decennary portion “consumer terms scale (CPI) successful the state has been inflationary” wrong the aforesaid clip frame.

This fundamentally shows that investors are apt to tally to Bitcoin arsenic a hedge against the rising ostentation arsenic they judge the plus would, successful the agelong run, appreciate.

Get your regular recap of Bitcoin, DeFi, NFT and Web3 quality from CryptoSlate

It's escaped and you tin unsubscribe anytime.

Get an Edge connected the Crypto Market 👇

Become a subordinate of CryptoSlate Edge and entree our exclusive Discord community, much exclusive contented and analysis.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)