Data from the trading analytics level BitMEX Research reveals that Fidelity’s Bitcoin spot ETF – FBTC – has present witnessed a full inflow of implicit $1 billion. This improvement comes arsenic BTC attempts to rebound from its caller dip implicit the past 2 weeks with a 1.56% summation successful the past day, based connected data from CoinMarketCap.

Fidelity Joins BlackRock On Exclusive $1-B List, As Grayscale’s ETF Continues To Bleed

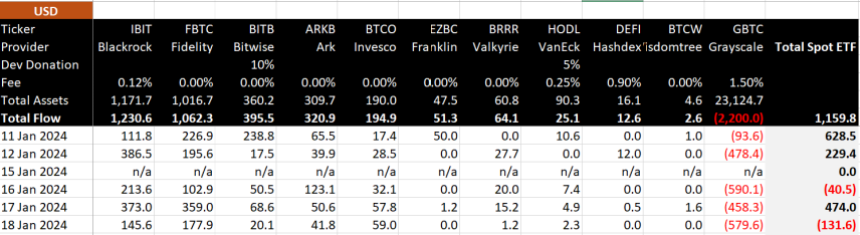

Following the authoritative motorboat of Bitcoin spot ETF trading connected January 11, Fidelity has present go the 2nd plus manager, with its BTC spot ETF signaling an accumulative inflow of $1 billion. According to BitMEX Research, Fidelity’s FBTC experienced an inflow of $177.9 cardinal connected January 18, bringing its full inflows to $1.1 cardinal wrong 5 days of trading.

FBTC present sits astatine the aforesaid array arsenic BlackRock’s IBIT, whose full inflows are valued astatine $1.2 billion. Together, some concern funds by Fidelity and BlackRock present relationship for implicit 67% of the $3.4 cardinal inflows recorded successful the Bitcoin spot ETF marketplace truthful far.

Other Bitcoin spot ETFs with a notable affirmative show see Bitwise’s BITB, Ark Invest’s ARKB, and Invesco’s BTCO, which person posted idiosyncratic full inflows of $395.5 million, $320.9 million, and $194.8 million, respectively.

Bitcoin Spot ETF Flow information – Day 5

Data retired for each providers

Net outflow of $131.6m connected time 5 for each spot ETFs, ample $579.6m GBTC outflow pic.twitter.com/McHZrRghtu

— BitMEX Research (@BitMEXResearch) January 19, 2024

On the different hand, Grayscale’s GBTC continues to experience outflows connected a monolithic scale.

BitMEX Research reveals that GBTC recorded an outflow of $579.6 cardinal connected January 18, starring the Bitcoin spot ETF marketplace to witnesser a nett outflow of $131.6 million. This represented the 2nd time the BTC spot ETF marketplace recorded a nett outflow since its launch.

GBTC’s full outflows are present valued astatine $2.1 billion, resulting successful Bitcoin spot ETFs having a cumulative nett inflow of lone $1.3 cardinal contempt the $1 cardinal presumption of BlackRock and Fidelity’s ETFs.

Bitcoin’s Price Overview

Against fashionable predictions, Bitcoin has witnessed a terms diminution successful the past 2 weeks pursuing the approval of the much-anticipated BTC spot ETF connected January 10. Many analysts person attributed this unexpected improvement to the monolithic selling unit generated by GBTC’s outflows.

At the clip of writing, Bitcoin trades astatine $41,536, with a diminution of 2.55% and 5.50% successful the past 7 and 14 days, respectively. As earlier stated, the premier cryptocurrency has garnered immoderate gains of 1.56% successful the past day, which whitethorn beryllium indicative of a recovery, however, it is excessively aboriginal to call.

Featured representation from Investopedia, illustration from Tradingview

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

2 years ago

2 years ago

English (US)

English (US)